Student Money Survey 2021 – Results

UPDATE: View our 2024 National Student Money Survey.

Looking back on an incredibly testing academic year, the National Student Money Survey 2021 reveals the widespread financial concerns and issues that students have faced.

Credit: Gorodenkoff – Shutterstock

From start to finish, the 2020/21 academic year posed innumerable challenges for university students who navigated uni life through the turbulence and confusion of the coronavirus pandemic.

Now in its ninth year, the National Student Money Survey identifies how students across the UK approach money management and highlights just how tough it is for many to make ends meet.

Among its findings, the survey brings to light some serious pitfalls with the Student Finance system. It also shows the concerning ways in which the wellbeing of students is suffering as a result of insufficient funds and inadequate financial education.

As many as three quarters of students in the survey have thought about dropping out of university, with a number telling us they cut out meals or turn to risky ways to earn money to get by. It's clear from this survey's results that changes need to be made by the government, urgently.

What's in our report?

- Key findings

- Students are struggling to get by financially

- Do Student Loans stretch far enough?

- How many students consider dropping out of university?

- How much do students spend?

- How do students get money?

- How would students get money in a cash crisis?

- Sex work at universities

- Which areas have the cheapest student living costs?

- Do students understand their Student Loan agreements?

- Is university good value for money?

- What students expect from graduate life

- Expert comments on our findings

Key findings from the Student Money Survey 2021

Here's a quick overview of the key findings from the National Student Money Survey 2021:

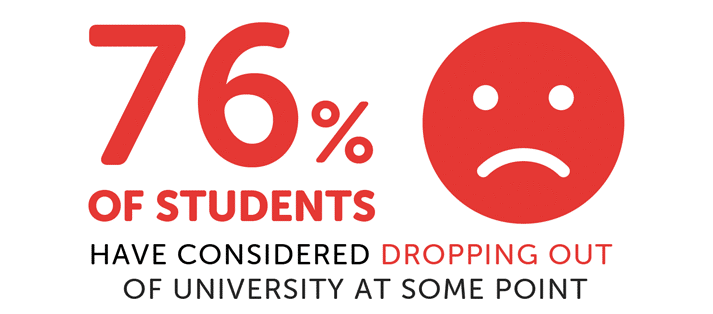

- 76% of students have thought about dropping out at some point.

- Each month, the average student's Maintenance Loan is £340 less than their living costs.

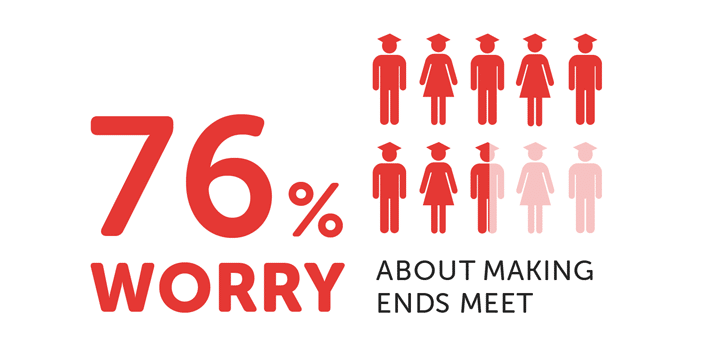

- Just over three quarters of students struggle to make ends meet.

- Two in five students have earned money from their own business or side hustle.

- The proportion of students investing in cryptocurrencies has tripled since last year.

- Students are expressing less confidence in finding a job after university, and lower expectations for their graduate starting salary.

Students are struggling to get by financially

Up from 71% in last year's National Student Money Survey, the proportion of students who struggle to make ends meet has increased this year to 76%.

It's extremely worrying to think that such a large majority of students are finding it hard to get by financially at university. It's more worrying still when we break down the results further to look at how money worries are impacting different areas of students' lives.

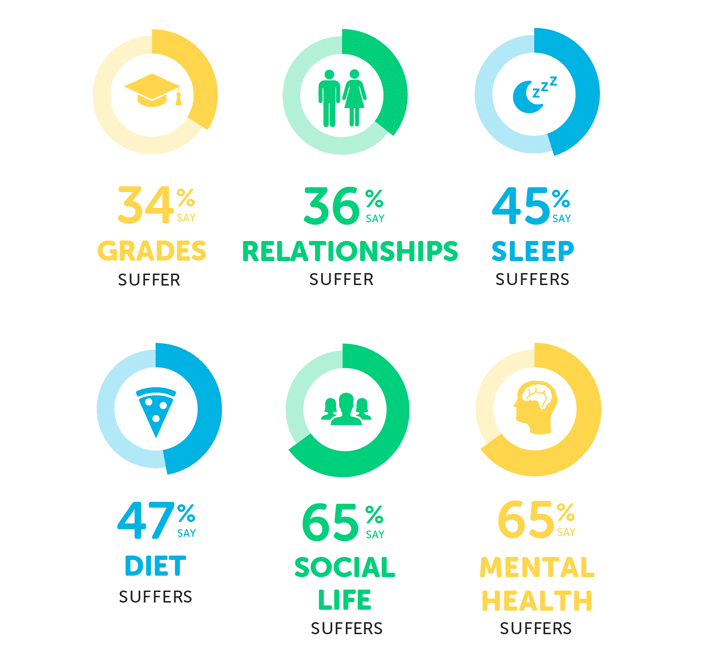

The proportions of students saying that money worries have affected their diet, social life, grades, relationships, mental health and/or sleep has increased in each category compared to last year.

Among the most widely affected areas of students' lives is their mental health, with 65% saying theirs has been impacted by money problems, up from 58% in 2020 and 57% in 2019.

A contributing factor to this is likely that a higher proportion of students are struggling to get by. But it's also important to keep in mind that money problems have been just one of a number of pressing issues that many students have experienced this academic year.

For those who were also facing challenges with online study, isolation and empty accommodation, money problems could have had a greater impact on their mental health than in previous years.

What students say about making ends meet

- [I] can barely afford rent let alone food.

- I had to [take out] a loan to pay for book fees which left me in financial hardship.

- [I] lost my job and had to use the university hardship fund three times since the beginning of COVID.

- It's really hard to have a good student experience when you're worrying about money. You can't even concentrate on work, and going out with friends is very rare because you don't have the money.

Do Student Loans stretch far enough?

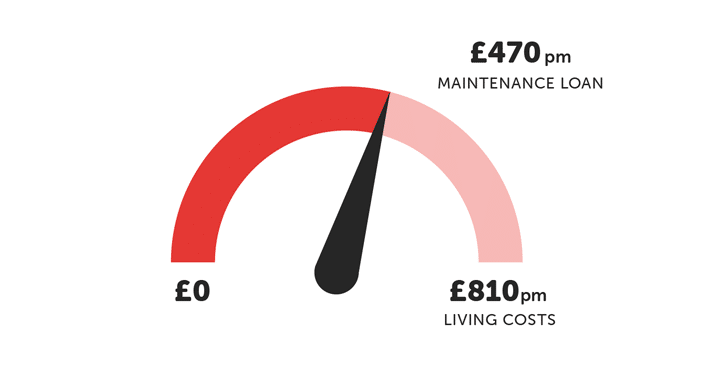

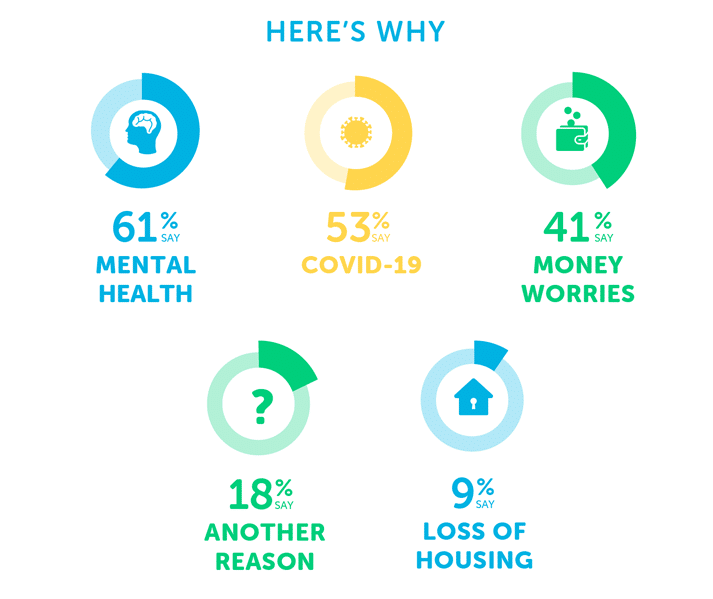

On average, students are facing monthly living costs of £810 while receiving a Maintenance Loan of only £470 a month, therefore facing a shortfall of £340 every month.

Month on month, this would add up, resulting in a shortfall of several thousands of pounds each year.

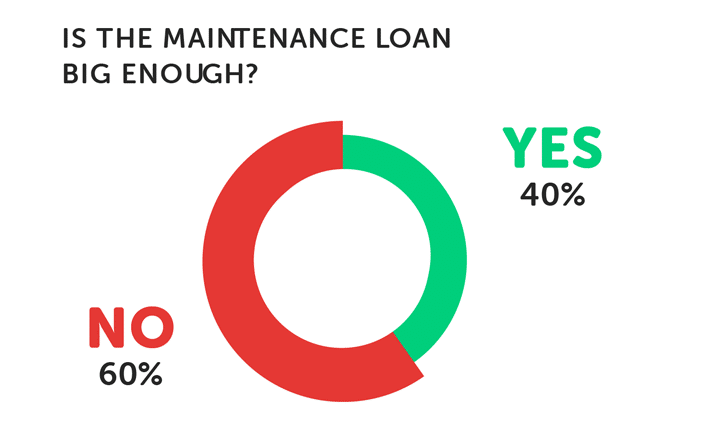

It's perhaps no surprise, then, that the majority of students feel as though the Maintenance Loan is not big enough.

The proportion of students in the survey who feel as though the Maintenance Loan isn't enough has grown in the last year, up from 55% who had said the same in the 2020 survey.

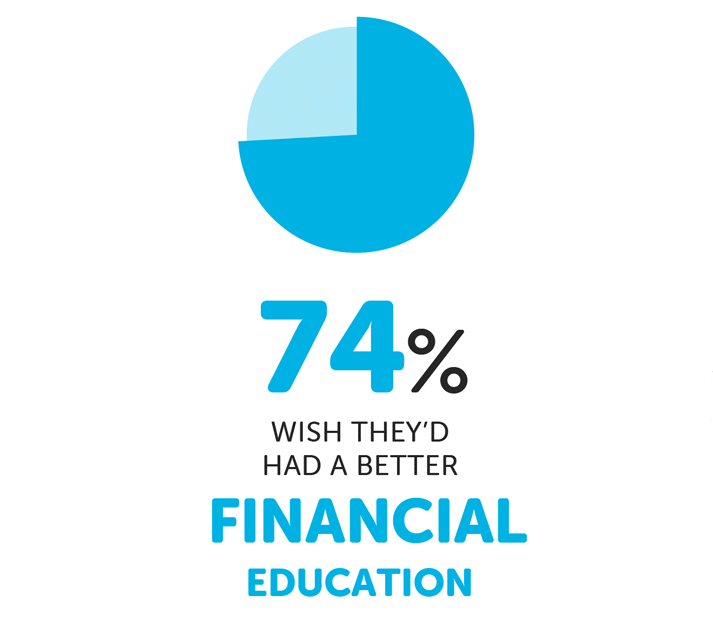

Do students get enough guidance about Student Finance?

As we've seen, the average student faces a significant shortfall in funding each month, with Maintenance Loans only covering 58% of their monthly living costs.

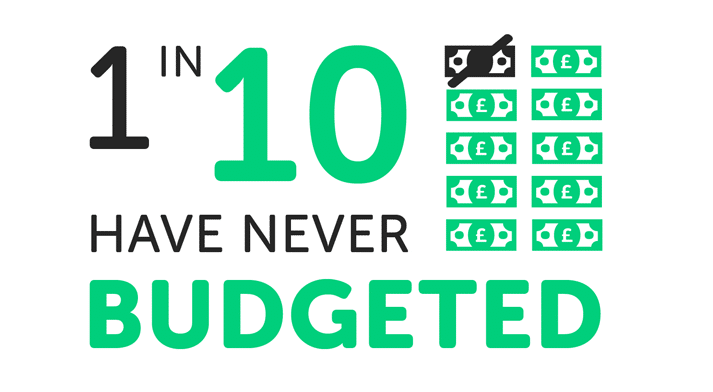

With this in mind, it's essential that students reach university with a solid understanding of personal finance – in particular, how to budget.

Unfortunately, the survey indicates that this is not the case for all students.

What students say about surviving on Student Finance

- [The Maintenance Loan] only gives money for rent but not enough to eat.

- It's not enough to cover rent, food, bills, etc. And what's worse is that getting a part-time job has become impossible due to COVID so I'm literally living on £50 per month because all my maintenance is going towards accommodation.

- Student Finance doesn't always take into account the amount of money having to go towards rent which leaves you little to live on for the rest of the academic year.

- I think the biggest issue is it being based on parental income. I know many students like myself left to struggle because their parents' income is high. However, like me, their parents don't support them financially.

- Last year, it wasn't enough as it didn't even cover my rent and if I didn't have my parents to help me out, I would've struggled. This year, it's not too bad as bills are lower so I have some money left over and I have a part-time job.

University drop-out rates

One of the most shocking stats to emerge from this survey is that around three quarters of students have considered dropping out of uni at some point.

Two in five students in the survey have considered dropping out due to money worries, while over half have also thought about quitting their degrees because of the pandemic.

However, the most common reason was mental health, which contributed to three in five students thinking about leaving university early.

When we consider that mental health is also one of the areas of life most affected by money worries, it becomes clear how interlinked students' financial situations, mental health and university experiences are.

This in itself shows that any signs of inadequacies in the Student Finance system should be taken seriously by the government.

Students are struggling, financially and emotionally, to make it through their degrees. If increasing funding has the potential to lessen the strain on students' mental health and reduce the risk of some dropping out, the benefits of making such changes to the Student Finance system would be huge.

And as one student in the survey pointed out, those who do consider dropping out are faced with further challenges outside of university, such as a very uncertain job market:

Dropping out would've seemed a good option if there were jobs available out there.

How much do students spend?

For the average student, rent is by far the biggest monthly expense, making up over half of the overall monthly living costs.

Bearing in mind that the average amount students get from their Maintenance Loan each month is £470, students are generally needing to put the majority of that funding towards rent.

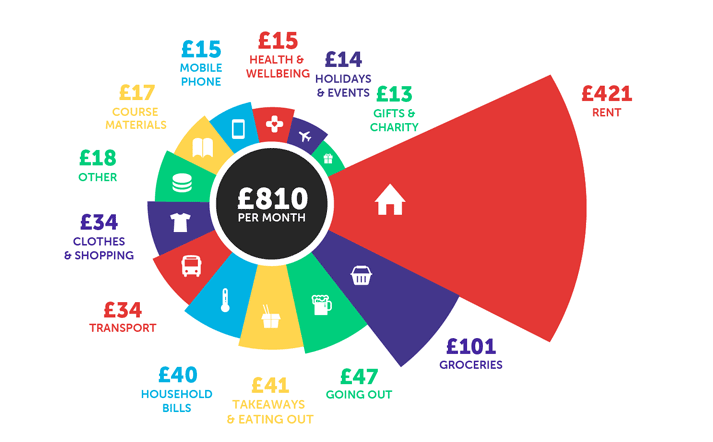

The next biggest expense is groceries. While this figure is almost identical to the figure in our 2020 survey (which had been £100), this year the amount students are spending on food as a whole has increased when we also factor in the amount they spend on takeaways and/or eating out.

With students spending more on takeaways and less on holidays, the effect of COVID-19 on their money habits is difficult to ignore.

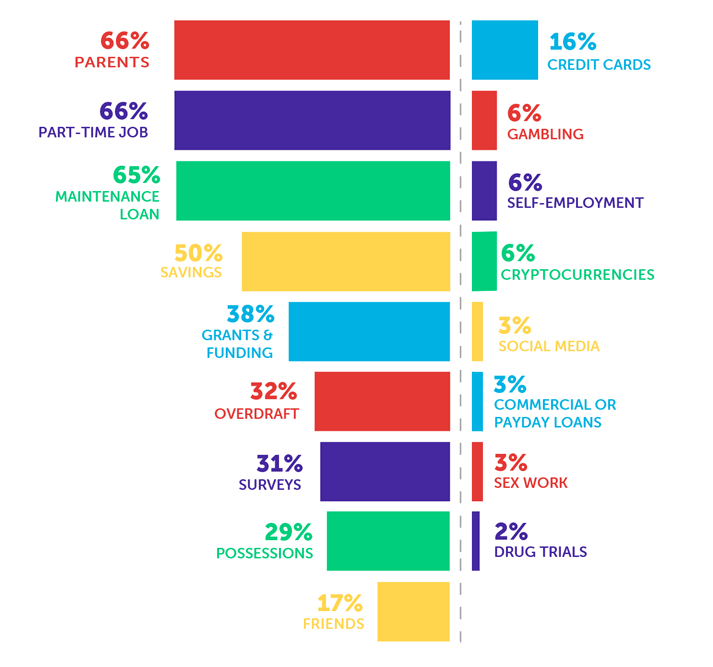

How do students get money?

Interestingly, we've seen quite a noticeable shift in the ways in which students have accessed money in 2020/21, compared to the previous academic year.

Particularly with so many businesses facing temporary, or even permanent, closures due to the coronavirus pandemic, some students who'd had part-time jobs before the pandemic were required to look for money elsewhere to make up for lost income.

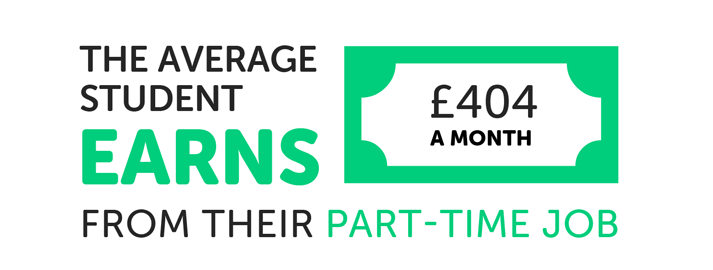

In last year's survey, just under three quarters of students (74%) told us that they'd had a part-time job – this figure has decreased noticeably in 2021, going down to 66%.

Among students who have a part-time job, the average amount that they earn is £404 per month. Despite the proportion of students with a part-time job going down, the amount that students in work are earning from their job has gone up, increasing from £326 per month in 2020.

On the other hand, with more people looking for alternative ways to make money from home, we saw a noticeable increase in students investing in cryptocurrencies...

More students are investing in cryptocurrencies

Since last year, the proportion of students that make money from cryptocurrencies has tripled, up from 2% to 6%.

There has been a lot of media attention this year about the growing number of new investors getting involved in trading crypto, as the likes of Bitcoin and Ethereum experienced a 'boom' in the market.

Some have expressed concerns that young people were getting swept up in the hype and investing in crypto without a full understanding of the risks and effective strategies involved in these trades.

With a growing proportion of students saying that they're investing in cryptocurrencies, it's evident that young people need to receive clear, balanced information about crypto to ensure they're making careful financial decisions.

How many students have small businesses and side hustles?

Among students in this survey, 40% said they had earned money from their own business or side hustle, which was down slightly from the 43% who had said the same last year.

This could be another area in which we're seeing the financial impact of COVID-19 on students – the economic uncertainty of the past year may have led some to stop running their own business, while also discouraging others from starting one.

Grants, bursaries and scholarships

There are a huge number of grants, bursaries and scholarships available to students.

Examples of common sources of funding include NHS bursaries and Disabled Students' Allowances.

However, there are grants available for a number of unusual reasons, including being a vegetarian, being talented at eSports and having the surname Graham.

These sources of funding don't need to be paid back, so they're effectively free money. To access the funding, students need to know where to look and how to apply – but too often, this isn't the case.

Over two in five students in the survey felt as though they haven't received enough information about the funding that could be available to them.

As this funding has the potential to really help students' financial situations, we'd hope to see students arriving at uni feeling informed by their school support services about the bursaries, grants and scholarships they could be eligible for.

How much money do parents give their children at university?

On average, students are receiving £120.56 from their parents each month and, for the majority of students in the survey, the amount they receive from their parents is enough.

However, over one in 10 students said they would like to receive more...

A contributing factor to some students feeling this way could be if their parents are also needing to support their siblings as well, if they're also at uni. In fact, 21% of students in the survey said that their parents need to financially support another student.

Generally, Maintenance Loan amounts are calculated based on household income, with students from higher-income households tending to receive less than those from lower-income households.

The Student Finance systems vary slightly in each part of the UK, but it's usually taken into account when calculating loan amounts if parents also have other children at university.

However, the fact remains that, on the whole, loans are still calculated with an expectation that higher-earning parents will contribute more money to their children at uni.

The reductions in household income to account for having additional children at uni could help some parents, but they will nonetheless still be expected to give some money to each child – and the more they earn, the bigger this expected amount will be. This is bound to put a strain on the finances of many families.

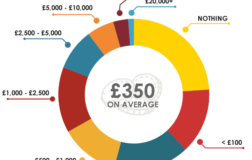

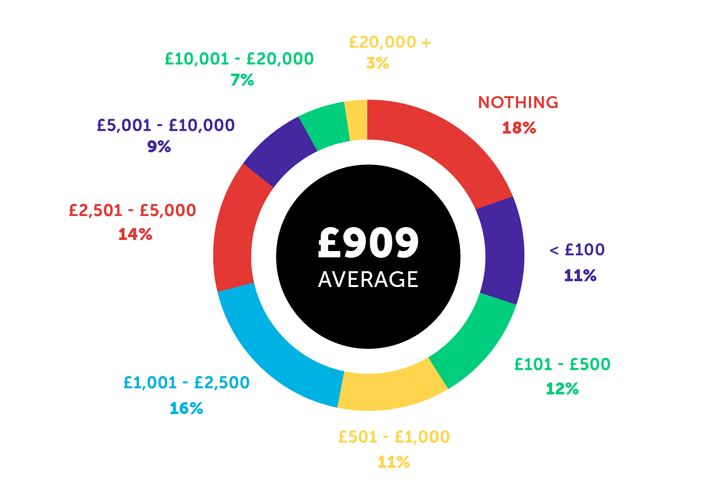

How many students save up money for university?

Just under seven in 10 students saved up before starting university which is noticeably similar to last year (70%), showing consistency in new students' saving habits.

And as we saw earlier, half of the students in the survey said they used their savings as a source of money while at uni.

Here's how much students currently have in savings:

What students say about budgeting and saving money

- [Regarding] the Maintenance Loan, it's good but only if you can budget well; and even saying that, most people (like myself) from lower income backgrounds have to get part-time jobs to cover most things as well.

- [I] wash plates and stuff in the bath to save energy and money [and] reuse all forms of water.

- I try to save by cutting down on groceries and not spending as much when I am with friends. It gets a bit lonely when all you do is try [to] focus on studying but don't have the energy to do so.

- I believe there should be better education on spending and the importance of saving. So many people make the mistake of spending an enormous amount of money on different things that they later regret [but] this could be avoided.

- I worry at times that I am not doing enough to save up etc. but given that my course is quite demanding, not sure I would really have the time anyways.

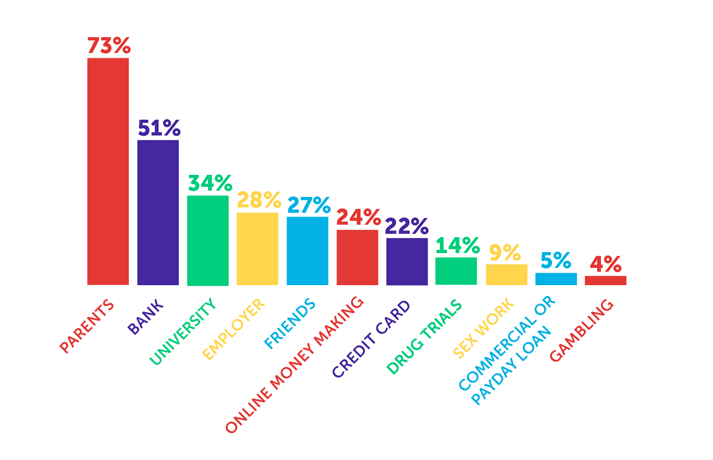

How would students get money in a cash crisis?

As we mentioned earlier, just over three quarters of students struggle to make ends meet, so it's vital that universities and parents are aware of where students might go for money in a cash emergency.

For the majority of students, their parents would be the people they turn to for money in an emergency.

And, while nearly three in 10 would seek extra earnings from an employer, this figure is noticeably down from 46% who had said the same last year. This goes hand-in-hand with the finding that fewer students have had part-time jobs this year, highlighting the noticeably different part-time job market in 2020/21 compared to 2019/20.

Some students also revealed that they would consider riskier ways of making money in an emergency, too.

Each year, we are concerned to see students looking towards credit cards, drug trials, sex work, commercial or payday loans or gambling when faced with a cash crisis. Each of these pose risks when used as emergency sources of money, having the potential to lead to debt and impact a student's mental, or even physical, health.

Student sex work, as we'll look into in more detail shortly, is a complex topic that is often misunderstood and misrepresented in the media.

Sex work at universities

Year after year, a small but relatively consistent proportion of students tell us that they have done sex work, or would consider it in a cash emergency.

Given the potential mental and physical risks involved in sex work, it's worrying to think of students doing it out of desperation for money. For those in this situation, it's essential that they are made aware by university support services of other low-risk ways to get money, like university hardship funds or student grants.

However, it's also important that universities provide appropriate support and guidance to those who do wish to do sex work to help them stay safe. This could include educating students on the legality of sex work and highlighting the safety measures and precautions that could be taken.

An example of where a uni has taken a proactive approach to this came in December 2020, when the University of Leicester published its Student Sex Work Toolkit.

Our surveys indicate that this sensitive and understanding approach to helping student sex workers was necessary. It was disappointing, therefore, to see the toolkit criticised by some individuals and media outlets who appeared to misinterpret the education of sex work as the promotion of it.

We hope that other universities were not put off by the negative press and see the benefits of publishing similar guidance for staff and students. This has the potential to significantly help the 3% of students who do sex work, and the 9% who would consider it in an emergency, to stay healthy, informed and safe.

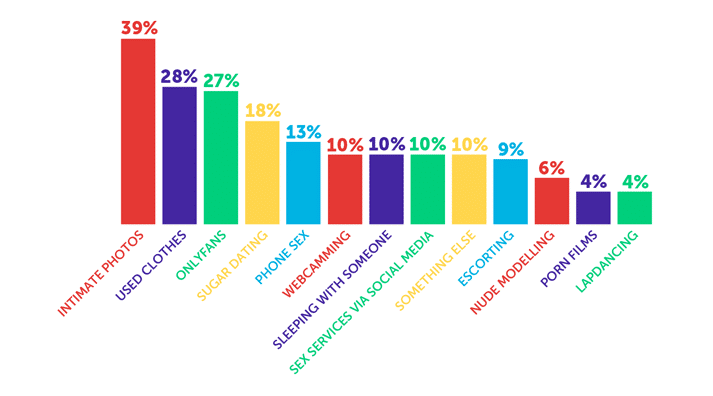

What kinds of sex work have students tried?

Among the 3% of students in the survey who have done sex work, these are the types they have tried...

By far, the most common type of sex work done by students is selling intimate photos, followed by selling used clothing and using the image-sharing website, OnlyFans.

What students say about doing sex work at uni

- I only did it once and got £10 from it. I'd like to do it more, but my boyfriend wasn't too keen on the idea.

- It's not my favourite source of income but I don't have to do anything I don't want to and I am in complete control. I've managed to learn the difference between fake and genuine people online but there are still some crooks out there.

- I think there is clearly a problem with the system if people have to turn to selling their body in order to make a means and support themselves. The government need to recognise this instead of reprimand it.

- Strange men sometimes messsage me on Facebook and ask me for the weirdest things, and I will do it if it doesn't include my being nude. E.g. I will sell shorts or something.

- Feet pics have been an amazing source of income as well as selling used socks. One pair for £40 goes like crazy.

- [I] had sex for money, [it] lasted two mins [and I made] £100. Took four nude photos and sold them – earnt £100. Easiest money of my life.

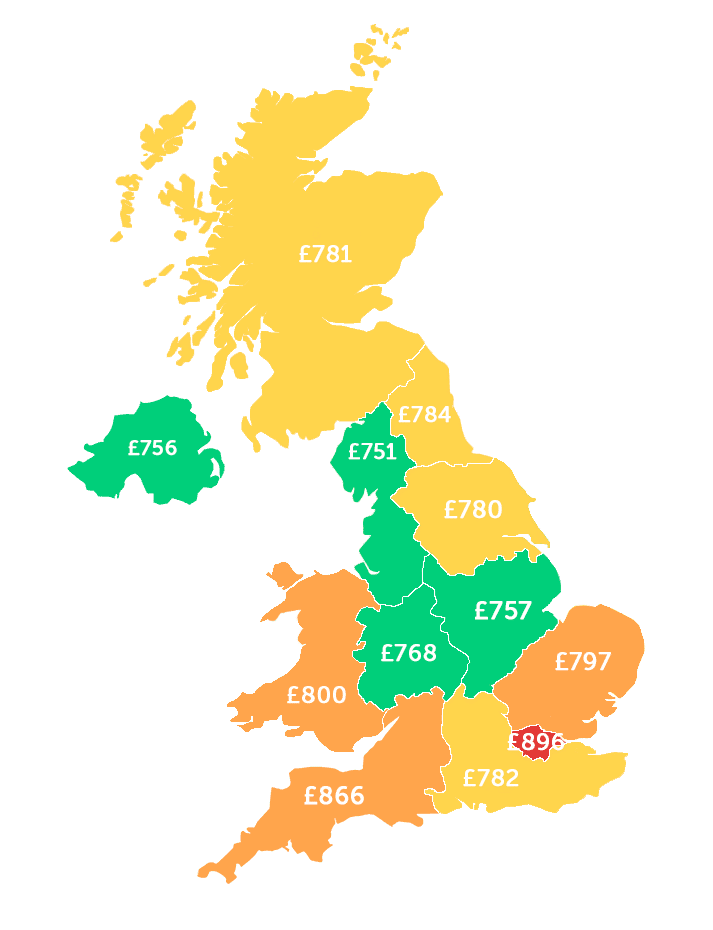

Living costs around the UK

This includes students who live away from home and with their parents.

London is, as we've seen in previous years, the most expensive area in the UK for students to live. But, the South West of England isn't much cheaper – just £30 less per month.

In contrast, the North West of England has the lowest student living costs, working out at an average of £751 per month.

10 surprising ways students have made money

Each year, we hear from students who find new, innovative ways to make money. Here are some of the most surprising ways to earn cash that we heard about in this survey:

- "I was volunteering at the Euros and [was] told to pick up Robbie Keane and he gave me £40 as a tip."

- "Testing mould sprays for a £10 Amazon voucher – sometimes there [are] benefits to old mouldy bathrooms."

- "Being an elf at a Christmas grotto."

- "Extras work for TV."

- "Covering someone's shift so they can go [to] the footy."

- "Minecraft."

- "I sold a homemade cardboard Tardis on Etsy."

- "Buying 600 shoe horns for 10p each in IKEA and selling them on eBay."

- "Crowdfunding."

- "I got £120 for filling in a paid survey of what I drank every day for three months. Easy money!"

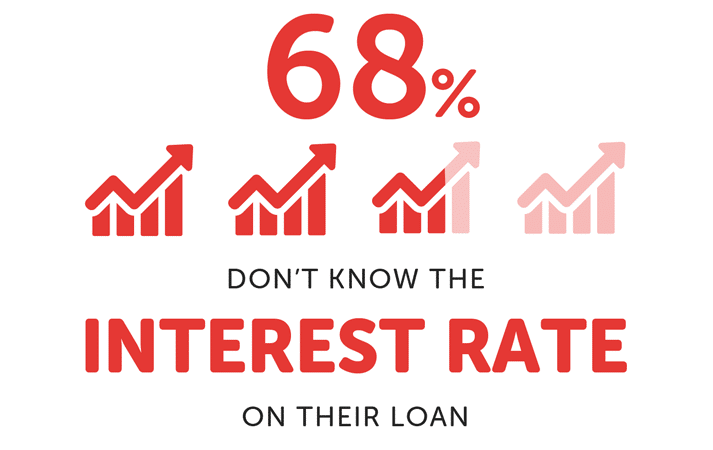

Do students understand their Student Loans?

For the 65% of students in the survey who rely on their Maintenance Loan for money, we would hope to see a strong understanding of how the terms and conditions of the loan work.

However, for many students, this isn't necessarily the case.

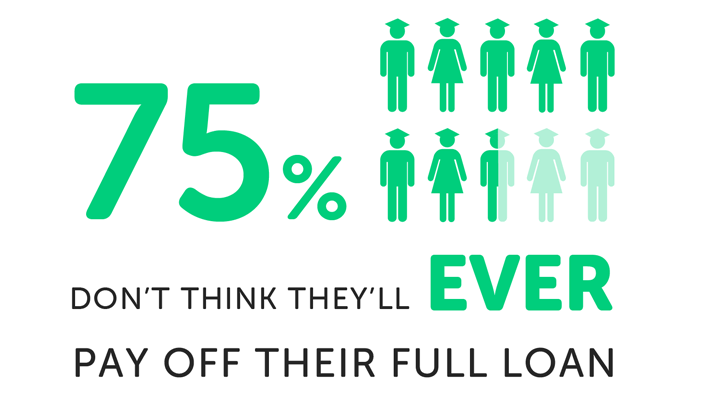

The proportion of students who worry about repaying their Student Loan has increased slightly since our 2020 survey – up from 49% to 52%.

This is one aspect of Student Finance that we would encourage students not to worry about. The way in which the repayment system is structured means that graduates only repay a small percentage of their loan when earning above a certain amount, limiting the risk of anyone needing to make repayments beyond their means.

Plus, regardless of how much a graduate has repaid, the Student Loan gets wiped after a certain period of time (around 30 years, depending on the loan's repayment plan). We explain this in more detail in our guide to Student Loan repayments.

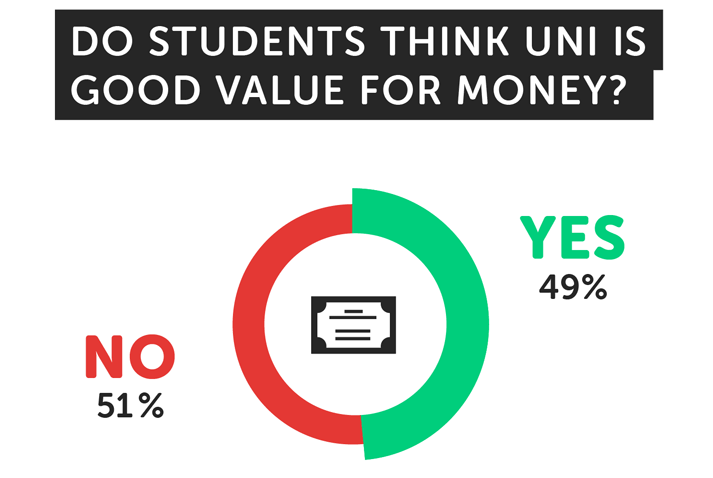

The value for money of university

It's been an undeniably challenging year for many students, with the majority of lectures and classes moving online, while tuition fees remained unchanged. So, it's disappointing but perhaps inevitable to hear from so many students who feel as though uni isn't good value for money.

The proportion who feel this way has gone up from 46% who said the same in the 2020 survey. Interestingly, though, both of these figures are down since the 2019 survey, when 55% had felt this way.

It's possible that, for some students, their universities responded to the pandemic in a fair and effective way, maintaining good communication and support throughout. As such, the universities' students could view their provision as good value for money.

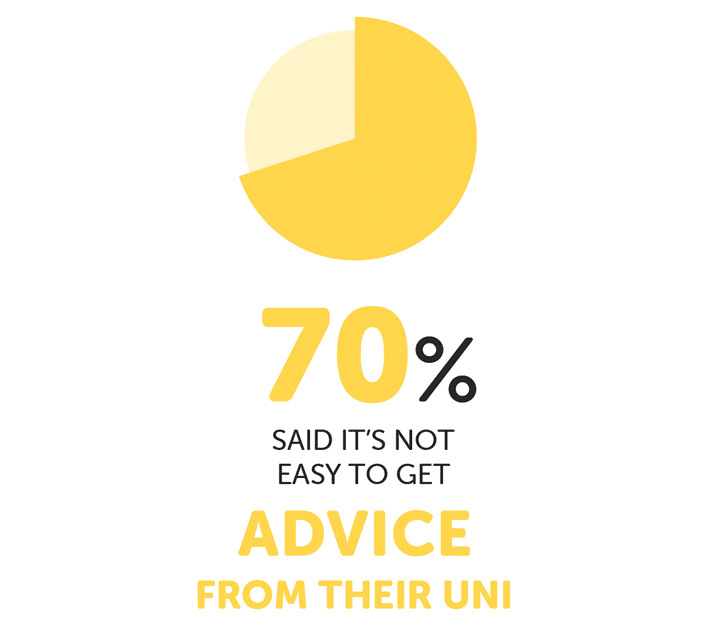

Having said this, though, we saw a significant increase in the proportion of students who said it was not easy to get help when they needed it.

Among those who have asked their uni for help, 70% said it was not easy, which is up from 51% in our 2020 survey.

What students say about tuition fees

- I'm a student nurse and have had to work through the entire pandemic on placement for free [...] and I have to pay tuition fees in full, with most teaching being online still.

- I do plan to write a formal letter of complaint requesting a partial tuition fee refund this month.

- I wish the tuition fee was lower this year as we had everything online and it was truly a massive struggle. If I was to go into lessons on campus, no doubt, I'd have gotten better grades.

- Students including myself have suffered financially with paying rent to accommodation we couldn't live at. Whilst also having to pay full tuition fees which didn't have the same quality of teaching. I'm currently in a position where I have had to pay lots of money toward university where I haven't benefitted and am now struggling to pay for my final year.

Students' graduate job prospects

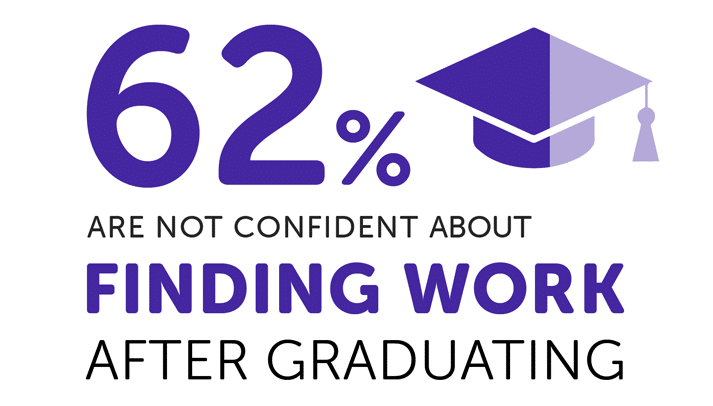

Since 2019, we've seen a steady increase in the proportion of students expressing concerns about their graduate job prospects.

62% of students in this year's survey said that they're worried about finding a graduate job after uni – this is up from 58% in 2020 and 51% in 2019.

As the impact on the economy has become increasingly evident over the course of the pandemic, students have become less and less confident in their chances of finding a job after uni.

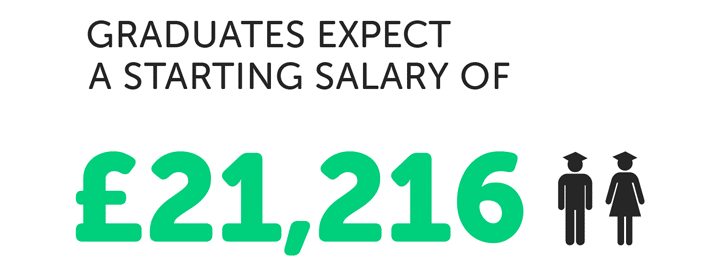

Not only this, but they're also expecting lower graduate salaries than previously.

Last year, students predicted an average graduate starting salary of £22,107. However, this year the average prediction has gone down to £21,216.

Expert comments

Our student money expert, Jake Butler, says:

In a year when things have been turned on their head, university students very clearly seem to be among the worst affected.

As we've found, the funding on offer to the average student is only slightly more than half of their living costs. With an unstable part-time job market as well as some parents losing earnings due to the pandemic, the usual funding sources for students bridging the finance shortfall have become hard to come by.

There is continued uncertainty over what to expect from this coming academic year and the government has done very little to put students at ease.

The education experience over the past couple of years has simply not been up to standard despite the financial outlay being the same. I am not surprised that more students have considered dropping out, but the revelation that three in four have considered such an extreme option is incredibly worrying.

I would always encourage students in this position to reach out to their university support services because there is extra funding available in many cases.

Sara Khan, NUS' Vice President for Liberation and Equality, adds:

Food and housing are basic human rights which every student should be able to access. Students shouldn't have to worry about working to cover basic necessities and should be able to focus on enjoying and thriving in their studies.

The pandemic has certainly exacerbated mental health issues as students have struggled to find work, to access their courses, have only been protected by some institutions through grade safety nets, and have struggled to access mental health services.

The Government must finally start taking this issue seriously. Universities are not separate from wider society, therefore a fully funded and resourced NHS is absolutely vital, so that waiting lists and costs for mental health services, medication, GP letters and diagnosis tests are not a barrier for anyone.

Education is a right that students should access freely from cradle to grave. The UK government must abolish tuition fees, fund maintenance grants for students in place of the profit-driven Student Loan system, and ensure our education system is properly funded, lifelong, accessible and democratic.

About this survey

Since 2013, we have been asking UK university students about their honest experiences of managing money during their degrees. Our independent findings provide insights into the realities of student life and allow us to improve the overall content and advice on our website.

If you'd like to find out more about this survey, case studies or comments, please feel free to get in touch with us.

- Source: The National Student Money Survey 2021 / www.savethestudent.org

- Average Maintenance Loan amount based on FOI information from Student Loans Company (SLC).

- The survey polled 2,038 university students in the UK from May – August 2021.

- Data from our previous surveys.

- Save the Student's Press Page.

- Tools and resources.

Student Money Cheatsheet

We created the Student Money Takeaway resource in response to the shocking findings from our recent national student surveys.

This free resource is a printable PDF, and it includes a one-minute budget sheet. You can find the best advice from our website condensed down to just two pages.

![What do students spend money on? [stats]](https://www.savethestudent.org/uploads/what_students_spend_money_on2-252x160.png)

![What do students spend money on? [stats]](https://www.savethestudent.org/uploads/what_students_spend_money_on2-100x100.png)