Student Money Survey 2022 – Results

UPDATE: View our 2024 National Student Money Survey.

As living costs continue to soar, the National Student Money Survey 2022 reveals the huge impact that the cost of living crisis is having on students.

Credit: Linda Bestwick – Shutterstock

Now in its tenth year, the National Student Money Survey consistently shows that the government's funding for students is lacking.

Save the Student was set up because of the challenges students face when it comes to managing money at university. But this year, as the UK faces the cost of living crisis, we are seeing financial struggles among students on a scale that we hoped to never see.

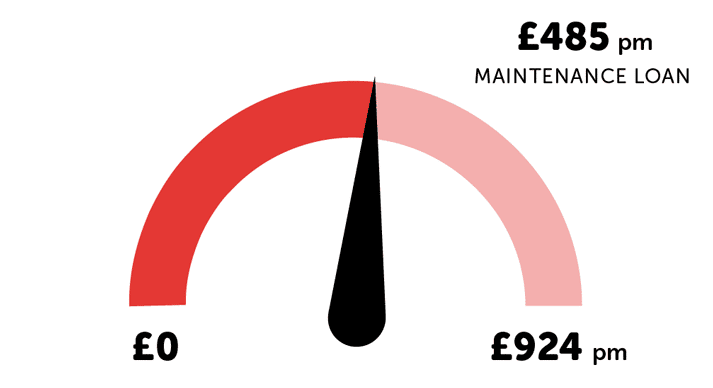

As we'll discuss below, Maintenance Loans now cover little more than half of the average student's monthly living costs.

Yet, for students from England, the maximum Maintenance Loan is increasing by just 2.3% in 2022/23, despite inflation far surpassing that currently.

Unless the government steps in to offer students increased loans and support packages in the new academic year, the results from this survey indicate that many students will struggle to cope with the rocketing costs of living.

What's in our report?

- Key findings

- Students are struggling to get by financially

- How many students use food banks?

- How much do students spend?

- Which areas have the highest student living costs?

- Do Student Loans stretch far enough?

- How do students get money?

- How would students get money in a cash crisis?

- Sex work at universities

- How many students consider dropping out of university?

- Do students understand their Student Loan agreements?

- Is university good value for money?

- What students expect from graduate life

Key findings from the Student Money Survey 2022

Here's an overview of the key findings from the National Student Money Survey 2022:

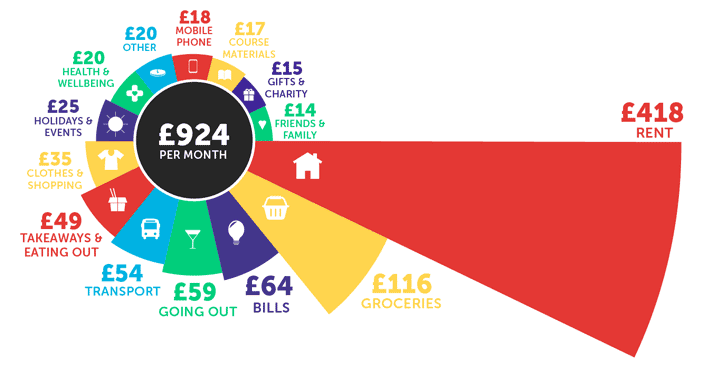

- Students are experiencing inflation that is higher than the national average. Living costs have seen a 14% increase since our 2021 survey, with the average student now spending £924 per month. In London, the average is £1,089 per month.

- The average student's Maintenance Loan falls short of covering their living costs by £439 every month. This is a big increase from last year, when the shortfall between average Maintenance Loans and living costs had been £340.

- One in 10 students in the survey has used a food bank in the last academic year.

- 82% of students worry about making ends meet.

- Four in five have thought about dropping out of university at some point. This includes 52% who have thought about dropping out due to money worries.

Expert comment

Save the Student's money expert, Jake Butler, says:

This is the most worried I've ever been about the financial situation students are facing.

In a decade of running the National Student Money Survey, this year's findings are bleak. And we expect much worse is yet to come.

The huge £439 monthly shortfall between Student Loans and real living costs is particularly alarming.

Most students are struggling to bridge this gap. And it's not fair in this climate for the government to 'expect' parents to contribute such a high amount.

Students were neglected throughout the pandemic and it appears that treatment continues with the cost of living crisis.

Inflation for students could be as high as 14%, yet government funding in England has only risen by 2.3%.

We welcome the news that energy bills will be capped for two years, but the new rate is still nearly double what households were paying last year. Students are getting the same rate and support as millionaires, despite being among the groups that will continue to struggle.

Save the Student calls on Liz Truss and the education secretary, Kit Malthouse, to take further action to address the Student Loan gap before thousands of students are forced to drop out of university.

Students are struggling to get by financially

Four in five students in the survey worry about making ends meet. This is up from 76% that said the same in last year's survey.

We had been concerned about the situation last year. At that point, students were dealing with the impact of the pandemic on the part-time job market.

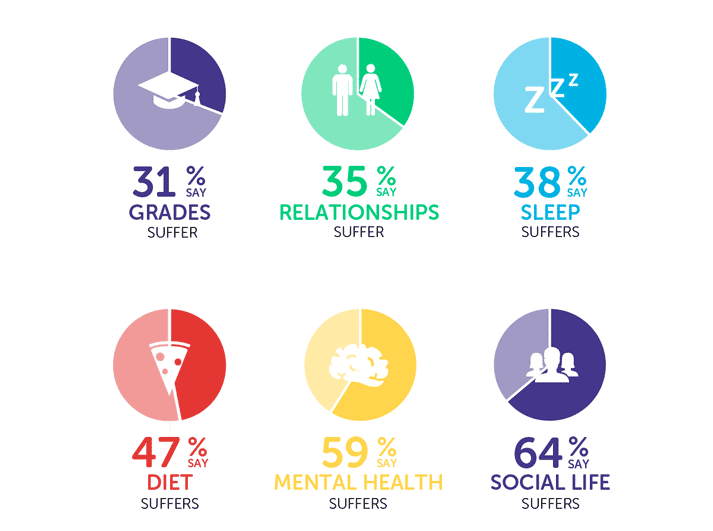

But now, with the cost of living crisis, students are dealing with yet more financial struggles. This is affecting many aspects of their day-to-day lives.

We asked students whether their grades, relationships, sleep, diet, mental health and/or social life suffer due to money worries. This is what they said:

Students are turning to food banks

With nearly half of students in the survey saying that money worries impact their diet, we looked into the proportion that has needed to turn to food banks to cope with the cost of living crisis.

10% of students in the survey have needed to use a food bank in the 2021/22 academic year.

This in itself highlights that Maintenance Loans are not sufficient.

For years, we have been calling on the government to increase loans to ensure students have enough money to get by. It's upsetting that these calls have been consistently overlooked – particularly now, at a time of such financial difficulty.

Having reached a point where one in 10 students need to use a food bank to survive, the government's lack of action is shameful.

We are calling on the government to address this and offer increased funding to help students through the cost of living crisis.

At the very least, students should be able to afford essentials like rent, bills and food. But, for too many, that is currently not the case.

What students say about making ends meet

- With the prices of everything going up right now I find it hard to stay positive in life.

- I am constantly worried about money and supporting myself, especially at the moment as the cost of living is rising exponentially. I am frightened that I will have a poor quality of life as an adult and struggle to get by.

- It becomes harder and harder when you can't afford essentials.

- I go for multiple days without food to be able to afford my rent.

- I have found myself not knowing if I'll be able to pay rent or feed myself throughout university.

- I don't go out with friends to save money.

- Constantly thinking [about] money problems makes it hard to sleep.

- I do get very upset and anxious when it comes to trying to find the money for bills, food, etc.

How much do students spend?

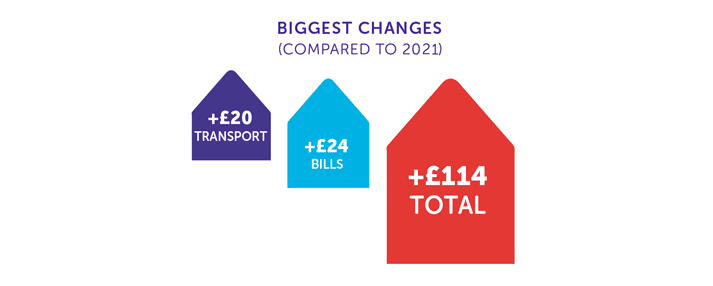

In last year's survey, the average student spent £810 per month. This has increased by around 14% this year, with students now spending an average of £924 each month.

Rent is by far the biggest monthly expense, accounting for about 45% of the monthly living costs.

Despite students generally spending much more this year than last year, rent is actually relatively consistent with the previous two years. In 2020, the average student spent £418 per month on rent, and in 2021, it went up slightly to £421. This year, the average has returned to £418 per month.

This could be due to students signing their tenancy agreements ahead of the 2021/22 academic year, before inflation rose to the levels we're currently seeing. In next year's survey, we expect to see the average student's rent increase because of this summer's high rates of inflation.

The two areas of spending that have increased the most for students are transport and household bills.

In September 2022, the government announced that the average household's energy bills will be capped at £2,500 a year, for two years, from October. However, this is nearly double what we were seeing last year.

The £400 energy discount will help, but on top of the other rising costs that people in the UK are facing, we see this as insufficient. Students are struggling, and will likely continue to struggle, unless the government does more to help.

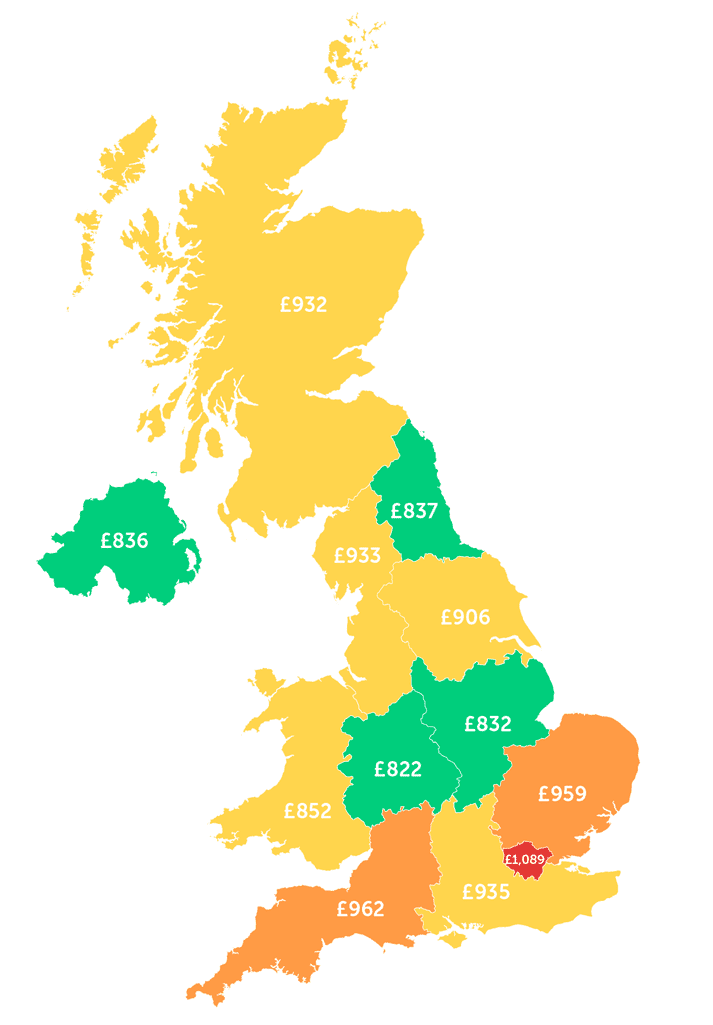

Living costs around the UK

This includes students who live away from home and with their parents.

In our 2021 survey, 10 of the 12 regions had average student living costs of £800 per month or less. The most expensive two regions in that survey had been the South West of England (£866 per month) and London (£896 per month).

However, this year, each region's average is above £800.

The cheapest region for students is the West Midlands, which has average monthly living costs of £822.

The South West of England and London are still the most expensive parts of the UK for students, but these have risen to £962 and £1,089 per month respectively.

Compared to last year, the average amount students spend on household bills and transport has increased in each region of the UK.

Do Student Loans stretch far enough?

The average student's Maintenance Loan falls short of covering their living costs by £439 every month.

This is a huge increase from last year. In the 2021 survey, the monthly shortfall between average Maintenance Loans and living costs had been £340.

Even before factoring in the Maintenance Loan shortfall, it's concerning that the maximum funding for living costs in 2022/23 is going up by very little for students around the UK:

- For English students, the maximum funding is increasing by 2.3%

- For Northern Irish students, the maximum funding is increasing by 0%

- For Scottish students, the maximum funding is increasing by 4.5%

- For Welsh students, the maximum funding is increasing by 3.5%.

All of the above figures are dwarfed by the current rates of inflation.

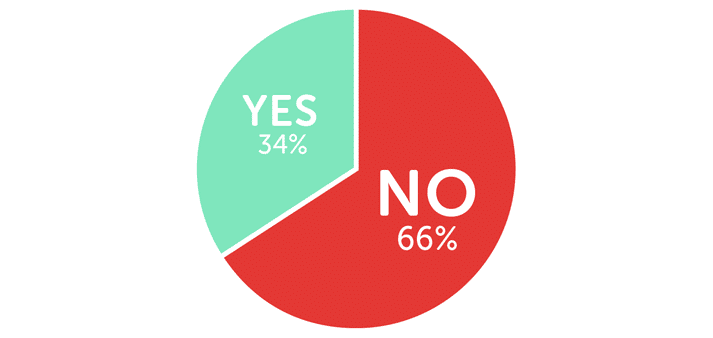

When you consider that Maintenance Loans are already failing to cover around 48% of the average student's living costs, increasing them by such small percentages will only widen the gap between the loan and living costs.

Maintenance Loans are intended to help students get by while studying. Yet, even as the cost of living crisis hits the UK, the government is offering shockingly little to a group that is reliant on their funding to afford daily essentials.

Some may argue that, as Maintenance Loans are generally based on household income, with students from higher-income families receiving less than those from lower-income families, a slight gap between the average student's Maintenance Loan and their living costs is to be expected.

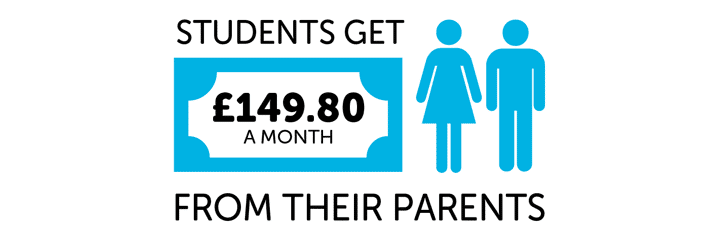

However, as we'll discuss in more detail later, the average student receives £149.80 per month from their parents. So, even when we combine the average student's Maintenance Loan and parental contributions, that still leaves a shortfall of £289.20 every month.

Here is what students said when we asked them if Maintenance Loans are enough to live on:

For around two-thirds of students, Maintenance Loans are not big enough.

Do students have enough financial education?

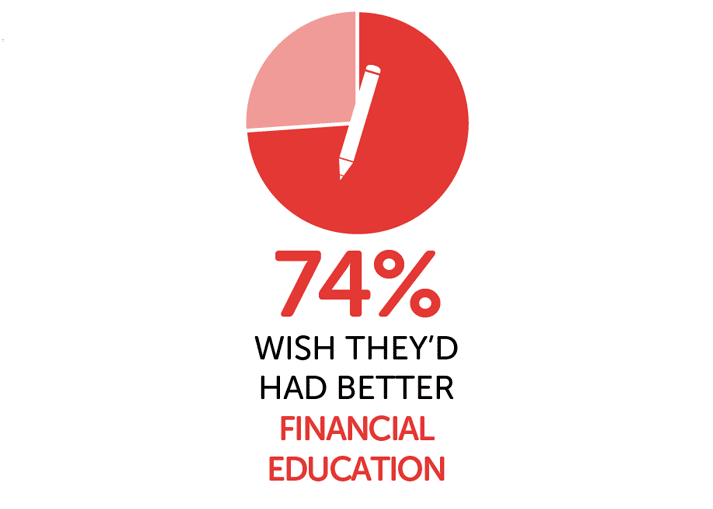

With Maintenance Loans falling well short of covering living costs, strong financial literacy skills would help students to navigate this challenging period. But, worryingly, the survey indicates that not all have the level of financial education we would hope to see.

We would urge all students to make and keep to a budget – now more than ever. However, 15% of students in the survey said they don't budget.

Personal finance should be taught in schools to ensure young people approach adulthood with the skills required to manage money. Yet, around three-quarters of students in the survey said they wished they'd had better financial education at school.

What students say about surviving on Student Finance

- [The] cost of living has increased and the loan doesn't cover it anymore.

- I get the lowest possible amount [because] my dad is a high earner. However he is very stingy with money. My loan doesn't cover my rent.

- They don't take into account enough factors – household income is not a good enough indicator of how well [off] a student will be financially.

- My Maintenance Loan doesn't cover rent, let alone other expenses such as bills and food etc.

- It doesn't cover enough, and so we have to make sacrifices constantly.

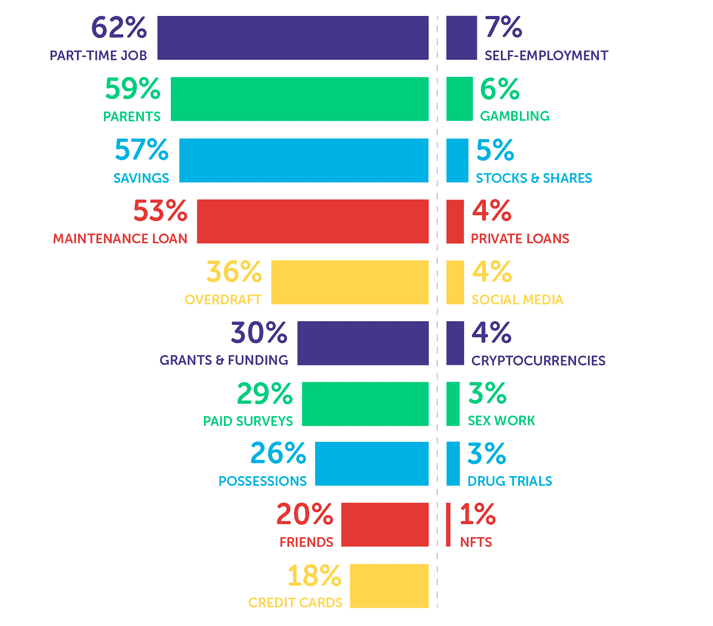

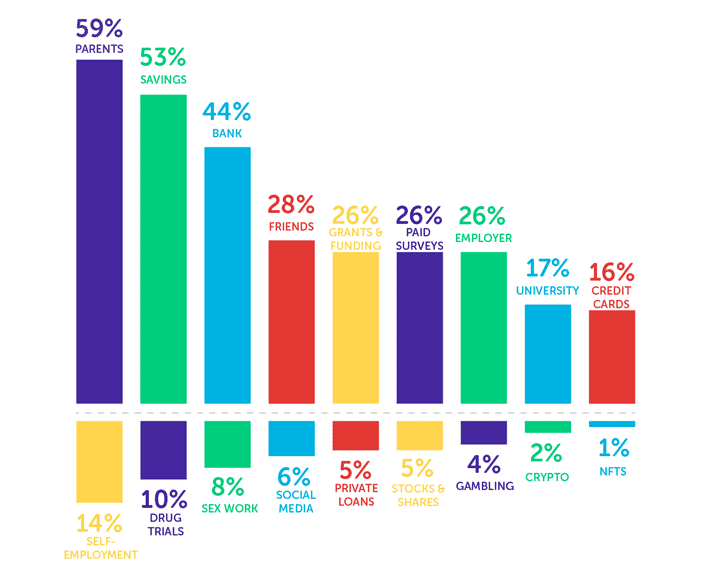

How do students get money?

Compared to last year, we have seen a slight shift in terms of where students get their money.

In our 2021 survey, the three most common sources of money were from parents (66%), a part-time job (66%) and from a Maintenance Loan (65%). All three of these figures have dropped in the 2022 survey.

The reduction in the proportion of students relying on parents for money could reflect the impact of the cost of living crisis on families. Many parents, when dealing with the rising cost of bills, food and other essentials, may struggle more to financially support their children at uni than in previous years.

The drop in students using Maintenance Loans is particularly noticeable. This could be linked to new EU students no longer being eligible for Student Finance in the 2021/22 academic year onwards.

While a smaller proportion of students are getting money from their parents and Maintenance Loans, we have seen a rise in the percentage who are using their savings to get by. This increased from 50% in last year's survey to 57% this year.

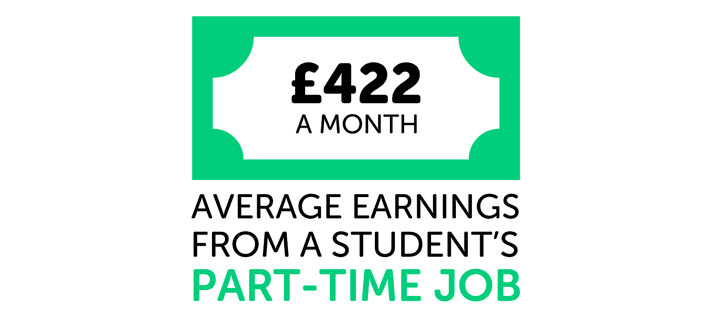

The most common source of money for students was a part-time job. And, among those with a part-time job, their average earnings were £422 per month.

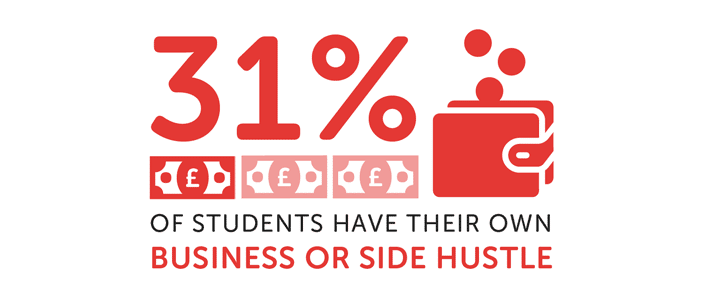

How many students have small businesses and side hustles?

Just under a third of students have their own business or side hustle. Among these students, 67% earned less than £500 in the last year. So, for the majority, these businesses and side hustles will likely not be enough to fund living costs.

However, for a small percentage, these can be high-earning ventures. 2% of students in the survey who had their own business or side hustle told us they earned over £10,000 from them last year.

Grants, bursaries and scholarships

30% of students in the survey said they received money from grants, bursaries and scholarships. As these forms of funding don't generally need to be repaid, they can make a massive difference to students' finances.

But, unfortunately, 42% said they weren't made aware of the funding options, like grants, that were available to them.

There's a huge range of grants, bursaries and scholarships available. Here are some examples:

- Disabled Students' Allowances (DSA)

- NHS bursaries

- Scholarships for UK students from ethnic minorities

- Scholarships for international students in the UK

- Unusual university bursaries, grants and scholarships.

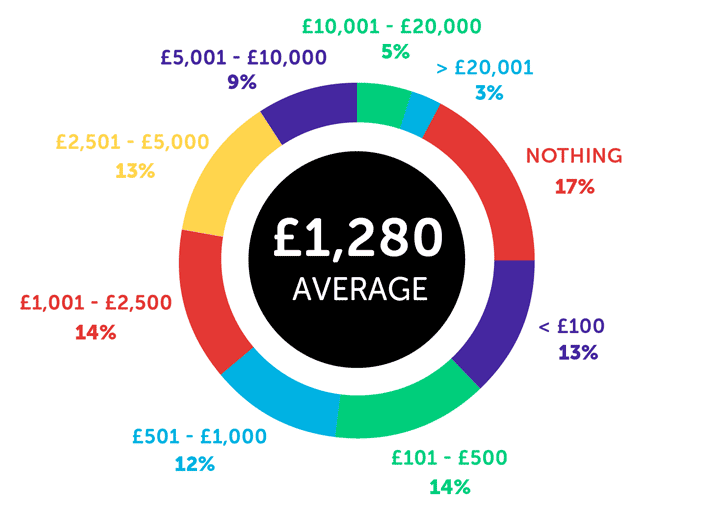

How much money do parents give their children at university?

On average, students receive £149.80 per month from their parents.

It's important to keep in mind that, for the average student, the Maintenance Loan falls short of covering their living costs by £439 every month.

As we mentioned earlier, generally, the loans are calculated based on household income, with students from higher-income households receiving smaller loans. The underlying assumption is that parents will make up the difference between their child's loan and the maximum loan, contributing that much money to them while they're at uni.

Theoretically, if the system was successful, we would be seeing the average contribution from parents matching the average Maintenance Loan shortfall. But this is far from the reality.

This, again, highlights that Maintenance Loans are too small. And the issue is worsened by the unrealistic assumption, when loans are calculated, that parents will make up the shortfall.

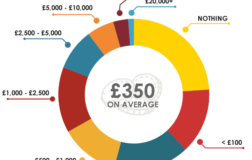

How many students save up money for university?

66% of students in the survey saved up money to go to university.

We mentioned earlier that more students are using their savings as a source of money at uni. But, the proportion that saved up ahead of their degrees has actually decreased over the last couple of years.

In 2021, 69% said they had saved up to go to uni, and in 2020, 70% said the same.

And here is an overview of how much students currently have in savings:

10 surprising ways students have made money

Here are some of the unusual ways to make money that students in the survey have tried:

- "By reading out loud different sentences for a new device to understand and learn a Scottish accent."

- "Completing online surveys."

- "I let people on the internet choose my outfit for a night out, as embarrassing as they liked."

- "Ended up taking part in an experiment where I solved riddles with a robot at my uni's psychology department to get extra cash."

- "By repairing a cafe's internet router, in exchange for a sandwich and coffee."

- "Picking up dropped coins after closing outside a pub."

- "Giving urine and spit samples to graduate research."

- "Stood in a field looking for bats."

- "I washed clothes for people to get paid."

- "Licked the pavement for £20, wouldn't do it again."

What students say about budgeting and saving money

- I budget and save quite a lot of it which sometimes takes a toll on my social life, etc.

- I think a big contribution to me saving so much money was I budgeted to spending only £10 a week for groceries at Aldi, eating [three full] meals with plenty of vegetables and rice. So [the] majority of the time I did not need to touch my savings and any spare time I had I would participate in competitions and sign up for grants and bursaries.

- I have enough money to live a basic lifestyle and still treat myself without going into my overdraft as a result of budgeting.

- A lack of money sometimes makes me not able to join in with activities friends are doing, such as nights out or going to a different city. My mental health can also suffer sometimes because I worry about saving for after university.

- [I] can't afford my house next year even without bills so have to use savings and work more whilst studying to cover [the] cost of living.

How would students get money in a cash crisis?

Here's where students in the survey said they'd turn to for money in an emergency:

The most common response was their parents, which 59% answered. However, this is down from last year, when 73% had said they would approach their parents in an emergency.

As we mentioned earlier, we have seen a drop in the proportion of students who are receiving money from their parents to help with living costs.

If students are also less likely to approach their parents for money in a cash crisis, this again suggests that the cost of living crisis is impacting parents' abilities to support their children at uni.

It's surprising that the proportion of students who would approach their university in a cash crisis has dropped. 34% of students in last year's survey had said they'd turn to their uni, but this has dropped to 17% this year.

When students are struggling for money, we would always suggest approaching their university as soon as possible to ask about hardship funding. For students who are successful in applying, hardship funds can provide short-term financial support to cover essentials like bills and food.

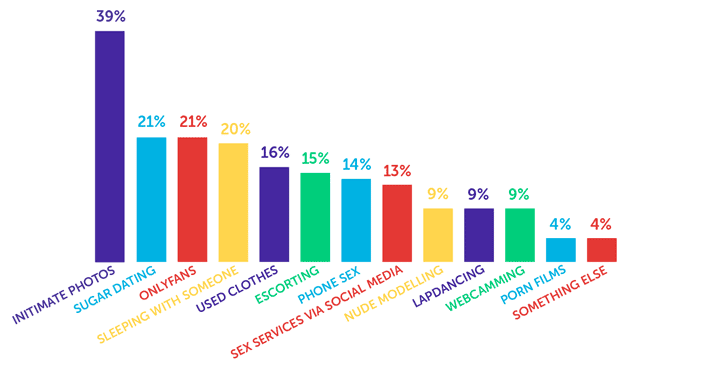

Sex work at universities

3% of students in this survey said they have done sex work. And each year in our National Student Money Surveys, a small but relatively consistent proportion of students tell us they do sex work to make money at university.

To ensure all students are supported as much as possible, it's important that universities are aware that there will likely be some within their student population who have done, or would consider doing, sex work.

We've heard from some students over the years who talk positively about doing sex work.

However, it's concerning to hear from others who don't enjoy sex work, but do it out of desperation for money.

8% of students in the survey said they would consider sex work in a cash emergency, indicating they see it as a last resort. For students in this position, it's vital that they're aware of the full range of funding options available to them.

No student, or anyone for that matter, should have to do anything they're uncomfortable with for money, especially if it involves putting themselves in unsafe situations.

What kinds of sex work have students tried?

Among students in the survey who have done sex work, these are the kinds they have tried:

By far, the most common type of sex work done by students in the survey is selling intimate photos.

What students say about doing sex work at uni

- It helps with the bills.

- It is not regular employment, just when things get a bit difficult.

- [It] was a scam even though I know the person had money.

- I have not personally done sex work, but I understand why many girls have to consider it/do it and they should not be shamed.

- It's degrading and depressing but I have to survive.

- I stopped doing it but before I earnt quite a lot but it affected my mental health.

- I don't do it anymore but I hated it.

- It's degrading but it pays for my food.

- I have considered sex work but unsure of a safe way to do so.

- I haven't done sex work for money but I do plan to this year – I feel that I have exhausted everything else and the course I will be starting is too intensive for even a part-time job.

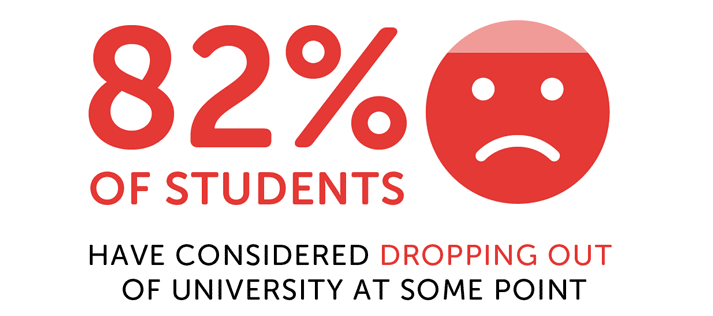

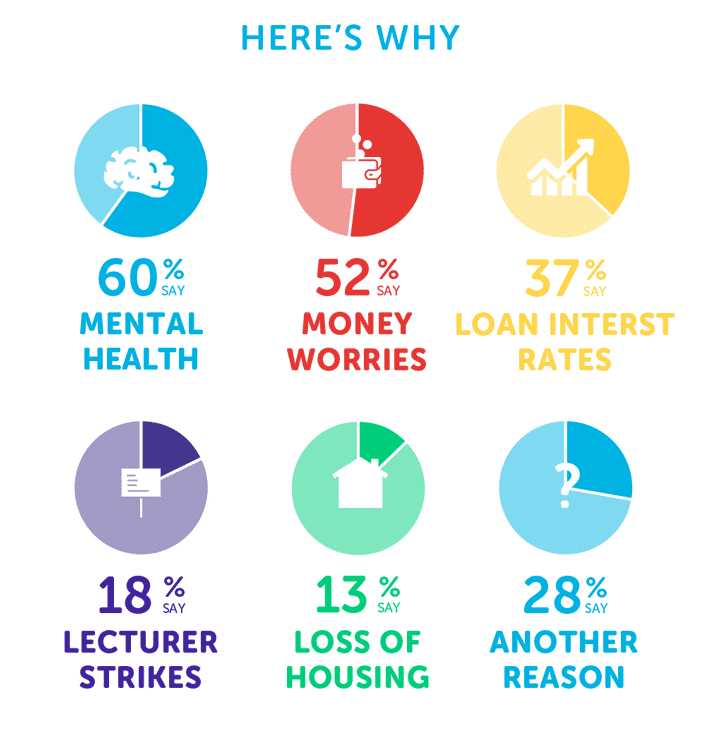

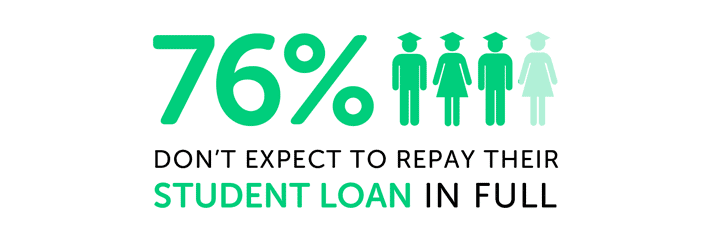

How many students think about dropping out?

In last year's survey, we had been worried that 76% of students said they had thought about dropping out of university at some point. Sadly, this figure has risen in the 2021/22 academic year to 82%.

The most common reasons were related to mental health (60%) and money worries (52%).

The proportion of students saying they had thought about dropping out due to their mental health was down by just one percentage point from the 61% who had said the same in the 2021 survey.

But, the proportion of students who have thought about dropping out due to money worries has risen from 41% in 2021 up to 52% this year. This, again, indicates the impact that the cost of living crisis is having on students and their uni experiences.

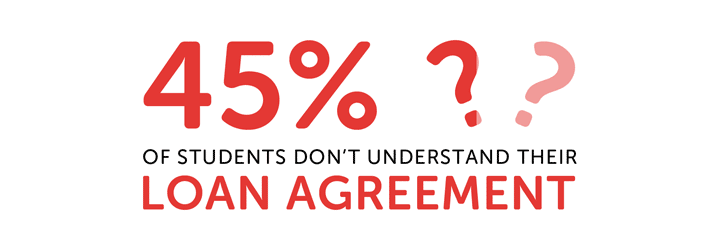

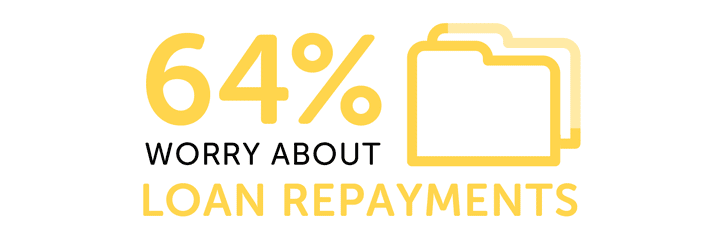

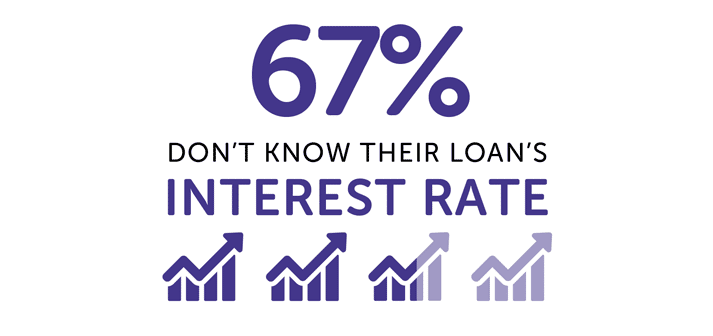

Do students understand their Student Loans?

In this year's survey, we have seen an increase in the proportions of students who are confused and uncertain about their Student Loans.

This was particularly noticeable when we asked students if they understand their Student Loan agreement. Among those in the survey who have a Student Loan, 45% said they don't fully understand the loan's repayment terms. This is up from 40% who said this in the 2020 survey, and 38% who said the same in the 2021 survey.

It's perhaps unsurprising that we're seeing a rise in the proportion of students who are confused by their loan's repayment agreement. Over the last academic year, there have been some major announcements about changes to Student Loans.

For example, in February 2022, it was announced that students who start uni in 2023/24 onwards and take out Plan 2 loans will face changes to the Student Loan repayment system. These include an extended repayment term from 30 to 40 years, and interest rates changing from RPI plus up to 3%, to just RPI.

On top of this, there have been changes to the Student Loan interest that people with Plan 2 loans can expect from September 2022.

It was announced in April 2022 that this year's March RPI rate was 9%. Following this, many, including us at Save the Student, called for clarity from the government as to whether Plan 2 interest rates really could increase as high as 12% (RPI plus up to 3%).

The government then announced in June 2022 that the interest rates would be capped at 7.3%. However, they made another announcement in August 2022 that the interest rates would be cut further, and will now be capped at 6.3% from September 2022.

Considering that last year, prior to these announcements, two in five said they didn't fully understand their loan's repayment terms, the changes are bound to cause further uncertainty.

For such important loans with long-term repayment commitments, the full terms should be clearly communicated to students and graduates by the government.

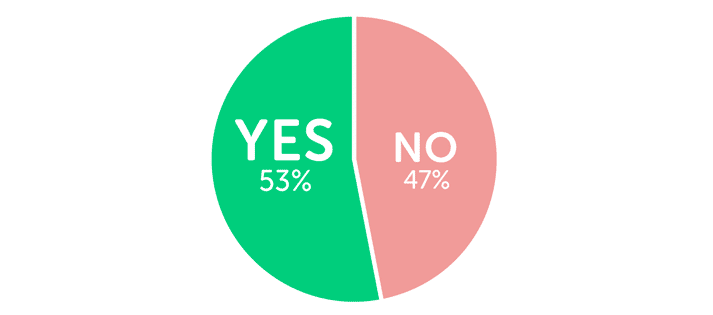

The value for money of university

Here's what students said when we asked them if they view university as good value for money:

Just over half of students in the survey do think that uni is good value. This is an improvement from last year, when 49% had said the same.

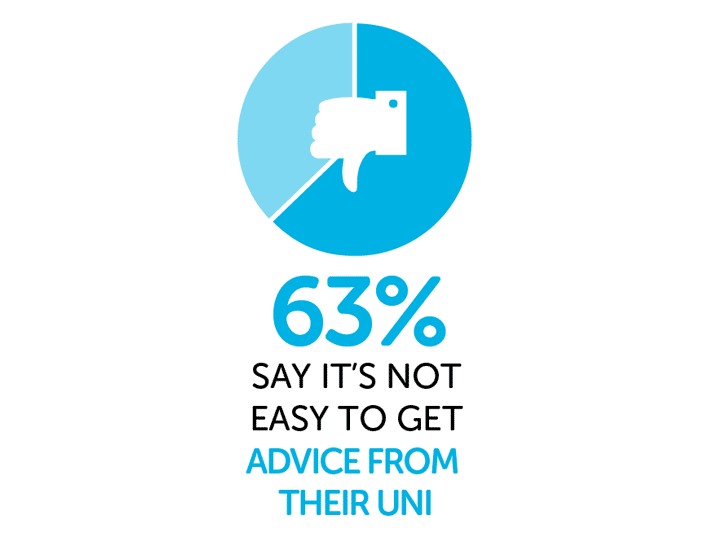

We have also seen a slight improvement in the proportion of students finding it easy to get advice from uni. Among those in the survey who asked their uni for financial support or advice, 63% said it wasn't easy. This is still much higher than we'd hope to see, but it is down from 70% that had said this in the 2021 survey.

What students say about tuition fees

- Tuition fees shouldn't be so high and even if it is a loan it should be interest free.

- We should know what our tuition fees [are going] towards exactly.

- I'm a student in Scotland who benefits from free tuition. I believe that free education should be an option for all people, and feel empathetic for all students in England, Wales and elsewhere that have to take out Student Loans, and even worse that they have to pay interest on them.

- I wish international student tuition fees were lowered to what home students pay.

- I have gone to university to study a Primary Education course with QTS to enable me to get a job as a primary school teacher as soon as I finish my course, therefore, I believe tuition loans should be forgiven/free when attending university for a specific profession that benefits society (e.g. teacher, nurse, etc.)

Graduate job prospects

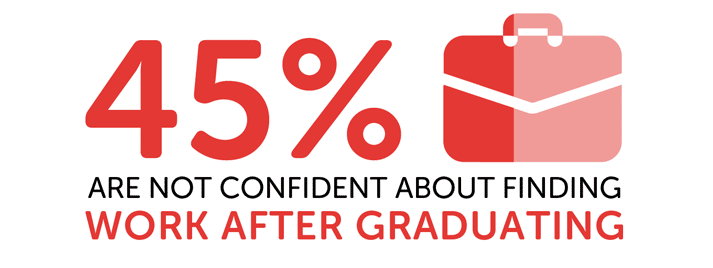

The pandemic is no longer shaping the job market quite as much as it was in the last couple of years. As such, we have seen growing confidence among students in terms of their job prospects.

In our 2020 survey, 58% of students said they weren't confident about finding work after graduation, which increased to 62% in the 2021 survey.

This year, only 45% said they were not confident about finding graduate jobs.

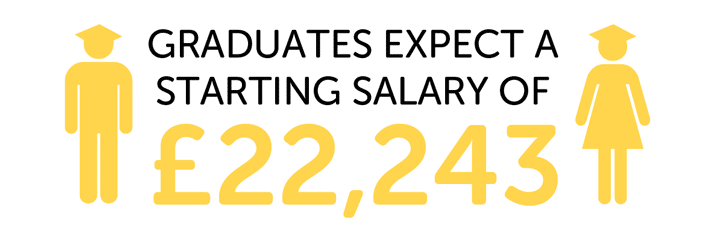

And when we asked students in the survey how much they expect to earn in their first graduate role, the average was £22,243.

What others say about the survey

A Department for Education spokesperson said:

We understand global inflationary pressures are squeezing household finances and people are worried about covering the basics.

To support students with living costs, we have increased maintenance loans every year, meaning disadvantaged students now have access to the highest ever amounts in cash terms.

Students who are worried about making ends meet should speak to their university about the support they can access. This year universities can boost their hardship funds by drawing on up to £261m we have made available through the Office for Students.

Kellie McAlonan, Chair of the National Association of Student Money Advisers (NASMA), said:

Now more than ever, it is important to have clear statistics on how students are approaching their finances and coping in the current climate, and Save the Student's annual Student Money Survey gives clear insight into this. The key stats from this survey will allow colleges and universities from across the country to better support students by understanding the challenges they are facing.

It is worrying to see the financial situation that students across the country are facing. Students have had a limited opportunity to recover from the impact of the global pandemic and are now facing another challenging climate with the cost of living crisis.

It had been evident for a long time that there is a worrying shortfall between student funding packages and real living costs. Students simply cannot bridge this gap that is now widening, nor can they rely on support from parents who are also under pressure.

Now must be the time for Governments to ensure student funding packages are robust enough for students to survive and thrive during their studies.

About this survey

Since 2013, we've been asking UK university students about their honest experiences of managing money during their degrees. Our independent findings provide insights into the realities of student life and allow us to improve the overall content and advice on our website.

If you'd like to find out more about this survey, case studies or comments, please get in touch.

- Source: The National Student Money Survey 2022 / www.savethestudent.org

- Average Maintenance Loan amount based on FOI information from Student Loans Company (SLC).

- The survey polled 2,370 university students in the UK from May – August 2022.

- Data from our previous surveys.

- Save the Student's Press Page.

- Tools and resources.

Student Money Cheatsheet

We created the free Student Money Takeaway resource in response to the shocking findings from our recent national student surveys.

This is a printable PDF, and it includes a one-minute budget sheet. In the resource, you can find the best advice from our website condensed down to just two pages.

![What do students spend money on? [stats]](https://www.savethestudent.org/uploads/what_students_spend_money_on2-252x160.png)

![What do students spend money on? [stats]](https://www.savethestudent.org/uploads/what_students_spend_money_on2-100x100.png)