National Student Accommodation Survey 2025 – Results

As this year's National Student Accommodation Survey reveals, students are living further from their universities, paying more in rent and, in many cases, living in substandard conditions.

Credit: Monkey Business Images (background) – Shutterstock (background)

Our National Student Accommodation Survey is now in its ninth year, on this occasion receiving almost 1,300 responses.

2024's results, coupled with the National Student Money Survey later in the year, painted a grim picture for those at university – one in which the effects of soaring inflation were still being felt.

This year's results show some signs of improvement. The proportions who said they struggled with the cost of rent or bills, took action to reduce their energy usage, and whose health suffered from the cost of renting, are all down since 2024.

However, in these cases and others, the recovery has been sluggish. Despite small year-on-year improvements, our findings suggest conditions are still considerably worse than before the cost of living crisis.

Action is desperately needed and, looking ahead, the Renters' Rights Bill is expected to become law in the coming months.

Among other things, this promises to end bidding wars on rental properties, extend the grace period for tenants in arrears, and allow renters to terminate their agreement with two months' notice at any time. To a greater or lesser degree, these measures could lead to even more positive changes in our 2026 report.

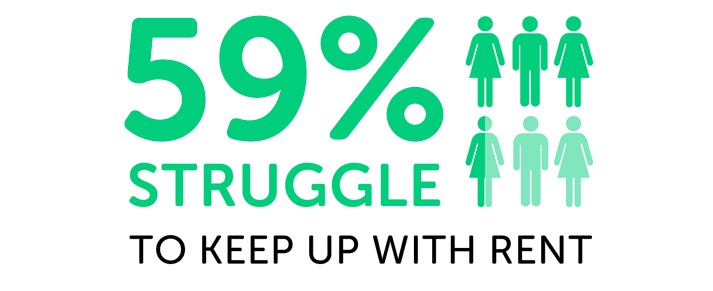

But the Bill has been criticised for its approach to student accommodation, and with Maintenance Loans in England still suffering from long-term real-terms cuts, it's hard to foresee a significant reduction in the 59% who told us they struggle with rent at least some of the time.

As such, in addition to improving conditions for renters, the government must increase maintenance funding to catch up with inflation and enable students to comfortably cover the cost of accommodation.

What's on this page?

Key findings

These are some of the key findings from the National Student Accommodation Survey 2025:

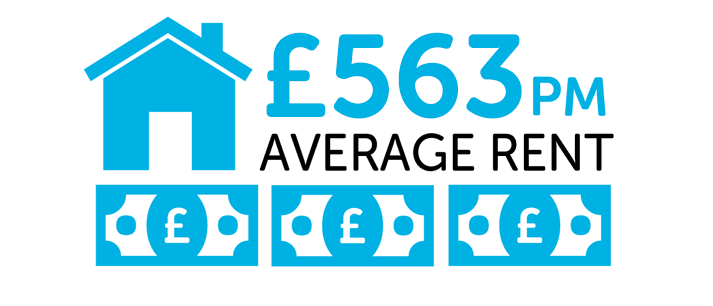

- The average cost of rent among those surveyed was £563 per month, with London the most expensive region (£812 per month).

- The average distance that surveyed students live from campus has risen to 26 minutes.

- 7% of respondents said they've experienced homelessness as a student.

- 36% have thought about dropping out of university due to the cost of rent.

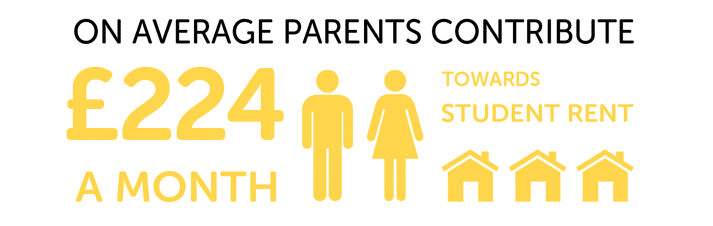

- Parents contribute an average of £224 per month towards student rent.

- 69% have had at least one issue with their student home, with damp (31%) the most common.

- Just under half (46%) of respondents didn't feel their accommodation represented good value for money.

- 12% believe they will never own a house.

Expert comment

Save the Student's money expert, Tom Allingham, says:

Despite the upcoming Renters' Rights Bill aiming to improve conditions for tenants, we fear it won't be enough to rectify the state of student housing.

Thankfully, this year's survey findings point to some small improvements. Compared to 2024, fewer students told us they're struggling with the cost of rent, and there's been a decline in the proportion who say it impacts their health.

But across the board, the results suggest that the landscape is still far tougher than before the cost of living crisis. For instance, while 59% of respondents saying they struggle with rent is an improvement on last year's 64%, it's still far higher than the 50% who said the same in 2021. And, of course, even that was far too high.

If, as expected, the Renters' Rights Bill comes into force later this year, we will hopefully see more time given to tenants in arrears, and an end to no-fault evictions. Combined, these measures should help tackle student homelessness.

However, many have criticised the Bill for its approach to student housing. Reflecting on our survey results, we anticipate it will have little to no impact on the severe shortage of university accommodation, nor the extent to which rent currently swallows the majority of the Maintenance Loan – both of which are among the reasons students told us lead to a period of homelessness.

We urgently call on the government to increase maintenance funding to reverse the real-terms cuts of the past few years, to allow all students to live at university without the undue stress of keeping a roof over their heads.

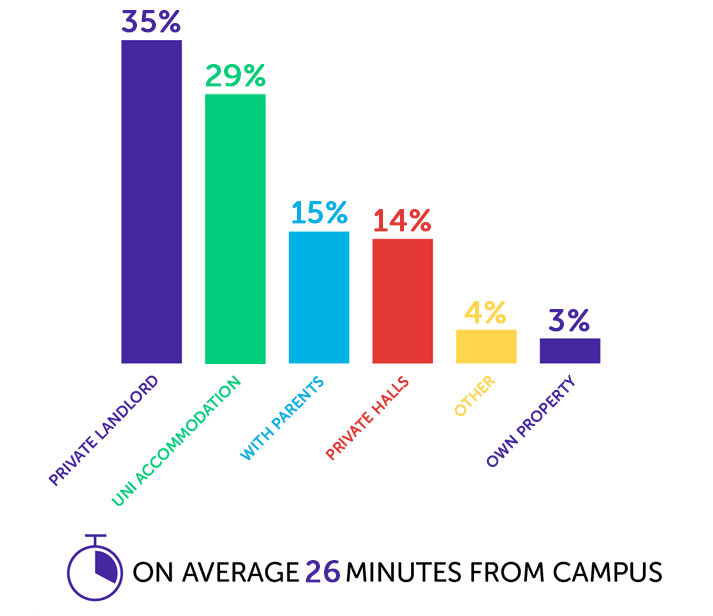

Where do students live during term time?

As is the case every year, students in our survey most commonly lived in a privately rented house or flat. At 35%, this is slightly down on last year's figure (39%), and reflects an almost equal but opposite shift in those living in university accommodation (29%, up from 24%).

Commuter students are a growing talking point in the sector, and the proportion of respondents living with their parents or guardians remains at 15% for the third consecutive year. Meanwhile, the average distance students live from their university has increased to 26 minutes.

| Survey year | % of respondents living with parents/guardians | Average distance from campus (all accommodation types) |

|---|---|---|

| 2020 | 12% | 21 mins |

| 2021 | 10% | 21 mins |

| 2022 | 13% | 21 mins |

| 2023 | 15% | 24 mins |

| 2024 | 15% | 24 mins |

| 2025 | 15% | 26 mins |

Taken together, these two results highlight the blurring of what constitutes a commuter student. Students who still live at their pre-university address, and those who have moved – but still live far enough away to involve a substantial commute – will ultimately face many of the same challenges.

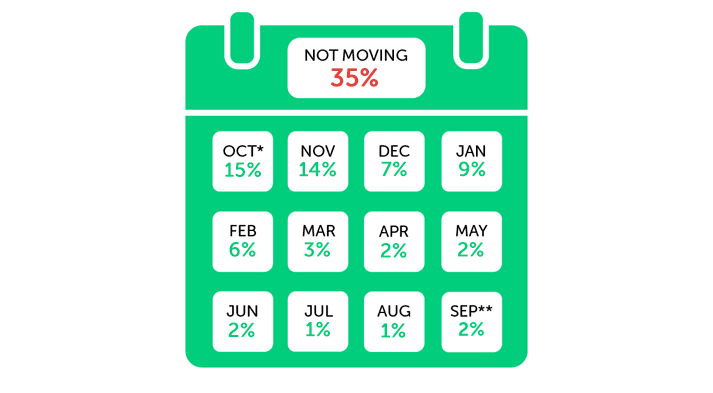

When do students look for accommodation?

Since 2024, there has been little change to when respondents start looking for next year's accommodation. But compared to 2023, and indeed earlier, there is a clear trend of students starting their house search earlier.

Between 2020 and 2023, the proportion of respondents looking for accommodation before November was consistently either 10% or 11%. Yet, in the two surveys since, that figure has been 15%.

This correlates with concerns about the university housing shortage, including reports of students queueing overnight to secure next year's accommodation, in fear of missing out.

The student housing shortage

Fewer students in this survey were worried about the university housing shortage than last year (47%, down from 51%). And, despite continued media coverage, there has been a decline in the proportion of respondents who were aware of the issue (75%, down from 80%).

Nonetheless, for those who are affected by the crisis, it's a great source of concern:

- I was worried I'd be homeless this year, I only found a place to live via Facebook Marketplace a couple days before moving in. (Private landlord)

- Last year I lived in a different city to my university and it meant that travelling was an hour long, and that was hard for me as I am a disabled and chronically ill student. It basically meant that I just didn't go to university at all last year, but I passed my foundation year so I guess that's all that matters. (Private halls)

- [I] struggled so much to find current accommodation and don't want to repeat [that] as it was really stressful and [I] ended up having to live with someone I didn't want to. (Private landlord)

- The pressure was extremely stressful and it felt like it was the only thing on everyone's minds. The estate agents were pushy and played into this and honestly rushed us a lot. (Private halls)

- This does not affect me but it affects students living in our town and using the university here. There is not enough private student accommodation and there is no halls of residence here. (Own property)

- Too many students, too little housing, and it's too expensive for anyone to afford on their own. And no one seems to care. (Private halls)

- We tried to get housing this year but there was none available so [we] had to apply for university halls, leaving one friend to defer a year as they were no rooms available for her. (University halls)

Student homelessness at university

As was the case in 2024's survey, 7% of respondents told us that they'd experienced homelessness as a student.

While it's a relief that this figure hasn't increased, it's still greatly concerning that roughly one in every 14 surveyed students has been without a home at some point during their degree.

It's also important to bear in mind that homelessness is a complex issue, and the definition is far wider than just rough sleeping. Although some students reported doing this, others described their experiences of sofa surfing, squatting or staying in hostels.

The reasons behind student homelessness are equally as varied, as outlined by these comments:

- Didn't pay on time so had to squat somewhere.

- Got kicked out of my parents' house over Christmas.

- I [was a] student in [a] different city in the first month of my studies. I was not admitted to the student dormitory, so as not to travel, I slept with friends during the working week and sometimes at the university without the knowledge of security.

- I couldn't make rent consistently on time in my old property. I ended up in a hostel with my two daughters. It was awful.

- I had to sleep rough due to having no money.

- Lived in a car for four weeks.

- [I am a] Ukrainian refugee [fleeing] from the war, and had a fallen relationship with [my] host family.

The upcoming Renters' Rights Bill will abolish Section 21 no-fault evictions – something that has been welcomed by Crisis, among others, and should help protect tenants from homelessness. The extra time promised for renters in arrears will likely make a difference too.

However, with Maintenance Loans in England falling drastically short of inflation in recent years, and many university towns and cities severely lacking in student housing, it's clear that the Renters' Rights Bill alone won't be enough to eradicate homelessness at uni.

How much does student accommodation cost?

Of the respondents who pay rent, the average cost was £563 per month. This represents a 2.4% increase on 2024 (£550), which itself was a 2.8% increase on 2023 (£535) – both broadly or exactly in line with the annual increases to the Maintenance Loan in England.

On the face of it, this would appear a popular move, with 77% saying rent should be pinned to Maintenance Loans.

But considering how funding in England has fallen drastically short of inflation in recent years, simply tying costs to loans is no longer enough.

Just under three in five surveyed students (59%) said they struggled with the cost of rent at least some of the time, with 17% describing it as a constant problem.

| Survey year | How many said they constantly struggle? | How many said they struggle from time to time? | How many said they have no difficulties? |

|---|---|---|---|

| 2021 | 13% | 37% | 50% |

| 2022 | 11% | 42% | 47% |

| 2023 | 18% | 45% | 37% |

| 2024 | 20% | 44% | 36% |

| 2025 | 17% | 42% | 41% |

As the table above shows, these particular findings have improved since 2024.

However, when contrasted with 2021 and 2022, more respondents reported a struggle to pay rent (in particular, "constantly"), and fewer said it's never an issue.

We hope this small year-on-year improvement is the start of a longer-term trend, reversing the impacts of the cost of living crisis. But, without a significant real-terms increase in maintenance funding in England, this may not be possible.

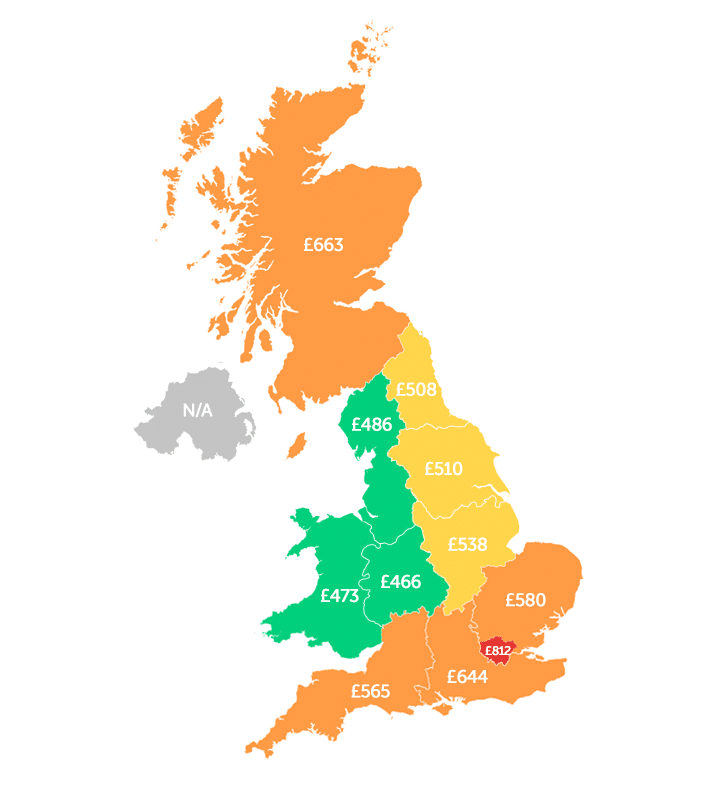

Average student rent across the UK

Surveyed students in London face the highest average rent in the UK, at £812 per month – almost £150 more than any other region.

At £663 per month, respondents in Scotland reported the second most expensive average rent. However, it's worth remembering that while rent in areas such as Glasgow and Edinburgh will be around or above this figure, the cost in smaller towns and cities will likely be lower.

By contrast, those in the West Midlands (£466 per month) paid the lowest average rent in the UK, closely followed by respondents in Wales (£473 per month) and the North West of England (£486 per month).

Unfortunately, we didn't receive enough responses in Northern Ireland to provide a reliable figure for the average rent in the region.

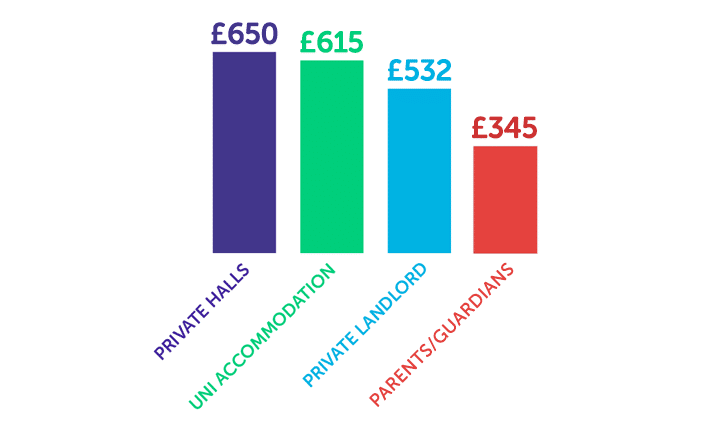

Student rent by accommodation type

Looking more closely at the four most popular types of student accommodation, it's perhaps unsurprising that respondents living with their parents or guardians paid the least rent by far (£345 per month).

Renting from a private landlord is significantly more expensive (£532 per month), but still markedly cheaper than living in university or private halls (£615 and £650 per month respectively). This is to be expected, though, as halls tend to have some or all bills included in the cost of rent.

What is included in student rent?

To that end, this is what students in our survey told us is included in their rent:

Roughly two-thirds (67%) said their rent covers the cost of at least one extra service – most commonly water (60%), electricity (58%), gas (53%) and broadband (45%).

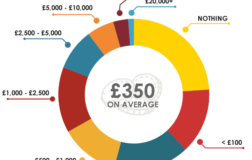

How much are student rental deposits?

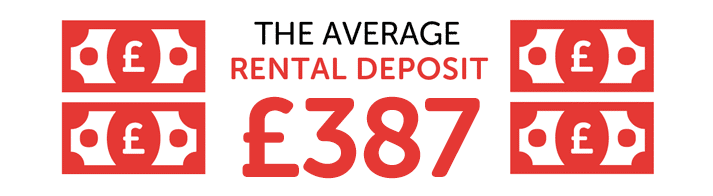

Among the respondents who paid a deposit this year, the average amount was £387.

Of those who have paid a deposit at any point while at university, 15% said they've struggled to get it back. This is a slight improvement on 2024 (17%) and continues a slow and steady trend in the right direction, with 18% saying the same in 2023, and 19% in 2022.

Many students also chose to provide extra detail about the difficulties they've faced reclaiming their deposits, including disagreements over damage to the property:

- [The landlord claimed] we had ruined the mattresses [but] they already looked like that when we moved in.

- Damage to the door that was already there when I moved in.

- No real reason, they claimed that a chair was broken, however it was a chair they refused to replace from the very start of the tenancy.

- Our landlord never registered it with the deposits scheme.

- No valid reason, they just took five months to pay us.

- [They] said it was left a mess but [we] took photos before we left, so got it back.

- They accused me of paint damage that was there from before me.

While some respondents explained that reasonable deductions were made from their deposits, the vast majority of written responses were from those who disagreed with the decisions.

In particular, many of the above students claim they were faced with paying for damage that predated their tenancy. Others said their deposits were never placed in a protection scheme, or that it took months to be returned.

To minimise these issues as much as possible, it's vital that students know their rights as tenants and how to improve their chances of reclaiming their deposit.

Simple measures, such as asking for an inventory, taking detailed photos upon moving in and out, and ensuring deposits are legally protected (when required) will all help, particularly if the dispute needs to be resolved by the protection scheme itself.

How much are student energy bills?

*This figure is only for respondents who pay bills separately. Many students either have bills included in their rent or don't contribute to energy costs.

Once again, the average cost of student energy bills has increased. This year, respondents reported an average of £88 per month, up from £86 last year, £85 in 2023 and £62 in 2022.

That said, despite the extra cost, respondents appear to be finding it easier to keep up with payments:

| Impacted by rental costs | How many said they constantly struggle? | How many said they struggle from time to time? | Total |

|---|---|---|---|

| 2023 | 22% | 42% | 64% |

| 2024 | 19% | 36% | 55% |

| 2025 | 15% | 41% | 56% |

Although the overall proportion struggling is slightly up, the trend since the peak of the energy crisis in 2023 is one of improvement – not least in the proportion of those describing bill payments as a constant struggle.

We also asked respondents what measures, if any, they take to cut back on energy usage:

| Ways to use less energy | How many respondents did this in 2024*? | How many respondents did this in 2025*? | Difference (percentage points) |

|---|---|---|---|

| Not put the heating on | 73% | 59% | - 14 |

| Stayed in bed longer than usual to stay warm | 62% | 55% | - 7 |

| Asked housemates to use less electricity/gas | 46% | 51% | + 5 |

| Had shorter/fewer showers | 46% | 45% | - 1 |

| Spent longer at uni to avoid using electricity/gas at home | 40% | 44% | + 4 |

| Not cooked as often | 33% | 37% | + 4 |

| Used an electric blanket | 19% | 21% | + 2 |

| Asked landlord to improve insulation | 16% | 11% | - 5 |

*This data only includes those who pay bills separately.

The biggest change since last year is in the proportion of surveyed students avoiding turning the heating on to save money. Significantly fewer respondents are doing this than in 2024 (59%, down from 73%), and similar can be said of those staying in bed to keep warm (55%, down from 62%).

In fact, despite an increase in those taking some of the other measures, 13% said they did none of the above – up from 7% in 2024, and 6% in 2023.

How rental costs impact students' health and studies

We asked students if their physical or mental health suffers due to rental costs – and if so, to what extent. In total, 68% of respondents said that it did.

This includes 19% who said it greatly suffers, and 49% who said it somewhat does. The headline figure of 68% is slightly down on 2024 (72%) – entirely accounted for by a drop in those responding "somewhat".

Breaking this down, it appears that of the two, mental health suffers both more often and more intensely as a result of rental costs:

| Impacted by rental costs | How many said it suffers greatly? | How many said it suffers somewhat? | Total |

|---|---|---|---|

| Physical health | 11% | 37% | 48% |

| Mental health | 16% | 49% | 65% |

In addition, of the respondents who have experienced some sort of problem with their accommodation, 41% said their studies have suffered as a consequence.

Students considering dropping out of university

In some cases, the stress of keeping up with the cost of renting can lead students to consider dropping out of university altogether.

| Have students considered dropping out? | Rent | Bills |

|---|---|---|

| Yes – thought about it | 36% | 23% |

| Yes – have dropped out | 2% | 3% |

| No | 62% | 74% |

Fortunately, the proportions saying they have either thought about (36%) – or gone through with (2%) – dropping out of university due to the cost of rent are both down since 2024 (40% and 3% respectively).

The proportion who have considered dropping out due to the cost of bills is also down (23%, compared to 28%), although there has been a slight increase in those saying this expense caused them to leave university (3%, up from 2%).

This is what students told us about keeping up with rent while at university:

- Had to save to come to uni. Savings quickly disappearing. Makes you consider dropping out while you have any money left. (University halls)

- Have considered changing universities due to the cost of living in London, to somewhere with cheaper rent. (Private landlord)

- Have to work full-time to pay rent which can be overwhelming with studies. (Private halls)

- I am supported by my family so I'm not in too much stress, but I do feel guilty when I think of the amount they have to pay for me to study here. It's more of a mental burden since I want to help too, but it's kind of hard to look for a decent part-time job. (University halls)

- I dropped out due to financial struggle, which led to a depression phase where I couldn't function. My sister stayed by my side and supported me until I recovered, after which I reapplied to finish my studies. (Private landlord)

- I have dropped out of uni in the past due to [the] cost of living, this is my second attempt at uni. (Private landlord)

- I suffered greatly, partly due to stress including financing. My parents were struggling to help me pay rent as I cannot work as a disabled student. I had to take out loans. [I] got so physically ill I am now back at home and on a year out which might become two. (With parents/guardians)

- My rent costs so much that after paying, I barely have enough money for food. I'm also type 1 diabetic and my diet is vital for my health. I've had to call several ambulances for myself and have been hospitalised and on death's door a few times now due to struggles with money/food. This causes me to stress so much about getting money which affects my education, which then affects my mental health in a cruel cycle. (Private landlord)

How do students pay for their rent?

Our National Student Money Survey routinely finds that Maintenance Loans fall short of living costs – most recently, by an average of £504 per month. As a result, many students must look to other sources of income to make ends meet.

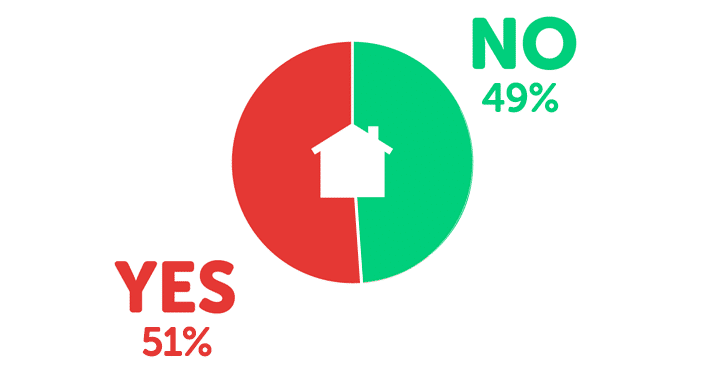

This year, just over half of respondents (51%) told us they've borrowed money at least once to help pay their rent – significantly down on 2024 (61%).

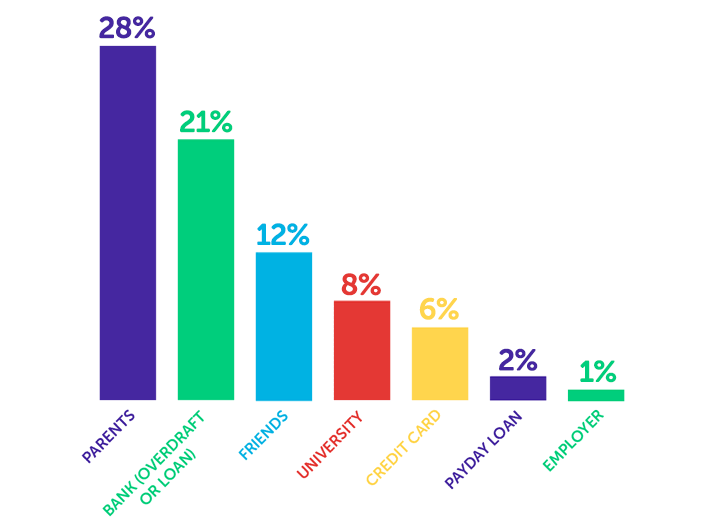

As for where they borrow that money from, the order of popularity has remained the same, albeit with a decline in the proportion turning to each source.

28% have borrowed money from their parents, while 21% have used cash from their bank in the form of an overdraft or loan. Both of these figures have dropped since 2024, when they stood at 36% and 25% respectively.

Parental contributions to student rent

*This stat does not differentiate between money parents have lent and money they have gifted.

Among the respondents who pay rent, their parents contribute an average of £224 per month to cover the cost. This represents a modest increase on 2024 (£214 per month), which itself was substantially up on the previous year (£145 per month).

In last year's report, we remarked on how falling inflation and faster wage growth may have allowed parents to offer extra financial support to their children.

While it's far from ideal for this burden to increasingly fall upon parents – particularly if they're unwilling or unable to provide funding – it is arguably preferable to borrowing cash from more expensive or riskier alternatives.

Students in rent arrears

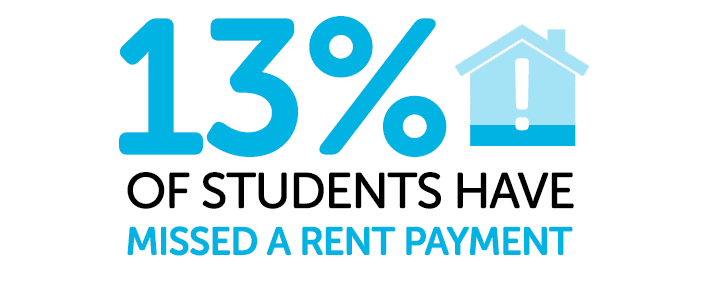

Approximately one in eight respondents (13%) said they've missed a rent payment in the past, with around half that figure (7%) telling us they were in rent arrears. Both of these stats are within one percentage point of the findings in 2024.

Among the 7% who are in rent arrears, the average amount owed is £714.

3% said they have been evicted for not paying rent. This is a figure we hope to see decline in future, especially as the Renters' Rights Bill comes into force and extends the period for which a tenant can be in arrears before being served an eviction notice.

This is what students told us about their experiences of being unable to pay rent:

- I ended up in a horrible cycle that I'm still trying to get out of using a credit card. (Private landlord)

- I had to ask my parents to use their savings. (Private landlord)

- I was locked out of my room. (Private landlord)

- I was struggling with renting as a student and missed one of the first payments [but] the landlord was understanding. (Private landlord)

- My lease was terminated and [I] had to move out. (Private landlord)

- My uni got back to me really late about having to repeat a year, leading to Student Finance being late paying me and [me] having to [ask] friends and family for money because I had no other choice. (Private landlord)

- [I] spoke to the halls before it happened and they allowed me to push back my payment. (Private halls)

What issues do student renters face?

Despite the ever-increasing cost, student homes often come with their fair share of issues – be they with the property itself, or those who live there.

Biggest problems with student houses

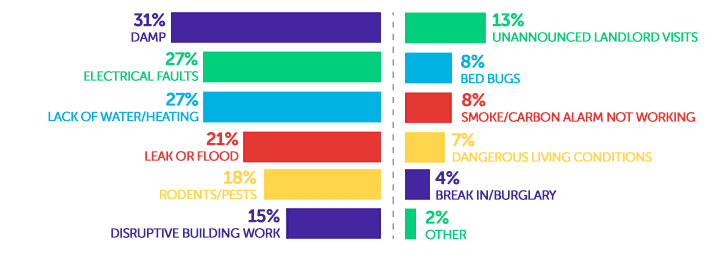

69% of respondents said they'd had at least one problem with their property – a very slight increase on the previous two surveys (both 68%). Almost half (47%) had experienced two or more, while 7% had at least five separate issues.

Once again, the most common problem was damp or mould – although, at 31%, this is down on the previous two surveys (37% in 2024 and 36% in 2023). This correlates with the earlier finding that fewer surveyed students are avoiding using the heating, perhaps helping prevent dampness from emerging.

Based on feedback, this year we also introduced two new issues for students to report: electrical faults, and leaks or floods. At 27% and 21% respectively, both are comfortably among the most common issues respondents have encountered in their homes.

How long does it take for issues to be sorted?

Of those who reported at least one problem with their properties, 18% said they were resolved within 24 hours and almost half (48%) said within a week. 7% of respondents said issues were never resolved.

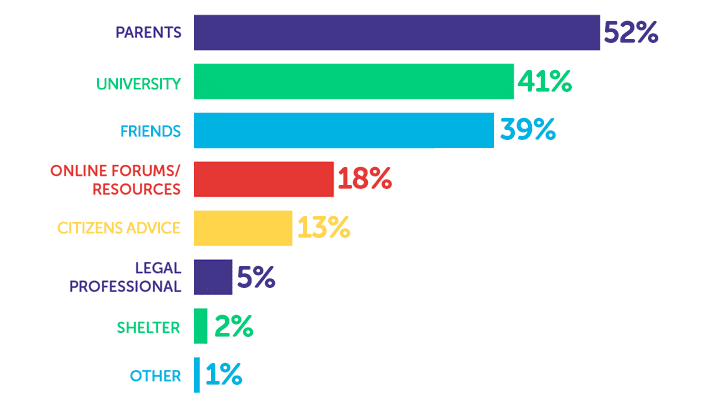

In these situations, it's natural that students will turn to advice or help from a third party.

Among those who have, parents (52%) are the most popular choice, followed by university accommodation services (41%) and friends (39%).

These are a selection of comments from students who have encountered issues with their property or landlord:

- At my first student accommodation, the landlady and her husband would let themselves into our room without ever telling us. They got caught on camera by one of my roommates. (Private landlord)

- [The] upstairs flat's bathroom flooded. [It caused] water damage in my own flat and ruined anything on the floor. (Private halls)

- He's a great landlord but the house just has so many problems. He's always happy to fix a problem with the house and will be [here] within an hour, but there are just so many problems with the house. (Private landlord)

- Complaints are only partially answered when sent, taking weeks to confirm dates for contractors to sort issues. (Private landlord)

- The landlord can be quite controlling with the heating as he can track on his phone when we turn it on and off etc. There have been times where we've been cold in the house and put the heating on and then he's turned it off from his phone and sent us a message. This has left some housemates feeling scared to put the heating on in fear of having him tell us off when we have a bills-included fair usage policy so should be able to put the heating on whenever we wish. Also, he does come by now and again but doesn't give us any notice, we just find him in the house. (Private landlord)

- The uni are very good. They have a 'fix a fault' section on the portal where you tell them the fault and what's wrong and where and they come and fix it quite quickly. For example, we said our fridge was freezing our food and by the next day they had brought us a new fridge. (University halls)

- Currently have a leak in our kitchen from the 16th of December. It is now the 7th of January and still not been fixed. Only just had an engineer out to look as it has tripped the fuse on all plug sockets in the kitchen so we have been without a fridge or freezer for a month. (Private landlord)

- Had an issue with black mould in my bathroom that was not resolved until I told them I got sick and threatened to tell the local council. (University halls)

- We had a fly infestation and the landlord basically tried to blame us and just told us to clean the kitchen more, despite us already being very clean. (Private landlord)

Biggest problems with student housemates

Of the respondents who live with at least one person, the vast majority (84%) said they've had at least one issue with their university housemates.

Many of the most common complaints centred around hygiene, with leaving dirty dishes out (64%) and not helping with cleaning (56%) the two biggest concerns.

Other notable issues include excessive noise (46%), leaving lights or appliances on (43%) and housemates allowing food to rot (40%).

Is student housing worth the money?

Just over half of respondents (54%) felt student accommodation represented good value for money – one percentage point lower than last year (55%).

Over the long term, this figure has declined more dramatically. In 2022, 65% felt it was good value for money, dropping to 59% in 2023.

| Accommodation type | How many think student accommodation is good value for money? |

|---|---|

| Private landlord | 47% |

| University halls | 53% |

| With parents/guardians | 63% |

| Private halls | 49% |

There's also a noticeable trend when the data is split by respondents in the four most common types of accommodation in the survey.

Among those living in any of the three options that involve moving away from home, approximately one in two believe their accommodation is good value for money. This figure is notably higher (63%) among the respondents living with their parents or guardians.

Students' house-buying prospects

Looking to the future, and with home ownership a notoriously sore subject for younger generations, we asked students when they think they'll join the property ladder.

On average, respondents thought they would buy their first house when they're 30, and 38% believed they would own a property before then.

However, 9% said they don't expect to own a house until they're at least 40, and a further 12% believe they never will.

This is what respondents said about the prospect of becoming a homeowner:

- It's scary that salaries are so low and house prices [so] high. I don't know when I'll finally be able to get a house and get rid of the constant stress of paying rent and moving and getting another flat to rent.

- Things are so expensive now that it feels so difficult to think about being able to afford a house in the next 10 years, especially as I am from London and I would like to stay here. Rent, food, travel, leisure and utilities take up so much money that saving is difficult and has made me so hopeless.

- The housing market has reached a new record of prices. Our generation will never be able to own a house unless we inherit it.

- I will never be able to afford to buy a house with the cost of living and mortgage rates.

- Someone like me buying a house? In this economy? Not unless some serious changes happen.

- Our generation has been really screwed over by the rising cost of living and it seems so unlikely any of us will own houses until we've worked for decades. For example, my parents bought their three bed house for under £200,000 in the 1990s. The same house with minimal renovations now costs almost double this price, according to a valuation three years ago.

What others say about the survey results

Vivienne Stern MBE, Chief Executive of Universities UK (UUK), said:

This report demonstrates how essential housing is to the student experience.

Although it is reassuring to see that these results have improved since 2024, this feedback shows just how challenging rising living costs have been for students.

Our current students are the next generation of teachers, doctors, nurses and scientists, and while universities are doing all they can, it’s imperative that the maintenance support package is looked at more closely.

UUK will continue to work with universities and share good practice accommodation supply.

Kellie McAlonan, Chair of the National Association of Student Money Advisers (NASMA), said:

Access to safe and affordable housing while studying should not be as challenging as it has become in recent years. While it is great that this year's survey findings indicate fewer students are struggling with the cost of rent, a considerable number (36%) are still reporting that this cost had led them to think about dropping out of uni.

When the cost of rent uses up the majority of students' Maintenance Loans, we really should not expect our students to face the kinds of challenges they are, from obstacles sourcing appropriate housing and issues with damp, to inadequate heating and struggles to get deposits back.

While we hope to see the Renters' Rights Bill bring some improvements to the experience of student renters, it won't address all of the issues highlighted through this survey. The cost of rent is still significantly out of sync with the Maintenance Loan support students receive.

We cannot seek to improve the experience of student renters without also considering the inadequacies of the Maintenance Loan system.

Student housing resources

These guides include info or advice about many of the topics covered in this report:

- National Student Money Survey 2024

- Student rent calculator

- How to get help with energy bills

- Cost of living crisis: 20 ways to cope

- Parental contributions calculator

- How to save money on rent.

About the National Student Accommodation Survey 2025

If you'd like to know more about the survey or receive expert comments, please get in touch.

You're welcome to reference or re-use data from the survey with credit and a link back to the site: "Source: The National Student Accommodation Survey 2025 / www.savethestudent.org".

Stats were calculated based on 1,294 responses, cleaned to remove non-students and clearly false entries.

The survey was open for responses from 2nd December 2024 – 22nd January 2025.

![What do students spend money on? [stats]](https://www.savethestudent.org/uploads/what_students_spend_money_on2-252x160.png)

![What do students spend money on? [stats]](https://www.savethestudent.org/uploads/what_students_spend_money_on2-100x100.png)