7 times Cardi B gave us her best financial advice

Cardi B rose to fame through Instagram and reality TV. Classic millennial. But her money advice is lightyears ahead of "cut out the avocado toast".

Credit: Eugene Powers (left), Lev Radin (centre and right), Solomon7 (background) – Shutterstock

Cardi B's been slaying since Bodak Yellow. But she's not just a musical genius! She also likes to dish out tips and tricks on X (formerly Twitter) on how to get money.

If the lyrics of her single Money – an indicator in itself of the importance she places on being financially savvy – are anything to go by, Cardi is all about the hustle. She was, after all, the first solo female ever to win Best Rap Album at the Grammys.

We went through her tweets and found the financial advice she has to offer. As Cardi would say, make money moves.

Cardi B's tips for financial success

Here are Cardi B's top money tips:

-

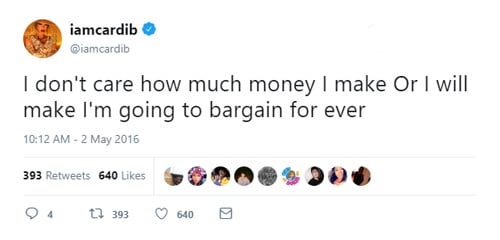

Never pass up a bargain, no matter how rich you are

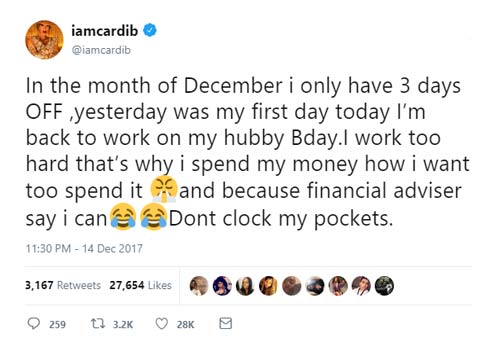

Exhibit number one: this tweet is our first piece of evidence proving that Cardi B is one of us.

Sure, you might have a Lamborghini and a Rolex on your wrist, but that doesn't mean you should refuse a bargain when one presents itself.

No one is ever too good for a good deal. On top of that, knowing how to negotiate a bargain will make sure you never miss a beat.

-

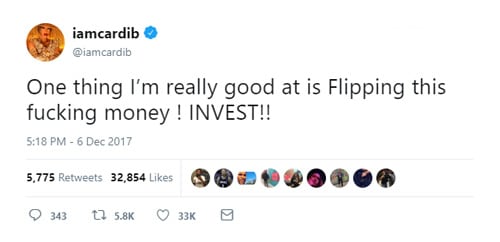

Invest your money (when the time comes)

Growing your money by investing it properly can make your bank account flourish.

Cardi has invested in property and a business. If her tweets are anything to go by, she is even planning to launch a company of her own.

Property, a business or the stock market are all great places to start burying your treasure once you're earning and are financially sound.

-

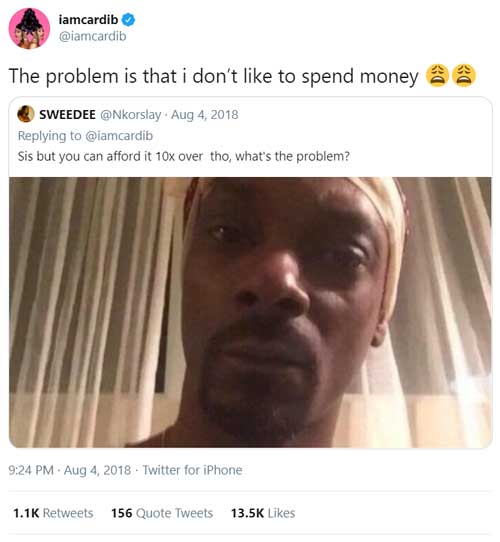

Work out what your financial goals are

Just because you've got money, doesn't mean you have to spend it all in one place.

As tempting as it is when the number in your savings account starts to grow, try not to blow your money all at once. Keep some aside for a rainy day or for a long-term project you're working towards.

Do you want to buy a house? A car? Go travelling? Remind yourself of those the next time you accidentally end up on ASOS...

A savings account with a good interest rate and a budgeting strategy will help you reach your goals faster. -

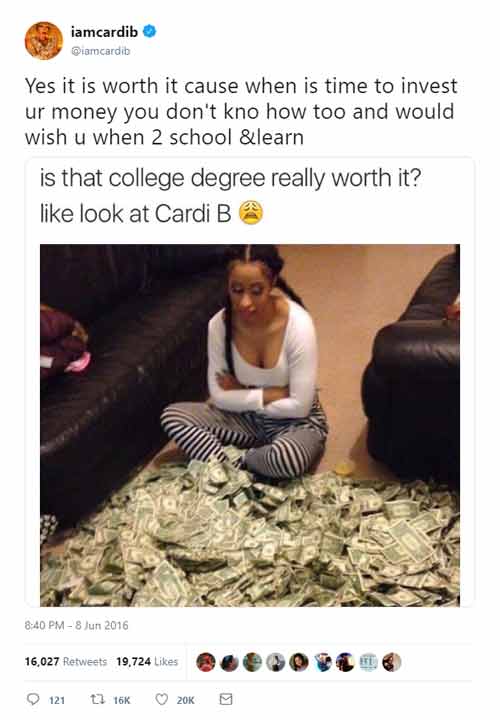

Educate yourself about money and finance

There are loads of different ways to learn about money.

Cardi didn't complete her university degree. Instead, she dropped out after three semesters at a college in Manhattan and famously made money stripping after quitting her part-time job as a cashier.

But she does recognise the value in getting savvy about your finances early on. We know money jargon can be boring, but the earlier you get in there, the more time you have to grow your finances.

Putting this into practice can mean doing something as simple as looking at our daily deals or doing a quick assessment of habits that might be draining your bank account unnecessarily.

Which brings us to our next point...

-

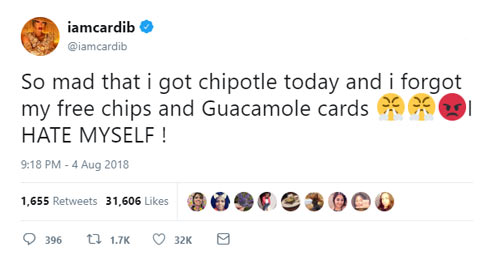

Ask for financial advice

Even the rich ask for advice on how to spend their money.

Don't be shy about asking for financial advice if you're thinking about spending a lump sum in one go or making a decision that could have long-term effects on your finances. For example, taking out a loan is a big deal.

But be mindful about who you ask. A mate that doesn't think twice about blowing £300 on the latest gadget probably isn't the fountain of wisdom you should be turning to.

Family is always a good place to start, as is your bank or your family accountant if you have one.

And get savvy about how much tax you should be paying, especially if you're already working a part-time job at uni. Make sure HMRC have put you on the right tax code or you could end up paying more than you should be.

-

Always check for freebies and discounts

Basic money-saving 101: never forget to pick up the free stuff!

According to an interview Cardi did with Fader magazine, her humble abode is furnished with a lot of things she got for free. She only pays full price for something if she's on the move and doesn't have time to negotiate a lower price.

Supermarket cashback apps are a great way to make money back on your food shop. Freebies often come in the fine print and shop assistants may 'forget' to remind you to pick up the free goodies or 'forget' to apply the student discount on your latest purchase.

This is especially relevant when you're spending a considerable amount of money. For example, retailers often do discounts when you spend over £50. And don't forget to check whether you're entitled to any loyalty card discounts/freebies, whether you're shopping online or in-store!

-

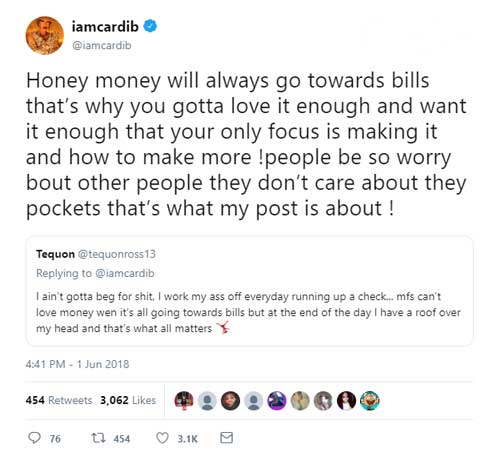

Work out a budget to avoid living beyond your means

Unfortunately, Cardi is living proof that bills will follow you around no matter how much money you earn.

Whether you're an international megastar or a student, some of your income is going to have to go towards boring household bills like rent and electricity. It's best to make sure you always budget accordingly.

Don't forget, you can get cashback on your bills too when you register through sites like Quidco or TopCashback. Some student bank accounts now offer cashback deals on bills when you sign up as a new customer.

Earning money feels less like hard work if you're passionate about what you do – check out Ben Lebus and his foodie business MOB Kitchen with millions of Insta followers!