15 vital money lessons you should have been taught in school

For many of us, school involved too many quadratic equations and not enough about personal finance. Here are the money lessons they should have taught us instead.

Credit: Tetiana Shumbasova, Rvector – Shutterstock

Bizarrely, financial education has only been a compulsory part of the national curriculum since 2014. And they still won't teach you everything you should know about money. This can feel especially true when you're faced with £9,000+ tuition fees and complicated Student Loan terms.

In our latest National Student Money Survey, 45% said they didn't fully understand their Student Loan agreement. On top of that, nearly three-quarters (74%) said they didn't get enough financial education in school.

Today's young people face a tough economic climate, a tricky housing market and student debt. It's more important than ever to learn about money.

We asked Save the Student readers what they wished they had learnt about personal finance as teenagers. Here's what they said...

15 essential personal finance skills

Here are the lessons about money school should've taught you:

-

How to make money last

Credit: TierneyMJ – Shutterstock

If you're having trouble making ends meet, it effectively boils down to earning more or spending less. That's the first step when it comes to learning about finances.

However tempting it is to go on a massive shopping spree as soon as your Student Loan or wages drop, it's crucial that you work out your disposable income first. Paying the rent and setting aside cash for bills doesn't take long. Once that's sorted, you'll have a much clearer idea of what's available to spend.

App-based bank accounts can be a great way of keeping track of your money and knowing how much you have left to splash.

But still, try to avoid any impulse purchases. It's important to be aware of the tricks used by supermarkets to make you spend more cash. And take time to consider (and save towards) exciting big-ticket purchases, such as a new laptop or a summer holiday.

How much money do you need to get by?

There's no clear-cut answer to how much money you need to live off. The amount you need to get by in London will be very different from the amount you'd need in Leeds. That's why Maintenance Loans vary depending on your situation.

We have found out the average amount students spend at each UK university and what they spend it on. You can compare it with your own spending, but always try to cut back where possible.

The first step to working out how much you'll personally need is by calculating a budget. Follow our budgeting steps and download our nifty spreadsheet to get a clear idea of your outgoings.

The aim is to avoid any financial surprises by planning ahead. Got Mum's big birthday coming up? Add it to your spreadsheet, set a reminder on your phone and start saving for her present now.

Building up an emergency fund is also a bonus for unexpected costs. This could include anything, from last-minute group holidays to fixing another broken phone screen.

-

How to haggle

There's no shame in haggling to get the best deal when you're buying something. What better way to convince a seller to lower their price than the fact you're living off a Student Loan?

But, unless you've got years of experience as a market trader, you probably weren't taught how to barter in school. Thankfully, we've got a really useful guide to haggling like a pro. Get practising!

While you should always ask for a student discount (even if it's not advertised), the opportunities for a bit of bargaining are endless. For example, head to a farmers' market towards the end of the day and take home some gourmet stock for less than you'd spend in the supermarket.

One of the best opportunities for haggling is when your mobile phone contract is about a month or two away from expiring.

Just ring up, ask for the cancellation department, pretend you want to leave them and turn on the charm. Free texts, extra data, a better phone and cheaper plans are all achievable with determination and patience.

-

The real dangers of debt

Some debt is unavoidable (and even necessary).

For most students, going to university would be impossible without debt from tuition fees and Maintenance Loans. Despite some of the scare stories, Student Loan repayments are actually achievable and always in line with how much you're earning.

However, some other types of debt can be quite dangerous.

Credit card debt can spiral out of control if you don't keep on top of repayments. And payday loans come with astronomically high interest rates and should always be avoided. The consequences can be devastating, as we found out when we interviewed a man who ended up in £26,000 of payday loan debt.

Private loans also come with risks. Some are specifically aimed at students and may look tempting, but it's important to look into alternative forms of funding first.

For more in-depth advice, read our guide to managing debt at university.

If you need free and confidential advice on money problems, you can get in touch with organisations like Citizens Advice, the National Debtline and StepChange. -

How to improve your credit score

When you apply for most financial products (things like credit cards and bank overdrafts, where you essentially 'purchase' money), lenders will run a credit check on you to calculate their risk.

Credit checks are done based on reports of your borrowing history, managed by a small number of credit referencing agencies.

From your credit score, lenders will decide the likelihood that you'll be able to repay what you borrow.

A poor credit score can affect your chances of getting a mortgage later in life, renting a house, or even just getting a mobile phone contract. Think twice before applying for financial products and always make your repayments on time. Any missed payments will show on your credit score for years – and it's not a good look.

It's possible to check your credit reports to see how you're doing and to catch inaccuracies. One of the top credit rating companies offers them free of charge.

-

How interest rates work

Interest rates for the whole of the UK are set by the Bank of England and commercial banks, with the former setting the 'base rate' and the latter adding more depending on the service offered and how generous they're feeling.

Interest rates in the UK were at an all-time low due to the financial impact of the coronavirus pandemic. However, they then increased rapidly from the end of 2021. Increasing the base rate makes it harder on borrowers (mortgage rates go up, for example), but is great for savers.

As an example of how interest rates can work, someone with £20,000 of savings might earn 3% interest on top of their cash every year, while a shopaholic maxed-out on their credit card with a £3,000 limit could be paying 20% interest on the money they've borrowed.

Some credit cards, overdrafts and mortgages often advertise low interest rates, but there's no guarantee you'll get these deals. That's because the best rates are usually reserved for people with the highest credit scores.

-

The reasons to have a credit card

Credit: WAYHOME studio – Shutterstock

There are plenty of potential pitfalls to owning a credit card.

If you don't keep on top of things, you could spiral into debt. You should never have a credit card if you think there's a chance you might not be able to afford the repayments, including added interest.

However, when used in the right way, credit cards can be quite beneficial. Being a responsible credit card user is one of the easiest ways to build up a good credit rating. It's the most straightforward way to show you know how to pay up on time.

Every credit card is different. But, generally, they can help you make bigger purchases. Just make sure you'll definitely be able to pay it off in instalments at the end of each month.

If you've got the self-discipline to settle in full (not just the minimum payment) when the bill arrives, you typically won't pay any interest on the purchases you've made, either.

There are also a few perks for credit card customers out there, such as air miles to put towards a holiday, cheaper currency exchange, cashback and fraud protection. However, you shouldn't choose a credit card based on the benefits alone. Otherwise, you could find yourself overpaying just so you can build up your miles for a holiday.

A lot of credit cards offer 0% interest for a certain period of time when you first sign up. Some savvy people regularly switch between banks and credit card offers to take advantage of the perks, freebies and 0% interest period on offer.

Our guide to student credit cards goes into more detail to help you make an informed decision and avoid getting into any debt you can't handle. -

How to shop around for the best deal

When making a financial decision, it's important to take time to consider all of your options. This could be for anything, including:

For example, do you know how long your arranged fee- and interest-free student overdraft is available? Or how soon after graduation you'll have to start paying it back?

Plus, do you know what penalties are tied to your unarranged overdraft? Or when your savings account will drop to a measly 0.09% interest?

So many students we speak to stay loyal to their bank to 'keep things simple', but this could be costing you a lot of money. It's worth keeping an eye out for the best deals on accounts, and switching banks when a better offer comes up.

Banks even offer hassle-free switching (where they change over all your standing orders so you don't have to organise it yourself) and cash incentives to encourage you to switch. Read our guide to the best student bank accounts for more info.

-

Don't trust everything adverts tell you

If an advert is promoting something as 'free', you'd assume it would, in fact, be free. But, unfortunately, this isn't always the case.

The ASA (Advertising Standards Authority) is often calling out businesses for misrepresentation in their ads.

Be particularly wary of multi-buy offers. Not only could you end up with products you won't use up, but this is also one of the dirty supermarket tricks used to get you to spend more money.

-

What to look for in your bank statements

As painful as this may be, it's important you get into the habit of checking your bank statements regularly. This way, you can avoid unexpected charges, wasting money or being scammed.

This includes your current account, savings accounts, and (most importantly) credit cards. With most banks and building societies operating online, keeping an eye on your money is as easy as opening an app.

You've heard this all before, but we'll say it again: it's crucial to keep on top of debts. Going beyond your 0% overdraft limit or delaying a credit card payment can lead to nasty charges (and will negatively impact your credit rating).

Regular check-ins are vital. They help you keep tabs on expected payments and interest bonuses and will highlight Direct Debits or subscriptions you don't need anymore.

If you spot any charges for things you don't remember buying yourself, contact your bank straight away!

Keeping an eye on statements also shows you whether you're budgeting effectively or heading in a dangerous direction. If you're nudging the red more often than you'd like, you can check which areas you're overspending in and adjust.

-

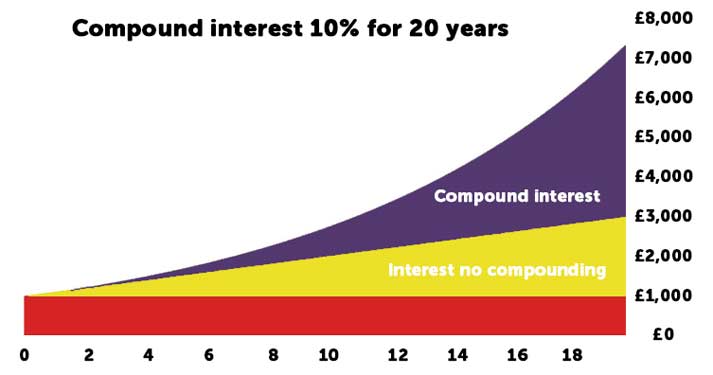

The magic of compound interest

Compound interest is a powerful thing. Whether it's good or bad depends on which side of the calculator you're sitting on.

This interest-ing (sorry) concept can grow the money you start out with faster than expected, but it makes it harder to clear any money you owe. Why? Because compound interest multiplies over time by adding interest on top of interest.

How compound interest boosts your balance

When you deposit money in a savings account, for example, after a certain period of time it will earn interest (essentially free money).If you leave any interest earned from your initial stash in the account, then the new (larger) amount continues to earn interest. And as it happens over and over again (called 'compounding'), your cash pile grows faster and faster, just like a snowball.

Leave £1,000 in an investment or savings account earning 10% interest a year (yes, rare, but we're making a point) and you'll have £7,328.07 after 20 years... from doing nothing. In this instance, interest is compounded monthly, meaning the interest is calculated and added at the end of every month.

How compound interest increases your debt

Unfortunately, compound interest works the same when you owe money with interest.

Companies who lend you money, whether credit card providers or car finance people, are literally making money from money too. Dangerously for us, this can lead to a debt spiral, as the more you borrow the more you owe exponentially.

The example above can apply to debt too: borrowing £1,000 at 10% a year (compounded monthly) would build up to a terrifying debt of £7,328.07 after 20 years. Ouch!

While you can't do much about borrowing rates, you can protect yourself by being aware of the long-term effects of compound interest. Plan your spending, budget for payback and get help if you're worried the costs are getting out of hand.

When you receive a lump sum that you don't need immediately, move some of it into a savings account. Compound interest will work its magic and leave you with a little more money. -

You can earn money without investing much time

Most of us earn cash by trading our time for a paycheque. However, thanks to our beloved World Wide Web, your income doesn't always have to be generated from your limited and valuable time on earth.

In fact, if you want to be rich or just have a good work-life balance, it's a good idea to start thinking about passive income ideas.

Some passive income ideas include:

- Saving and investing

- Owning/renting out a property

- Setting up a business

- Creating a blog

- Selling digital copies of something you created once (an ebook you've written, for example).

It's not an overnight route to early retirement and may well require a lot of time to set up. But, it's very possible to generate passive income alongside your regular salary.

-

How to plan your pension

It seems a long way off right now, but you'll never regret forward-planning your retirement fund.

In a nutshell, a pension is a savings account where you put away money to use when you retire from work and no longer have regular income from a job.

The government provides a State Pension once you're 60-something (although it's likely to be 70-something by the time we all reach that stage). To receive the full amount, you'll need to have paid enough National Insurance.

Either way, it isn't always enough to live on. Some people end up working much longer than they should because the State Pension leaves them short.

A good option to look into is the Lifetime ISA (launched in 2017), where the government pays you 25% on top of what you save (up to £4,000 each year). By the time you reach 60, that could involve a fair amount of money. Read our guide on the Lifetime ISA for everything you need to know.

There's also the Workplace Pension, where part of your salary is put towards a pension before you get paid. Some employers match whatever you put in – extra money for free!

It's worth checking what your pension is invested in, too. You could opt for an ethical fund, which means your money will be invested in clean energy, reforestation and more. Doing so is a great way to cut your carbon footprint.

For more info, including how and when to start saving, check out our guide to pensions.

-

Whether to rent or buy a house

Credit: WAYHOME studio – Shutterstock

Living away from home can give you a taste of freedom (e.g. watching TV in your pants and eating ice cream at 2am).

At some point, you'll start to wonder whether things could be sweeter if you actually owned a home. And by sweeter, we also mean cheaper.

The way to get on the property ladder at a young age is to get yourself a mortgage. This is money that a bank loans you to buy a house. You'll be making monthly payments for about 20-odd years, and you'll also pay for the privilege (land searches, solicitors, arrangement fees and interest).

The earlier you pay off a mortgage, the more years of free shelter you'll have later. The hardest part is saving for a deposit, as you'll be required to put down a lump sum at the start of a mortgage deal. If you plan on buying somewhere, start saving for a deposit now.

No lenders will loan 100% of a home's value. Plus, the bigger the deposit you have, the better the deal you'll get and the less you'll have to borrow (and repay).

Benefits of owning vs renting a property

Owning a house is almost always cheaper each month than paying rent, but getting on the property ladder can be tough.

Any money you put into your property, whether towards your mortgage or interior decorating, benefits you instead of your landlord. It could even become an income stream if you buy to let instead of living in your property (utilising 'buy-to-let' mortgages).

On the other side, renters could put away savings that homeowners might have to spend on fixing leaky pipes or faulty boilers. Plus, the moving process is easier when you're renting.

Renting is generally a good idea at the start of your career while you're figuring out where you want to live more permanently.

-

How much tax you need to pay

Did anyone ever tell you at school that the first few grand you earn each financial year is tax-free? It's called your Personal Allowance (PA) and it's updated every April at the start of the tax year.

In 2024/25, you won't pay tax on the first £12,570 you make.

Income doesn't just mean your wages, although that's the most obvious source. 'Taxable income' (the kind you're expected to pay tax on) also includes interest from bank accounts, profit from selling any goods or services and even some state benefits.

However you earn money, you'll only pay tax on anything you make over the PA. Tax will be charged at 20% on the difference up to £50,270, with higher rates on anything you earn above that.

Most students won't come close to earning more than their PA each year. But because of the way income tax is collected through wages, you could accidentally be overpaying tax on a part-time job. Check your payslips and make sure your tax code is correct. If you think you're being overcharged, get in touch with HMRC to get a tax refund!

At the same time, don't ever be tempted to avoid the tax that you owe. HMRC know who you are, they will find you, and they will... ask for their money.

Get a tighter grip on this with the key tax facts you need to know.

-

Where to invest your money

Warning: As with all investing, your capital is at risk. The value of your portfolio can go down as well as up, and you may get back less than you invest.

Learning to invest is the key to making more of your money. It can result in a really solid source of money on your side.

The primary lesson here boils down to: get rich slowly, diversify (reduce risk), minimise leakages (fees) and eradicate all emotion from investment decisions.

Investing may seem scary at first, but it doesn't have to be complicated. Rather than picking individual stocks and companies to invest in (or paying a fund manager to pick assets to invest in on your behalf for a pricey fee), you can reduce the risk and invest in index funds instead.

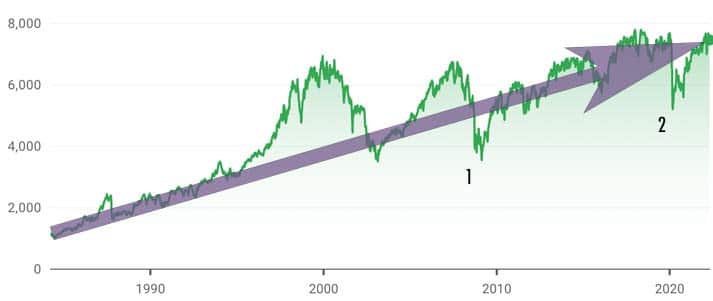

Index funds are funds that track the market as a whole (its index). For example, you can invest in the UK's FTSE 100, which includes the top 100 UK companies. This means you're banking on the very best companies in the UK to grow collectively. They don't promise quick wins but, instead, as the market grows, so do your returns.

With no fund manager to pay for, index funds are cheaper to buy and hold. They also diversify your risk and remove ongoing decision-making and cold sweats at night.

Historically, as the chart below shows, the top UK companies have performed well and are growing overall.

It's important to note that there was a dip in 2020, largely due to the pandemic. However, the FTSE 100 has since recovered.

FTSE growth chart. Credit: Google

On the whole, there are very few fund managers and individual investors who outperform the markets over the long term.

You can invest in an index fund through an online broker, but make sure you're getting the best deal by checking this table by Monevator.com. There are lots of index funds to choose from, such as Vanguard (which is typically the cheapest). All you need to do is stump up some cash, sit back and leave it.

If you'd first like to dip your toe into the markets, read our guide on how to start trading and check out Andrew Hallam's fantastic book The Millionaire Teacher.

The bell's ringing, so that's all for today...

We've only touched briefly on some important finance basics to give you an overview of the vital money lessons missed in school.

Now it's time to do some of your own homework and equip yourself with the knowledge to have greater financial freedom for the rest of your life. You can start by downloading our free money-saving cheat sheet.

Now you've learned some essential money lessons, check out the truth behind common Student Finance myths.