Student Banking Survey 2015 – Results

UPDATE: View our 2024 Student Banking Survey.

Ahead of a new academic year, we wanted to know which banks score top marks from students - as voted for exclusively by you. Here's what you revealed.

Credit: Banzai Media SrlThis year's National Student Money Survey exposed the reality that many students struggle to meet the costs of daily living, so we're keeping up the pressure on organisations who can improve student finance.

Credit: Banzai Media SrlThis year's National Student Money Survey exposed the reality that many students struggle to meet the costs of daily living, so we're keeping up the pressure on organisations who can improve student finance.

In the first ever Student Banking Survey, we uncovered which banks are most popular and - more importantly - which provide the best service for students. It was also an opportunity to ask broader questions about choosing a bank and dealing with borrowing. A huge thanks to everyone who took part!

What's on this page?

Making the right choice

Why did students choose their current account?

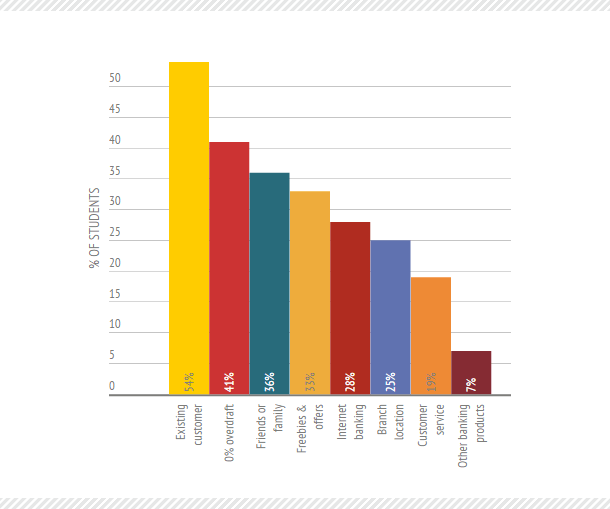

We've got heaps of advice on how to shop for a better student bank account - but what really influences where you choose to stash your cash?

Our survey revealed that more than half of you plump for a student account somewhere you already bank. Access to an interest-free overdraft, and banking at the same place as family and friends, also came out as important factors.

Our survey revealed that more than half of you plump for a student account somewhere you already bank. Access to an interest-free overdraft, and banking at the same place as family and friends, also came out as important factors.

Perhaps most surprisingly, almost a third of you don't have a student account at all - which means (intentionally or not) you may be missing out on cost-free borrowing and student-friendly banking by sticking with a standard bare bones current account.

Do students switch to get better deals?

Whether it's an all-singing student account or your regular garden variety, just 1 in 5 of you are currently looking to switch to a new bank.

If you've done your research on the best student banks and have all the facilities you need, you're on to a winner (although it's still worth regularly checking that you're on the best deal). If you're sticking with a bank you're not happy with, it's in your interest to switch it for something better.

With just 20% of students saying they shop around for the best deals - and a paltry 5% switching when they do find a better offer - it's worth asking now whether bank loyalty is paying off for you.

Student comments:

- I received a free 4-year rail card (which I would have bought anyway), a large overdraft, and £5 if I have at least £500 deposited into my account every term (covered by Student Loan payments going in)

- It seemed most sensible to choose the best freebie - it's going to save me more money than that extra 0.02% interest from another bank

- I attempt to go with the bank with the least controversial reputation at the time (difficult). However, freebies often sway me (I am weak)

- I have never wished to go overdrawn so never opted for a student account

- I ended up staying with the same bank as my parents, which makes transfers really easy

Most popular student banks 2015

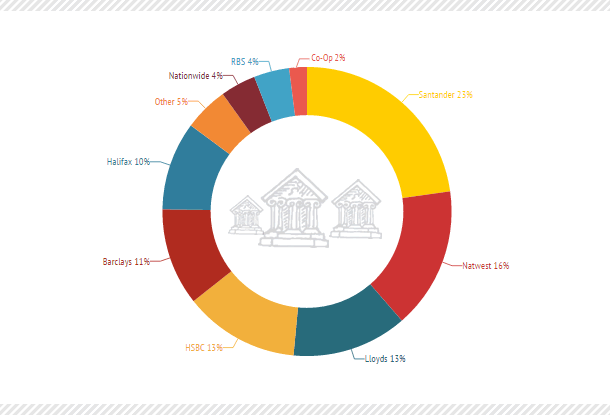

Santander - already the best value student account in 2015 - is the most popular bank in our survey: 1 in 5 students already keep their main account there.

Santander - already the best value student account in 2015 - is the most popular bank in our survey: 1 in 5 students already keep their main account there.

NatWest (16%) and Lloyds (13%) came in second and third on the list for the most preferred student banks.

How satisfied are students with their bank?

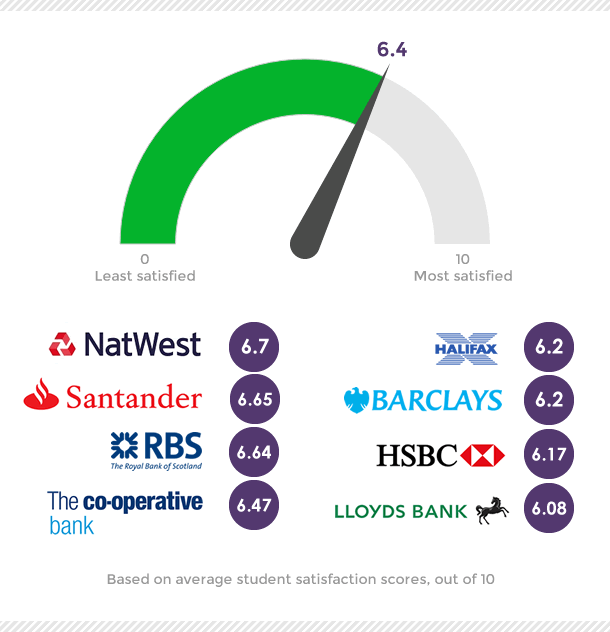

We also asked students to rate how satisfied they are with their bank, and were pleasantly surprised. The average score was 6.4 out of 10, but almost 1 in 3 gave their bank an incredible 9 or 10 out of 10!

Interestingly the satisfaction scores for the individual banks were very close, but leading the way on putting smiles on student faces this year are NatWest, Santander and RBS.

Interestingly the satisfaction scores for the individual banks were very close, but leading the way on putting smiles on student faces this year are NatWest, Santander and RBS.

Student comments:

- They let me open a student account in my 4th year of university, but the 1st year of a new course

- They get things done as quickly as they can and are always polite, smiley and helpful, which can really help if you're having a really rubbish day

- The second you don't have money they don't have any time for you and charge you £15 every time you use your card if overdrawn!

- When I lost my debit card on a cookie run the customer service was fab. I had a new card very quickly and could still use online banking while I waited

It’s great to hear most students are happy with their bank, but loyalty also comes with a risk of missing out on better deals – namely getting the highest possible interest-free overdraft.

Student borrowing

With the average student short £265 a month after the Maintenance Loan, banks play a very important role in bridging the gap. We wanted to know how much you rely on your bank - such as through an interest-free overdraft - compared to other, costlier types of borrowing.

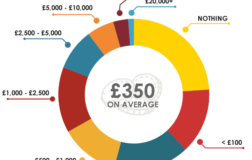

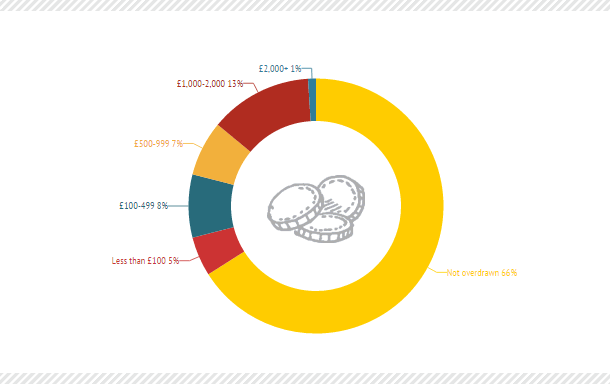

While the majority - 66% of students - said they weren't overdrawn at all, the most popular place to borrow extra cash is from family. Only 8% said they were currently overdrawn by £100-£499, compared to 25% who have borrowed that amount from family in the past year.

While the majority - 66% of students - said they weren't overdrawn at all, the most popular place to borrow extra cash is from family. Only 8% said they were currently overdrawn by £100-£499, compared to 25% who have borrowed that amount from family in the past year.

We also heard from some students who said they'd turned to private or payday loans after they were refused overdraft facilities at their bank, which typically only made their debt worse in the long term. Ensuring your bank covers you for emergency money is one of the main reasons to switch to one that gives you what you need.

Student comments:

- The payday loan I took out started as a £200 loan to get myself out of charges at the bank. That then turned into a £300 loan from another company to cover the £200 I couldn’t pay back, and it snowballed!

- Big overdraft at first (£1,500) but by third year, I need more. My Maintenance Loan doesn't come close to paying my rent even

- I've been with my bank for 15 years, but they wouldn't give me a loan

- When I needed to borrow money and extend my overdraft, the bank refused because I'd used a payday loan - so I had to take another payday loan

- The £1,500 interest free overdraft offers flexibility, especially when it comes to large necessary payments such as uni rent over summer

Many students get stung after graduating with sudden demands for repayments or additional charges, so make sure you’re well aware of the conditions before signing up for an overdraft.

Do students save?

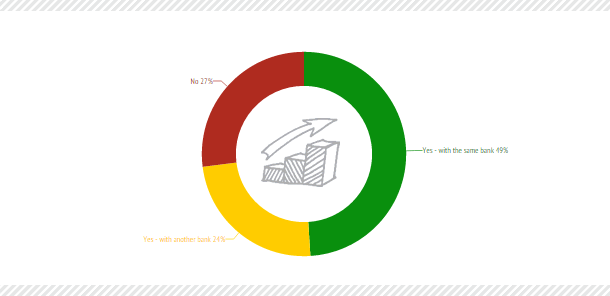

When it comes to student savings accounts, we found almost half of you hold a rainy day fund with the same provider, a quarter keep it with another bank, and the rest of you (27%) don't have a savings account at all.

When it comes to student savings accounts, we found almost half of you hold a rainy day fund with the same provider, a quarter keep it with another bank, and the rest of you (27%) don't have a savings account at all.

If you've managed to scrape together some savings, or have a decent 0% overdraft but don't need the funds right now, stick the money in a tax-free ISA to earn on it! It also makes it harder for you to blow it all on a crazy weekend full of regrets.

Student comments:

- I've found it fairly straightforward to manage my money simply by trickling my loan from my savings account into my student account weekly so I don't over-spend

- The savings account I have gives me pence in interest but I sometimes have thousands in there

- Setting up savings accounts and transferring money can be done through their app or Internet banking - it's helped me so much as a student

- Managed 1st year fine for saving money, but going into 2nd year with increased expenses!

- I have six savings accounts (each with a different bank) to make the most of interest rates

Do you think students get a good deal from the banks, or should there be more support? Let us know - leave a comment below.

If you think your bank is short-changing you, it's time to trade-up: read the Best Student Bank Accounts and get a better deal.

Want to know more about the survey, or need case studies, comments or quotes? We’re happy to help – just drop us a line.

- Source: The Best Student Banks Survey 2015 / www.savethestudent.org

- Survey polled 1,097 current or recent students in the UK and ran between 24-31 August 2015

- Background reading: the National Student Money Survey 2015

![What do students spend money on? [stats]](https://www.savethestudent.org/uploads/what_students_spend_money_on2-252x160.png)

![What do students spend money on? [stats]](https://www.savethestudent.org/uploads/what_students_spend_money_on2-100x100.png)