How does the stock market work?

Despite the jargon and confusing numbers, investing is pretty simple at its core. Don't believe us? Allow us to explain the stock market to you.

Credit: Krakenimages.com (man), Phongpan (background) – Shutterstock

The stock market might seem like the reserve of high-flying city bankers and the more mathematically-minded among us. But the truth is that investing money is a lot more accessible than you might think – albeit with some risks.

To help you understand, we've compiled a one-stop shop for learning the basics of how the stock market works. From what the market actually is to how to buy stocks and shares, we've got you covered.

This guide is intended for educational purposes only. It should not be considered as investment or financial advice.

How the stock market works

What are stocks and shares?

Theoretically, there are slight differences between 'stocks' and 'shares'. But really, they are two words for the same thing: owning a slice of a company.

Typically, a single stock or share will only be worth a very small percentage of a business (much smaller than 1%). But even owning one means you'll own part of that company. It's also possible to invest in funds and indexes, which we explain in more detail later.

You can buy shares in most of the world's biggest businesses. This includes Apple, Amazon and some British companies like Vodafone and Tesco. In fact, the stock market is pretty much exclusively populated by big businesses, as this is one of the requirements that a company must meet before entering the market (known as 'going public' or 'floating').

Other criteria a company needs to go public include having:

- A predictable and consistent revenue stream

- The potential to grow further in the future

- A long-term business plan.

But why would a company go public in the first place? While it does invite extra pressures like answering to shareholders and being subject to a constant expectation of short-term growth, there is one major benefit: money.

Going public gives a company a huge injection of cash which can then fund future growth. Although, obviously, this is only the case if investors actually buy the stocks.

What is the stock market?

Credit: Pavel Ignatov – Shutterstock

Essentially, the stock market is just like any other market. It's a place for trading assets of value. But in this case, it's company stocks.

We'd never recommend that you get involved in the stock market without doing some research first. But you certainly don't need to understand every little thing about the way it works to start investing.

And don't just take it from us. Take it from the most successful investor of all time, Warren Buffett:

If calculus or algebra were required to be a great investor, I'd have to go back to delivering newspapers.

Warren Buffett

Although people often talk about 'the' stock market, the reality is that there are lots of them. The New York Stock Exchange (commonly referred to as simply 'Wall Street') is the biggest of the bunch. But there are dozens of others around the world, including the London Stock Exchange.

Companies are usually listed on the stock markets of the countries they're based in. But in today's digital world, this doesn't really matter as much as it used to.

Thanks to online trading platforms, someone in England can now buy shares listed on the New York Stock Exchange just as easily as they could purchase shares on the London equivalent.

What are stock market indices?

Stock market indices (also known as 'indexes') measure the performance of a particular group of companies.

The companies within a single stock market index will always have something in common. This could be that they're all in the same country or continent, in the same industry, or all considered to be reputable and reliable investments (also known as 'blue chip' companies).

You may have heard of the FTSE 100, for example. This is a UK stock market index containing the 100 most valuable companies listed on the London Stock Exchange.

The Dow Jones Industrial Average (usually just called the Dow Jones) is another well-known stock market index. It measures 30 blue-chip companies listed on stock exchanges in the USA.

How are share prices set?

When a company goes public, the first batch of shares released to the market is known as an Initial Public Offering (IPO).

The share price is set by a consultation process between the company itself, an investment bank and a group of initial investors. Various factors are used to help decide a price. However, the most important is the value of the company at that time.

Once shares have been released to the market, however, the price is effectively set by an auction process.

To explain, we'll use an example.

Let's say Investor A bought stocks in a company for £1 a share and wants to sell. However, Investor B thinks they're only worth 90p a share.

The two traders must come to an agreement in order to make the sale. If Investor B thinks the value may rise in the future, they could agree to buy the shares for slightly more than their first offer.

Similarly, if Investor A thinks the value is set to decrease soon or they're keen to make the sale for other reasons, they could agree to sell for slightly less than £1 a share.

There are millions of investors and traders operating on the stock market, so each company's shares will likely be traded thousands of times every day. And this is often done by people who have differing opinions on the value.

These individual opinions won't be massively different (you'd rarely find one trader saying a share is worth £1 while another says it's worth 5p), but each trade will affect the price. At any given moment, the value of a stock is quite literally the last price at which it was sold during market hours.

What makes stocks go up and down?

These are some other factors that may cause a stock's value to go up or down:

- Supply and demand – There are only a limited number of stocks for a company. If you have shares in a company that everyone wants to buy, you can get away with charging more. Similarly, if very few people want to buy shares in that company, you'll probably have to sell yours for less (or hold onto them).

- Earnings reports and company events – Positive or negative earnings reports can impact the price of a company's shares, as can events the business is involved in. If a senior executive is involved in a high-profile scandal or a company's products are found to have a serious fault, large numbers of shareholders may try to sell their stocks. This will drive the price down.

- Political and economic news – Similarly, news from the wider political and economic landscape can impact share prices across the market. People like knowing that they're on to a winner. A bleak economic forecast from the government (or even events causing uncertainty, like Brexit) can bring share prices down.

- Herd instinct – If traders see large numbers of people buying or selling a particular stock, they may do the same, believing these other traders know something they don't. And when everyone is trying to buy or sell a company's stock, the price goes up or down respectively.

How to buy shares

Credit: Kidsada Manchinda – Shutterstock

The easiest way to buy shares in a company, fund or index is through an online investment platform like eToro. These services allow you to buy and sell shares across the world, all from the comfort of your own home.

And it's not just companies you can invest in. You can also trade in commodities (like gold or oil) and currencies (including cryptocurrencies like Bitcoin). However, it's worth noting that these types of investments are much riskier than trading shares in public companies.

A benefit of using an online trading platform is that it allows you to view and manage all of your shares and investments (known as your 'portfolio') in one place.

The other advantage of investment platforms is that they remove the barriers to entry that were previously linked with buying shares. That's why they're especially popular with those starting out who want to learn about the stock market by trading.

eToro has a virtual stock market which is great for practising without risk. We have a full guide to stock market investing for more information.

Before you open a real trading account with any platform or broker, make sure you understand the fees involved in the service. Charges vary from platform to platform, so do your research before signing up (more on this later).

Should you buy shares or invest in funds?

As a trader, you have the option to either directly buy shares in companies, or invest in funds (groups of similar companies).

Funds will usually focus on a particular region or theme. 'European businesses' or 'green-energy companies' are the kinds of factors you might see a fund based upon.

Fund managers decide how the fund's money is spent. They are so-called 'experts' in their field, and it's their job to ensure the fund increases in value as best they can.

If one or more of the companies in the fund performs poorly, it's not a disaster. Your money has been invested across multiple businesses. Therefore, a limited amount of your capital is at risk if that one company fails.

And that's the main benefit of investing in funds: the risks are typically much lower as funds are diversified.

The problem with most funds is that they have fund managers, which are both expensive and human. However much experience they have, and whatever promises they try to make, they can't predict the future.

Index funds address both of these issues. They simply track stock market indices (like the FTSE 100). Naturally, it focuses on the healthiest companies at any given time. With no fund managers' salaries to pay, the product fees are significantly cheaper. And, over the long term, they've been proven to outperform any managed fund.

How investing in funds reduces risks and returns

To exemplify, imagine you have £100. You're not sure whether to invest in a company (let's call it DabCorp) or into a fund that invests in 100 companies – one of which is DabCorp. For argument's sake, let's say this fund invests your £100 equally across every company. That works out at £1 per company.

Now, let's imagine DabCorp goes bust on day one. By investing via a fund, you're only losing £1. But if you'd invested everything in DabCorp, you'd lose it all.

But what if DabCorp is suddenly the next big thing and its share value doubles in a day? The £100 in the fund will only go up to £101 (ignoring the other stocks within it). But if you'd invested all £100 in DabCorp, your shares would now be worth £200.

While the prospect of doubling your money sounds great, you should pay equal attention to the risk of losing everything. Even the most experienced investors use funds. And that tells you everything you need to know about the importance of mediating risk.

How much money do you need to buy shares?

There's a misconception that investing in the stock market is only for the wealthy.

It's certainly sensible to only invest as much as you're prepared to lose (and being able to make this choice is, of course, a luxury that not everyone has). But it's also true that you don't need to have thousands of pounds lying around to get involved in stocks.

A single share in a company can be worth pennies so, in theory, almost anyone could own at least one stock. However, even if that share increased in value 100 times over, you'd still only have a few quid.

As such, you probably need to invest at least £100 in the market to make it worth your while. But we'll say it again: you shouldn't invest more than you're prepared to lose.

When should you buy and sell shares?

When it comes to investing, you can either take a short- or long-term approach. At the more extreme end of short-termism is what's known as 'day trading'. This involves buying and selling shares within a single day of trading. As you might expect, it's a very risky approach that often results in making a loss.

Your chances of making a profit on your investment are a lot better if you stick with it for a longer period of time. As such, the chances of not losing all your money are also better.

If you're confident that the company you've invested in has a good long-term future, it doesn't matter if it rises or falls in the short term. As long as the value of your stock increases in value over several months or years, you'll be golden.

This sentiment is one supported by Warren Buffett, who once said:

Someone is sitting in the shade today because someone planted a tree a long time ago.

Warren Buffett

So, we know that waiting it out is often wisest when you're thinking of selling stocks. But what about buying? When should you take the plunge?

While a stock market crash is bad news for anyone holding shares, it's ideal if you're looking to buy some of your own. In fact, there's no better time to invest than the point at which the value of a stock has 'bottomed out'. In other words, when it's reached its lowest price and is about to begin increasing in value again.

Of course, nobody can predict the future. It can be tricky to determine when a stock has bottomed out, or whether it'll continue to drop.

But, in the event of a market-wide slump, like the 2008 financial crisis or the COVID crash of 2020, you can be relatively confident that any shares you buy will be worth more than you buy them for. This should be true even if they continue to lose value after the purchase.

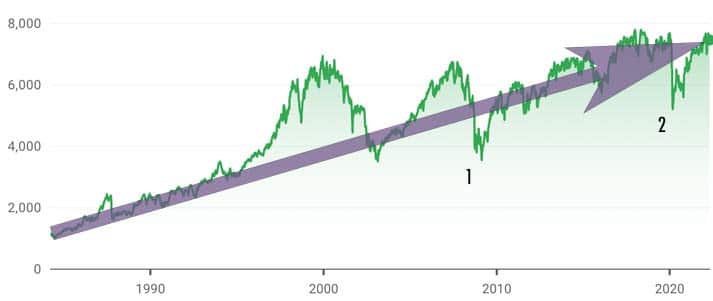

FTSE growth chart. Credit: Google

The image above shows the value of the FTSE 100 over time. As you can see, even after the devastating financial crash of 2008 (marked with a 1 on the chart) and the coronavirus crash of 2020 (marked with a 2), the overall trend is still one of growth.

So, in theory, it doesn't matter if you misjudge the point at which the market has bottomed out and go too soon. The chances are that the situation will eventually recover to a point where the value of your shares not only returns to the price you paid, but exceeds it.

Similarly, if you already own shares and the market suddenly tanks, selling might not be the best option. As the chart shows, the market has always recovered in the long term, going on to exceed previous peaks.

Or, as Warren Buffett puts it:

We simply attempt to be fearful when others are greedy, and to be greedy only when others are fearful.

Warren Buffett

How can you make money from shares?

You might have figured it out for yourself, but making money from shares comes down to selling them for more than you bought them for (accounting for any fees).

In reality, it's not as straightforward as that. Pinpointing the best times to buy and sell is a skill that takes time to acquire. You shouldn't expect to make a fortune on the markets – at least not straight away, anyway.

But there is a way to increase the value of your shares without having to buy any more: dividends.

Dividends are extra shares that a company gifts to existing shareholders at no extra cost. Usually, this happens after the company has posted strong performance figures.

You're welcome to cash out these dividends. However, it may be in your interest to reinvest them as further stock.

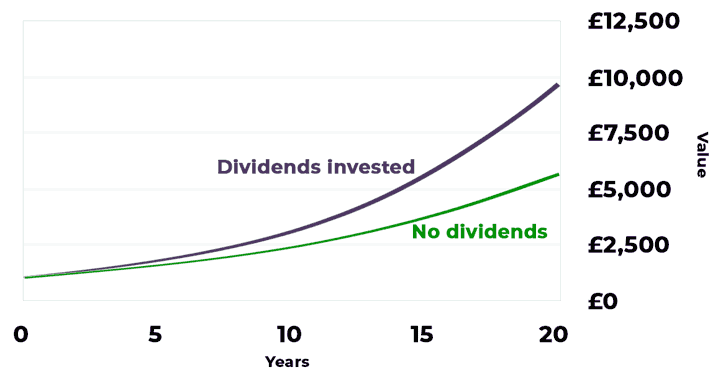

That's because dividends are paid equitably. In other words, the more shares you have, the more dividends you receive. If you invest those dividends as more stock, the next time dividends are paid, you'll receive an even greater proportion.

This phenomenon is known as compounding. It is similar to how your savings can grow exponentially with interest.

The graph above is just an example. The actual value of your shares over time will vary depending on the company's performance and the size of the dividends they pay out (if any).

But what it shows is how reinvesting your dividends can, over time, lead to substantial growth in the value of your portfolio. And that's without you having to invest a single extra penny!

If you're investing in funds, dividends will be reinvested on your behalf.

Why should you invest in the stock market?

These are the main benefits of investing in stocks and shares:

-

Long term, investing can make more money than saving

If you're fortunate enough to have any spare cash lying around, you should usually look to put it into a savings account or an ISA. But that's only half the story.

These accounts are good for increasing the value of your savings in the short or medium term. But, over longer periods, investing in the stock market usually provides greater returns. This has certainly been the case since the financial crash of 2008, as interest rates have been consistently low since then.

Of course, there's more to it than that. You may invest in a company that enjoys some rapid short-term growth, making the stock market a better option than a savings account. Or, you may invest in a company that barely grows (or even shrinks) over a long period of time.

Although there are ways to be relatively sure of a return over the long term...

-

Over long periods, indices always go up

As we explained earlier, over the course of several years, stock market indexes always increase in value.

And this isn't just true of indices tracking the biggest companies in a given region (like the FTSE 100). Regardless of what the index covers, these are usually a pretty sure bet for making a return on your investment.

As such, investing in a stock market index might not be the smartest move if you're trying to save for a holiday. The value of your shares may actually fall before it's time to jet off. But if you're young and thinking about saving for your retirement or buying a house, the chances are that the index you invest in will be worth more by the time you need to cash out.

-

Stocks and shares ISAs let you make tax-free gains

Credit: Images Money - Flickr

If you happen to make a substantial profit on the stock market, you'll be liable to pay Capital Gains Tax (CGT).

This kicks in if the profit you make on selling your shares or investments exceeds £6,000 in a single tax year (running from April to April). It charges basic rate taxpayers 10% of their profits, rising to 20% for higher or additional rate taxpayers (our guide to UK tax explains which band you fall into).

While making a profit of over £6,000 might seem unlikely, you don't want to be stung by CGT if one of your investments really takes off and you decide to cash in. And that's where stocks and shares ISAs come in.

Unlike regular savings accounts, the profits you make in an ISA are always tax-free. That includes stocks and shares ISAs, which present the chance to make larger gains than a normal ISA by investing your savings in the stock market.

Just note that stocks and shares ISAs aren't perfect. For starters, you can only invest up to £20,000 into them in a single tax year. And, unlike cash ISAs, there's a risk that the value of your investments can go down.

Lifetime ISAs are one of the best ways to save for a deposit for a house. And there's even the option to get one in the form of a stocks and shares ISA. -

The earlier you start investing, the better

The key to increasing your chances of success in the stock market is to play the long game. Naturally, it makes sense that the earlier you start investing, the more your money could grow.

There are a few reasons for this. Firstly, as we've outlined, stock market indices tend to increase in value over long periods of time. So, it follows that investing earlier should mean you make a larger profit by the time you want to cash out.

Secondly, there's the magic of compounding (explained above). This means the more often you've reinvested your dividends as extra stock, the more dividends you'll receive. And, in turn, your investments will increase in value too.

Finally, there's something to be said for experience. You don't need to be an expert to get involved in investing, but there's no denying it helps to learn from your mistakes and see how the market operates first-hand.

-

You probably already have investments

If you've got this far and don't think the stock market is your thing, we've got news for you. You may already have skin in the game.

As it can be lucrative in the long term, most private pension funds invest in the markets. If you have a job and a pension, the chances are that you already have money in the stock market. At least indirectly, anyway.

For this reason alone, isn't it worth educating yourself on the stock market and knowing what your retirement fund is up to?

What are the risks of investing in the stock market?

These are the main dangers of investing in the stock market:

-

The value of your investments can go down

We've mentioned it a few times, but it bears repeating. When you invest in stocks and shares, there's a chance their value will decrease and you'll lose money.

How much you lose depends on how much you've invested and how poorly the company (or companies) performs. But, in an extreme case, you could stand to lose everything you've invested.

This is in stark contrast to an ISA or regular savings account. Unless you go for an account with a negative interest rate (almost unheard of in the UK), the only way you'll lose any money is if the bank goes bust. And in that case, you'd only lose anything over the protected amount (usually £85,000).

-

Investment decisions based on emotion

With share prices going up and down all the time, it's easy to get sucked into the drama of the stock market.

Let's say that one of your investments doubles in value, and you decide to pump more money into other shares in the hope they'll do the same.

Or what if the opposite happens? A company you've invested in publishes some awful results, and the shares plummet? You might panic and sell your stocks at a loss, worried that the price will drop even further.

History may end up vindicating both decisions, but they could just as easily (and, arguably, more likely) look very foolish in time. That's because both are examples of decisions being led by emotions, and not by reason. This is something that most successful investors would advise against.

-

Chasing losses

Making decisions based on emotion really is one of the biggest dangers of the stock market, and it could lead to you chasing losses.

Put simply, chasing losses is when you invest extra money in an attempt to make up for a drop in the value of some other shares you own. However, doing this misses a crucial point: you haven't lost a penny unless you actually decide to sell at a loss.

Remember, as the FTSE 100 graph above shows, even a dramatic fall in share price doesn't necessarily mean it won't recover and later exceed the price you first bought it at.

As Warren Buffett famously said, patience is the key:

Our favourite holding period is forever.

Warren Buffett

-

Some markets are very risky

All investments entail at least some risk, but some involve a lot more than others.

Index or diverse funds are typically seen as the safest way to invest. On the other hand, forex trading is undoubtedly one of the riskiest. Forex is short for 'foreign exchange', and is the name given to the markets where investors trade currencies.

Chances are you'll have seen loads of TikToks and online ads promoting forex trading as a way to make money quickly. But the truth is that very few people involved in this corner of the market make a profit.

As Andrew Hallam explains in his book, 'Millionaire Teacher', for each dollar made in forex trading, a dollar is lost elsewhere.

Therefore, the only guaranteed winner is the investment bank making money on commission. This is the real reason forex trading is pushed so hard to people with little or no knowledge of the stock market.

-

Hidden fees

We explained earlier how a stocks and shares ISA lets you make investments without having to pay tax. But even an ISA can't save you from the other drain on your potential profits: investment fees.

There are lots of different fees that you could be charged depending on the type of investment and how it's managed. Some common ones include a platform fee, a fund management charge and a fee every time you buy or sell shares.

But it's important to remember that some charges are applied no matter how well your shares are performing. A 1% fee might not sound so bad if the value of your portfolio is massively up from when you bought it. But it'll feel like rubbing salt into the wounds if the price has dropped and you're still paying for the privilege.

This isn't necessarily a reason not to get involved in the market. Just remember to take the potential costs into account when you're figuring out how much you can afford to invest.

-

Overexposure to the stock market

Last, but absolutely by no means least, you should never invest all of your money into the stock market.

Prices can go up or down several times throughout the day, and more drastically so over the medium and long term. Even in the case of reliable long-term investments, like stock market indices, shares can dip below your original purchase price for months (if not years) before turning a profit.

For that reason, you should always have cash savings in an ISA or savings account. Preferably, you'll have some in an easy-access account, so you're not charged for making a withdrawal.

As well as risking the loss of every penny you own, having all your money in the markets is tricky if you're suddenly hit with an unexpected expense, like repairs to your car.

If you're having to sell stocks that are now worth less than you bought them for, you've made a loss. That's an issue that would never arise if you were simply dipping into an easy-access savings account.

Our guide to investing in the stock market with eToro is the perfect practical guide if you're looking to take the next step.