COVID-19 UK student survey 2021 – Results

Looking back on an academic year like no other, our new survey reveals the true impact of the coronavirus pandemic on students. Here's what we found...

Credit: Kate Kultsevych – Shutterstock

From start to finish, this academic year has been massively shaped by social distancing measures. For a vast number of students, there have been challenges to their abilities to study, socialise, earn an income and much more.

Following on from our previous two surveys on the effect of the pandemic on students from May 2020 and November 2020, this survey gives an overview of the full 2020/21 university year.

Having surveyed around 1,300 students across the UK, we are able to reveal more about how students have navigated the difficulties of the pandemic during their degrees. Read on for our full findings.

What's in this report?

- Key findings

- Issues students have faced due to coronavirus

- How easy is it for students to get help?

- How are students making up for lost income?

- How many students requested bigger Student Loans during the year?

- Where have students been living during term time?

- Face-to-face teaching at universities

- Are students happy with their university's response to coronavirus?

- How many students have received tuition fee refunds?

- How do students feel about their graduate job prospects?

Key findings from the COVID-19 UK student survey 2021

Before we go into the survey's findings in more detail, here's an overview of the key stats:

- Over seven in 10 students said they've experienced poor mental health due to the pandemic.

- 80% of students have had to ask for help with issues related to COVID-19 – but, of those, over half said that it was difficult or very difficult to get help.

- Just under 20% of students have accessed hardship funding this year, receiving an average of £611.

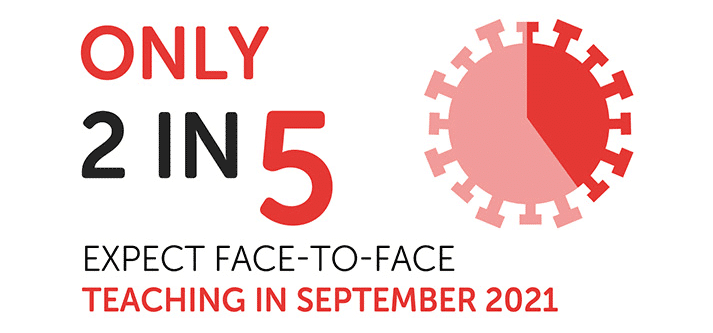

- Around two in five students expect there to be face-to-face teaching in September 2021.

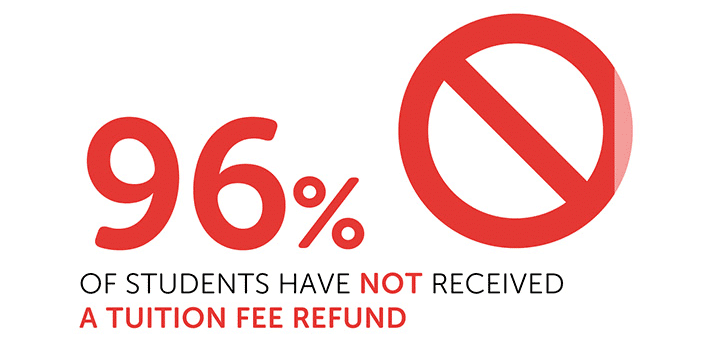

- Only 4% of those in the survey have had a tuition fee refund (either a full or partial refund).

- Around three quarters of students are worried about the impact of the pandemic on their graduate job prospects.

Issues students have faced due to coronavirus

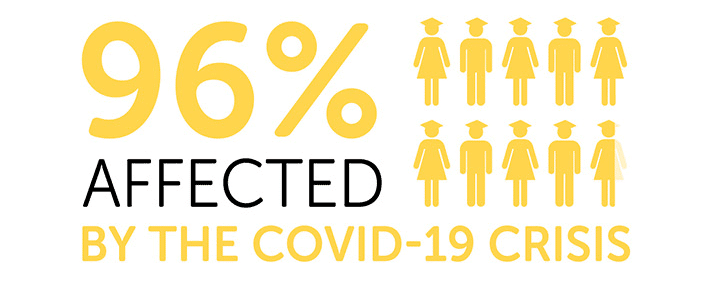

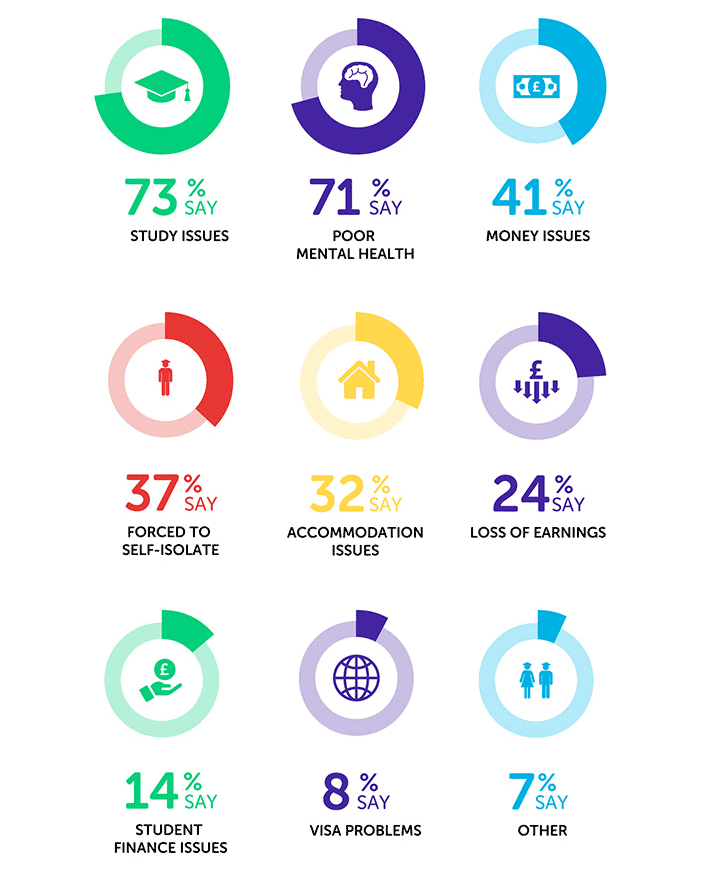

For the vast majority of students in the survey, the pandemic has had a direct, negative impact on them this academic year – with a particular toll being taken on their studies (73%) and mental health (71%).

With regards to the impact of the pandemic on students' mental health, we have noticed a steady increase in each of our COVID-19 surveys in the proportions who cite this as an issue they have faced.

In May 2020, 60% said their mental health had been affected, which increased to 66% in November 2020. Now, at the end of the academic year, the proportion of students affected has increased further to 71%.

It's extremely concerning to hear from such a high number of students whose mental health has been impacted by the pandemic. For any students who are struggling, be sure to talk to someone if you ever need to, and make time for self-care.

How easy is it for students to get help?

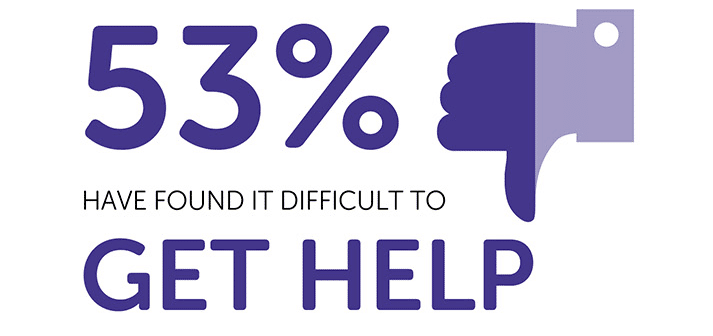

As many as four in five students in the survey (80%) have needed to ask for help with coronavirus-related issues this academic year. This is up from 61% in our previous COVID-19 survey.

Of those that asked for help, 53% (yes, over half) said that it was difficult or very difficult to get help. In fact, only 3% found it very easy.

With so many students understandably requiring support this year, help should have been easily accessible within universities for those who need it. Unfortunately, it seems that, too often, this was not the case.

What students say about the impact of COVID-19 on university life

- Student life throughout COVID-19 has been extremely lonely and isolating. I feel like I've not had the chance to meet anyone. I feel like all I do is stare at the four walls of my tiny room and it has definitely affected my mental health.

- [I] lost my job and had to use the university hardship fund three times since the beginning of COVID.

- I wish the tuition fee was lower this year as we had everything online and it was truly a massive struggle. If I was to go into lessons on campus no doubt I'd have gotten better grades.

- [My] self-employed parent couldn't work so [the] household financial situation got a bit worse, athletics training wasn't on, university teaching went entirely online, found it hard to socialise.

- My mental health took a toll as I had to spend so much time alone [...] I had so many qualifying exams that were very difficult and I had no income so I had to apply for the hardship fund, but things will look up.

How are students making up for lost income?

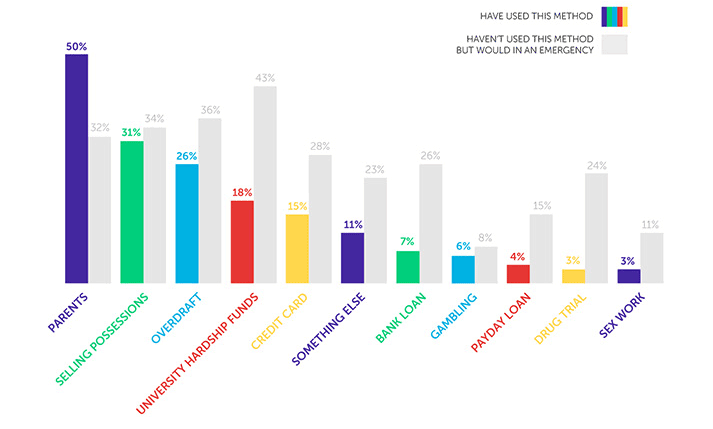

With around a quarter of those in the survey dealing with lost earnings due to the pandemic, how are students plugging the money gap?

Compared to our previous two COVID-19 surveys, it's striking to notice the increases in students saying they have used – or would use in an emergency – credit cards and university hardship funding. Here's what we've noticed about students' reported use of each of these funding sources:

Students' use of credit cards

If we first consider how many students have been using credit cards to make up for lost income due to the pandemic, the proportion who say they have done so has increased slightly with each of our three coronavirus surveys.

In May 2020, 9% said they had used credit cards, which went up to 13% in November 2020 and then up again to 15% in this survey.

While credit cards can be used safely, they come with risks – particularly if used at a time of financial struggle. If used by somebody who is short of cash, there could be much more risk of credit card payments getting missed and high-interest charges being applied, only making it more difficult for the individual to get out of debt.

It's worrying that a lot of students appear to view credit cards as a way of dealing with a cash crisis. On top of the 15% who have used credit cards, 28% said they would use them in an emergency.

For a lower-risk source of money, students could contact their university to see whether they're able to access hardship funding.

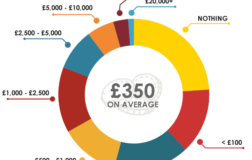

How much are students receiving in hardship funding?

Notably, there has been an increase in students saying they have or would use university hardship funds if needed. The proportion of students saying they have accessed this funding jumped up from 7% in both of our previous COVID-19 surveys to 18% in this one.

The numbers saying they would use hardship funds in an emergency also increased – 40% said they would in May 2020, which surprisingly dropped to 35% in November 2020, before jumping back up again to 43% this time.

While this may suggest an increased need among students for hardship funding, it could also indicate a growing awareness that the funds are there for those that need them.

For example, students may have become aware of the funds following the repeated messaging from the government that they have given an additional £85 million to universities to help with hardship funds.

Among the 18% of students in the survey who said they had used university hardship funds, the average amount they each received was £611.

How many students requested bigger Student Loans in 2020/21?

When a student's household income drops by a certain percentage, they are able to apply to the Student Loans Company (SLC) for a readjustment of their Student Loan amount. This is known as the Current Income Assessment.

The amount that the income needs to drop by for students to be eligible varies in each part of the UK. You can see a breakdown of this in our guide to Maintenance Loans.

As part of our preparation for this survey, we made a Freedom of Information (FOI) request to the Student Loans Company (SLC). We asked how the numbers of students applying for a Current Income Assessment differed in 2020/21 compared to 2019/20.

In response, we were informed that in 2019/20, 23,119 applied for this assessment, which increased to 33,697 in 2020/21 – that's a 46% year-on-year increase.

It's worth noting that there may well be more than 33,697 students in the UK who experienced a significant drop in household income this academic year, but who did not apply for a Current Income Assessment.

There could be a number of students who are not aware of the option to apply for the loan readjustment, while others may be aware but decide against applying for any number of reasons.

Also, when considering the numbers, it should also be acknowledged that the pandemic will not necessarily be the only reason for students applying for Current Income Assessments this academic year.

However, to see such a noticeable increase in the numbers applying from one year to the next, it does indicate that job losses, the introduction of furlough and additional pandemic-related reductions in household income could have had a significant impact on the numbers needing to request bigger Student Loans in 2020/21.

We also heard from a student who had hoped for a bigger Maintenance Loan, but sadly didn't qualify for the Current Income Assessment:

[My parents were] financially affected – 14% income decrease, but because it wasn't 15%, Student Finance wouldn't reconsider the amount for [my] Maintenance Loan.

They also gave me far below the predicted amount for maintenance on their calculator and said that the amount stated isn't a guarantee and basically [told me] to make do on an unliveable wage.

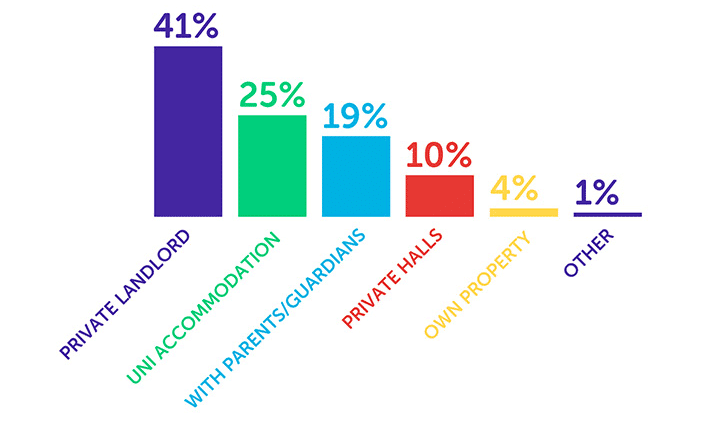

Where have students been living during term time?

For just over a half of students in the survey, they either remained in the same accommodation this year (42%) or had moved but have since returned to their usual term-time accommodation (11%).

But, around a quarter have moved back home with their parents and remained there, while a further 10% have moved into a home that's owned by a private landlord.

What students say about their accommodation

- [I've] been living on my own most of the time in my uni accommodation as the uni limited numbers in flats and my flatmates stayed at home most of the time. It's been very lonely.

- Due to the shift with online teaching, I had to move back home. Though I saved on rent and got to live with my family, my mental health has really deteriorated as a result of poor support from my university and feeling isolated.

- [I] had to rent a house next to the university in order to go to lectures and seminars ([I] was paying £200 a week). At the end, everything was online and I never really stayed at the house so I was basically paying for nothing.

- [I] pre-paid for accommodation for a placement which was cancelled.

Face-to-face teaching at universities

When it was announced by the government that all university students could return to in-person teaching from 17th May 2021, we heard arguments that this was too little, too late for many. It arrived very close to the end of the academic year when many were already fast-approaching exam season.

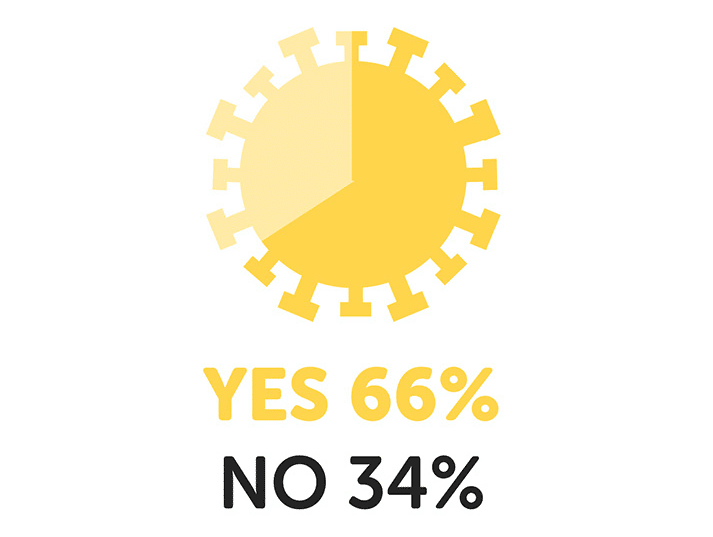

We asked students if they'd had any face-to-face teaching this term...

Around two-thirds responded that they have had some face-to-face teaching this term.

But, how many students expect to return to face-to-face teaching in September 2021?

Despite 66% having face-to-face teaching in the summer term of 2020/21, surprisingly, only 38% say they do expect in-person teaching in September, while a further 33% are unsure.

How have universities responded to coronavirus?

As discussed earlier, a large majority of students in the survey (71%) said that COVID-19 has negatively impacted their mental health.

This statistic is made all the more worrying by the additional finding that two in five students have been disappointed with their university's mental health support services during the pandemic.

While 28% said they were disappointed with their university's communication with students during the pandemic, it is worth noting that the majority felt that it was either satisfactory (44%) or good (28%).

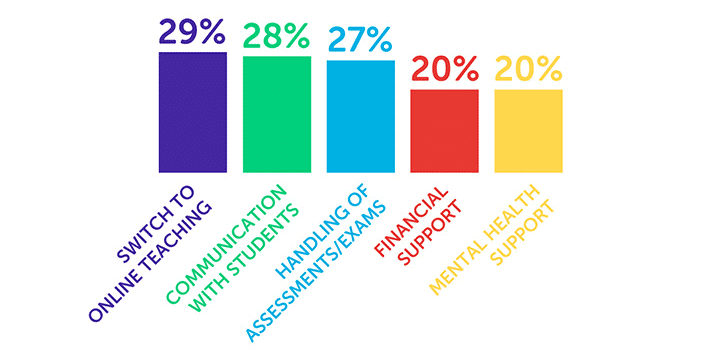

Here's a rundown of how many students in the survey thought that their university had a good response to COVID-19 in terms of their switch to online learning, communication with students, handling of assessments and exams, financial support and mental health support:

How many students have received tuition fee refunds?

There has been a lot of debate recently about whether students' university experiences have been good value for money this year.

Interestingly, though, only one in five students in the survey said they have requested a tuition fee refund this academic year, with 5% requesting a full refund, and 15% requesting a partial one.

When we look at how many students have received a tuition fee refund, the numbers are significantly smaller – 1% said they have received a full refund, while 3% said they have received a partial one.

Impact of COVID-19 on graduate job prospects

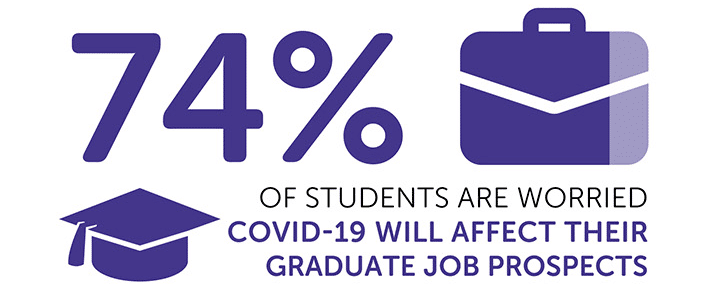

Just under three quarters (74%) of students in the survey said that they are worried about their graduate job prospects.

Interestingly, this figure is slightly down from the figure in our November 2020 survey, which saw 79% say the same. However, both of these figures are up from 70% in May 2020.

This could reflect that in May 2020, it wasn't fully clear how long the pandemic would continue, and to what extent the economy would be impacted.

Perhaps, as the government has now given a date for when lockdown measures will end (extended from 21st June to 19th July 2021), there is now slightly more hope among students about their graduate job prospects than there had been in November 2020.

About this survey

Our findings are completely independent. We don't conduct our surveys to sell products to students, or to keep universities and advertisers happy.

Since 2013, we have reached out to university students all over the UK for their honest opinions about university, with a focus on student money. We crunch the numbers to tell it like it is and improve the advice we provide across our website.

If you want to know more about the survey, need case studies, comments or quotes, we're happy to help – contact us.

- Source: COVID-19 UK student survey 2021 / www.savethestudent.org

- Survey polled 1,302 university students in the UK between 20th May – 22nd June 2021

- Data from previous surveys

- Save the Student Press Page

- Tools and resources.

Student Money Cheatsheet

Download The Student Money Takeaway for free. This printable PDF distils the very best advice from our website onto just two pages, including a one-minute budget sheet. It's designed to be accessible, fun and engaging.

We created this resource in response to the concerning findings from our recent student surveys.

![What do students spend money on? [stats]](https://www.savethestudent.org/uploads/what_students_spend_money_on2-252x160.png)

![What do students spend money on? [stats]](https://www.savethestudent.org/uploads/what_students_spend_money_on2-100x100.png)