Top cashback sites 2024

When shopping via the best cashback sites, it's possible to get 10% or more back from some purchases. Don't buy anything online without checking these offers first.

If you're a frequent online shopper, you could be earning £100s a year in cashback.

If you're a frequent online shopper, you could be earning £100s a year in cashback.

We've seen cashback offers range from 1% to £100+. You'll usually get the best deals from the biggest purchases, but even getting a small percentage back is worth it. It all adds up.

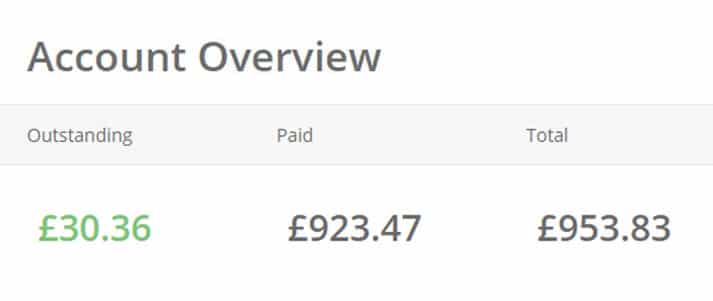

In five years, our very own Jake Butler has earned over £900 in cashback with TopCashback! Read on to find out how you could be doing the same.

What's in this guide?

Best cashback sites 2024

These are the top cashback sites:

-

TopCashback

TopCashback is a leading cashback site with excellent offers. It's often close between them and Quidco for the top deals, but we've recently seen some particularly good deals on TopCashback.

Their Classic membership is free. This lets you get £30 for referring a friend and up to 12.5% as a payout bonus from the Reward Wallet (which rewards you for transferring cashback for e-gift cards).

However, for just £5 out of your yearly cashback earnings, you can upgrade to the Plus membership. This increases the friend-referral bonus to £35 and the max Reward Wallet payout bonus goes up to 25%. Extra perks include exclusive promotions and competitions.

Also, look out for their Free Cashback feature. This allows you to earn cashback by completing tasks online, like filling out paid online surveys or checking your credit score.

-

Quidco

Quidco is one of the best cashback sites out there. They generally offer high rates, and most users give them glowing reviews.

They claim their average user makes £300 a year – that could bag you a summer holiday!

There's the option to pay for a Premium membership. This will get you higher cashback rates, better payout bonuses and other benefits. In exchange, you'll need to sacrifice £1 of your earned cashback each month you're active.

-

Swagbucks

Alongside cashback, there's a wide range of ways to make money on Swagbucks.

You can also earn rewards by completing surveys, playing games, watching videos and even downloading apps.

Earn your cashback and rewards by saving up 'Swagbucks' (or SBs as they call them) as a sort of currency that can then be exchanged for rewards. For more information, check out our Swagbucks review.

Every site we've listed is free to join, so you could sign up for a few and compare the cashback amounts between them. What's there to lose?

How to get cashback

Here are some of the best ways to earn cashback with minimal effort:

-

Get a cashback bank account

Some banks offer cashback with current accounts, where you'll receive a bit of money back when you shop with certain retailers or pay your bills, for instance.

Sometimes, cashback is offered for a limited time to new customers as a bank switch offer.

While this is an easy way to get cashback, watch out for potential drawbacks. Some accounts will charge a small monthly fee and/or expect a certain amount to be deposited in the account each month for you to retain the perks.

Check whether the cashback deals on offer match your spending habits. Otherwise, you might be better off opting for other bank account benefits instead.

-

Sign up for a credit card

If you're good at managing your money, a cashback credit card might be a better option. These essentially work by giving you cashback on some or all purchases (depending on the card).

Most only offer around 0.5% – 1% back on each purchase, but this soon adds up. Again, check if the offers work for you and watch out for monthly fees. Use our guide to student credit cards to find the best deals.

Make sure that, if you do have a credit card, you pay it off in full and on time at the end of each month. Only use it to buy things you know you can afford.

Otherwise, you'll be charged interest which could potentially be more than any cashback you've earned. And remember, if you don't pay it off, your credit score will likely suffer.

-

Switch energy provider

Many energy providers offer deals to entice new customers which include cashback. Just make sure you do the sums and ensure you're getting the cheapest overall deal.

For instance, there's no point in going for a deal that offers £30 cashback if you're going to end up paying £70 more across the year in bills.

Use our guide to comparing and switching providers to keep your bills as low as possible.

-

Do online shopping

If you don't fancy making a big commitment in the form of a new bank account or credit card, you can still earn cashback when you make purchases online using cashback sites. The ones listed above are good examples.

They're super easy to use and you can earn some serious cash over time if you stick at it. Keep reading to find out exactly how they work.

Our COO, Jake Butler, explains:

I don't buy anything online without checking if I can get cashback first.

It might not seem like much sometimes, but it really does add up, and bigger purchases like phone contracts or broadband can lead to much bigger payouts.

I've consistently earned over £100 a year since signing up.

How do cashback sites work?

Credit: Kalamurzing - Shutterstock

Cashback deals vary widely. You could earn as much as £100 or just a few pennies on a single transaction, depending on what you buy and where you shop. It might sound complicated, but it's very easy.

To start earning cashback, follow these simple steps:

- Sign up for a reputable cashback site like Quidco, TopCashback or Swagbucks.

- Whenever you decide to buy something online, open a new tab and sign in to your cashback site account. Alternatively, you could head straight to the cashback site to see which companies offer the highest rates or best deals.

- Search for the retailer you want to buy from in the cashback site search bar (e.g. 'ASOS', 'Currys' or even 'Sky Broadband', etc.).

- Follow the brand's link on the cashback site and it will take you to their homepage.

- Make your purchase as usual. The cashback site will have tracked your click so it knows you made your purchase through them, and they'll register your cashback.

How much cashback can you get online?

The amount of money you'll receive will vary. For smaller purchases, cashback rates can be around 5% – 10%, but if you're making a bigger investment (a new mobile phone contract or broadband package, for example) you could earn £100 or more.

Here's a list of typical cashback rates for some retailers at the time of writing:

- ASOS – up to 6.6% cashback

- Expedia – up to 10% cashback

- O2 Mobiles – up to £110 cashback

- Travelodge – up to 4% cashback

- Virgin Media – up to £115 cashback.

Remember that rates will vary depending on what purchase you make, which cashback site you use, whether or not you're a new customer and any special offers available.

Does cashback cost anything?

Cashback sites are usually free to use. Some, such as TopCashback and Quidco, have premium plans that give you access to the top offers, but it's possible to get cashback without spending anything beyond the cost of the purchase.

Some people worry these sites are scams – free cash does sound a bit suspicious after all. However, they have quite a nifty business model that makes it all possible.

Cashback sites make their money by earning a commission for sending customers to online shops, and you get a large slice of it (or, in some cases, all of it). Genius!

Companies like Argos, ASOS and even broadband providers pay cashback sites to advertise them and direct customers to their websites. When a customer makes a purchase, the cashback site earns referral money which it then passes on to you.

Some sites give their customers 100% of the commission. They instead make their money through bonuses received for referring large numbers of customers, or from premium memberships which typically cost a few pounds.

Top tips for using cashback sites

Credit: Yevgen Kravchenko, kamui29, Bell Photography 423 – Shutterstock

If you're keen to give cashback a go, there are a few things to consider before getting started.

Things to do on cashback sites

Here are our top tips for using cashback sites:

- Clear your cookies – Cashback sites use cookies to track if you have arrived at a retail site through them or another site. Therefore, if your browser history gets pages mixed up and doesn't register that you've come via a cashback site, you won't get your reward. Clearing your cookies before making your purchase will ensure this doesn't happen.

- Transfer any money you make out of your cashback account ASAP – Leave it in your account too long, and it won't be protected if the website goes bust.

- Do the maths before making your purchase – Cashback won't always necessarily get you the best deal. Shop around for student deals, check for promo codes and visit daily deal sites to find the best offer.

- Register your credit card with your cashback account – Do this so you can start earning cashback on purchases you make online and in stores too.

- Refer your friends – You'll earn extra cash for getting your friends to sign up with a referral link. At the time of writing, Quidco tends to offer £15 in their referral scheme, whereas TopCashback will give up to up £35 per referral (depending on your membership plan).

- Remember to use the price match – Both TopCashback and Quidco guarantee to match (and even beat) each other's offers. If you find you could have got a better deal elsewhere, you can submit a claim and get extra cashback. However, there are time limits on this, so read the T&Cs carefully.

Things to avoid on cashback sites

Here are some things to avoid when using cashback sites:

- Don't be distracted by flashy deals – It's easy to get excited by a £100 cashback deal on a new broadband package. But, if you don't actually need a new contract, don't go for it. Broadband providers also don't have the best reputation for being easy to understand. Even if they're offering great cashback, they might be stinging you with other charges.

- Don't assume anything – Just because you've followed the instructions, it doesn't mean the money is yours. Complications can occur that might lead to you missing out on your cash. To avoid disappointment, try not to rely too heavily on getting your rewards – instead, think of it as a bonus if you make some cash. If you have any issues, contact the cashback site's customer service department.

- Don't think that every deal is set in stone – There can be disputes between brands and cashback sites that might prevent you from getting what you're due. Admittedly, this is a pitfall of going for cashback. Nothing is guaranteed until it's safely in your bank account.

Looking for a faster way to earn cash online? We have a list of tried and tested methods to make money online.