Student Money Survey 2024 – Results

In this survey, we heard from students who skip meals, limit socialising and consider dropping out due to costs. We ask Labour to increase funding so students receive enough money to live on.

Credit: Linda Bestwick – Shutterstock

"I can't afford to eat. I can't afford to go out. I can't afford to travel into uni."

Comments like this are devastating. Yet, as you'll see throughout our report, this student is far from alone in struggling to afford daily essentials. In fact, 67% of surveyed students said they skip meals at least some of the time to save money – up from 64% last year.

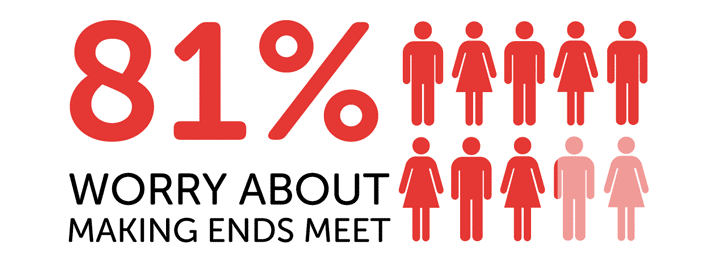

The year-on-year rise in average living costs was much smaller than in the 2022 and 2023 surveys. But, despite this, we continue to see widespread money issues among students, with over four in five of those surveyed this year telling us they worry about making ends meet.

This is our twelfth annual National Student Money Survey. If you've read our previous reports, you'll know that we at Save the Student have expressed concerns over the Student Finance system for years.

Particularly during the height of the cost of living crisis, we were disappointed with how little the Conservative government did to help students – as reflected in the ongoing issues we cover in this report.

While this survey is focused on students' experiences, we understand that financial issues within the sector expand beyond just Student Finance, with 40% of higher education providers in England expected to report a budget deficit in 2023/24.

The sector is at risk and students deserve better. We now need to see Labour "work with universities to deliver for students and our economy", as promised in their manifesto.

Our findings highlight the urgency with which change is needed. We will keep calling on the government to improve the situation until students skipping meals due to insufficient funding becomes a thing of the past.

What's in our report?

- Key findings

- Students are struggling to get by financially

- Food poverty at UK universities

- How much do students spend?

- Which areas have the highest student living costs?

- Do Student Loans stretch far enough?

- How do students get money?

- How would students get money in a cash crisis?

- How many consider dropping out due to money?

- Do students understand their loan agreements?

- Is university good value for money?

- What students expect from graduate life

Key findings from the Student Money Survey 2024

Here are some of the key findings from this survey:

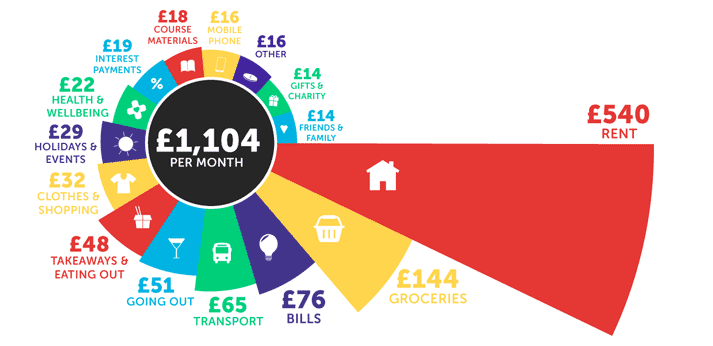

- Surveyed students spend an average of £1,104 per month. London students have the highest living costs, spending a monthly average of £1,264 per month.

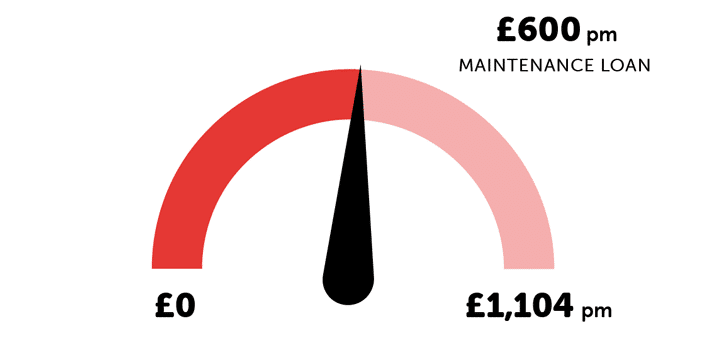

- Average Maintenance Loans fall short of covering living costs by around £504 per month.

- Over four in five worry about making ends meet.

- 67% skip meals at least some of the time, up from 64% in the 2023 survey.

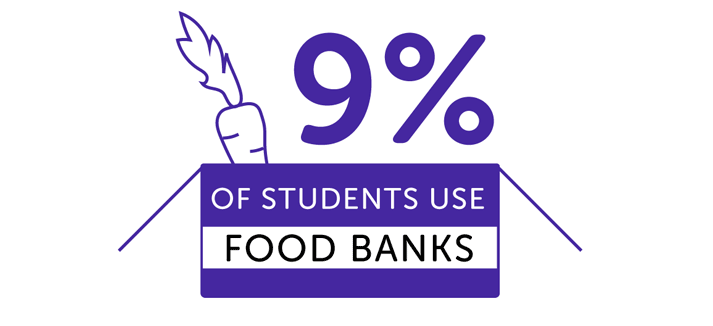

- The proportion using a food bank has halved compared to last year's survey, down from 18% to 9%.

- 48% have thought about dropping out of university due to money-related issues.

Expert comment

Save the Student's Communications Director, Tom Allingham, says:

The results of this year's survey underline the stark reality that the cost of living crisis is here to stay for students.

Fortunately, one or two stats have shown some signs of improvement – namely, the rate of inflation experienced by students, and the proportion using food banks. However, in the main, the results are just as bad as we found at the peak of the cost of living crisis.

Sadly, this is not a surprise. In England in particular, the Maintenance Loan has lagged behind inflation to such an extent that on average, it now falls short of living costs by £504 per month. Students are having to cut back on even the most basic necessities to make ends meet, with 67% skipping meals at least some of the time.

While there's been a lot of media attention on the financial crisis faced by universities, it's vital that those studying receive the funding they need too. Just as students need their universities to stay afloat, universities need their students to have the money to attend.

We're calling on the government to fulfil its manifesto promises to "deliver for students" by increasing Maintenance Loans to catch up with inflation, and end the financial peril faced by those at university.

Students are struggling to get by financially

In both the 2023 and 2022 surveys, 82% said they were worried about making ends meet – just one percentage point higher than this year.

As such, the situation shows minimal signs of improvement, rather indicating that the widespread challenges brought about by the cost of living crisis are becoming a new normal for students.

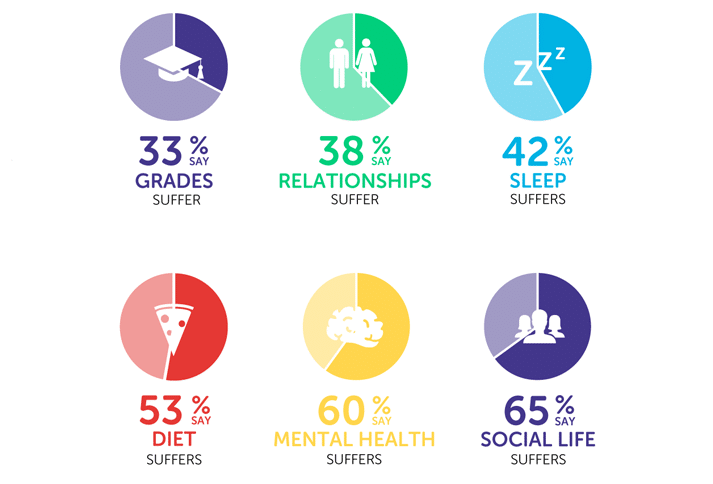

Money issues can have knock-on effects in numerous areas of life. When we asked students if their grades, relationships, sleep, diet, mental health and/or social life suffered due to money worries, this is what they said:

Students are struggling with food poverty

Almost one in 10 (9%) surveyed students told us they had used a food bank in the last academic year. This is still much higher than we'd hoped to see, but it is at least promising that it's down from 18% saying the same last year.

It has returned to a similar level to the 2022 survey when 10% had said they used a food bank.

However, despite a much smaller proportion saying they use food banks, we have worryingly seen a slight rise in students often skipping meals.

26% of respondents said they often skip meals due to money, while a further 41% said they sometimes do. This means that over two-thirds (67%) of those in the survey skip meals at least some of the time.

For comparison, in the 2023 survey, 22% said they often skipped meals and 42% said they sometimes did.

What students say about food costs

- Saving money in uni has been a nightmare for me. I have starved myself for three days in order to save up some money.

- I rely on my breaks at work to give me free food.

- I went a week living on 300kcal a day because I couldn't afford food and I had to pay my phone bill instead.

- I don't go out and I often don't buy food. My appetite decreases with stress so some days I don't eat much.

- Many people cannot rely on their parents for financial help – my parents' combined income is considered a fairly decent amount but they have a lot of Direct Debits and credit card loans which have to be paid off every month, so I feel bad asking them for money and don't tell them I am struggling to buy food, as they are struggling at home too.

- I ended up eating really poor quality food to save money. It got me sick enough to need medical attention and that combined with the stress may have left me with a permanent health condition.

- Uni has been crazy and a struggle to keep up money wise. I have had to cut down on food and have lost 8kg since moving to university.

- I really need textbooks but in order to save I'm having to cut my food and social life down which is affecting my mental health.

How much do students spend?

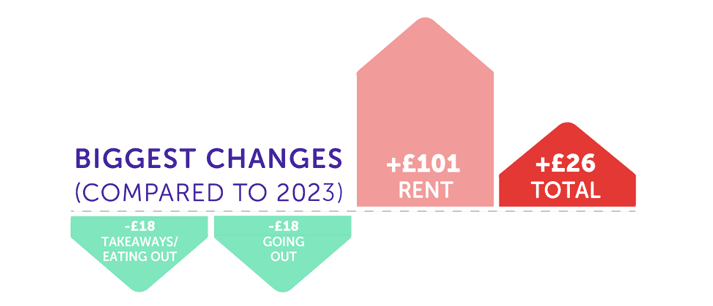

On average, students in the survey spend £1,104 per month, up by around 2.4% compared to last year's survey.

While still an increase, it is a relief to see a less drastic rise in living costs than we had seen in the previous two surveys (+14% in 2022 and +17% in 2023).

The average cost of household bills is slightly lower than in last year's survey, down from £79 to £76. This is good to see after the significant rise in bills we saw during the height of the cost of living crisis. However, we are concerned the upcoming energy price cap increase in October will add to some students' financial pressures.

In this year's survey, we introduced the option of 'interest payments' when asking students about their living costs. 17% gave a monthly figure for this, often stating numbers in the hundreds. Across all students in the survey, it worked out as an average of £19 per month.

Compared to last year's survey, rent increased the most among all categories, up significantly from an average of £439 in 2023 to £540 in 2024.

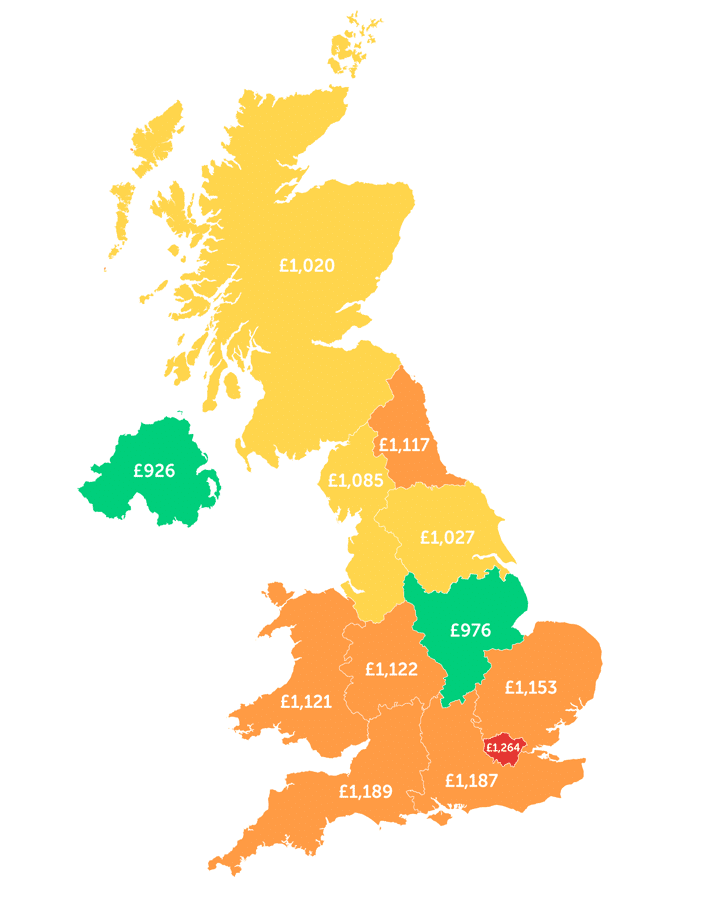

Living costs around the UK

This includes students who live away from home and with their parents.

As is to be expected, surveyed students in London reported the highest monthly living costs, spending an average of £1,264 per month.

Not far behind, the South West has a monthly average of £1,189 and in the South East it's £1,187.

Northern Ireland has the lowest student living costs among all UK regions in this survey, with an average of £926 per month.

Do Student Loans stretch far enough?

Following an FOI request to the Student Loans Company (SLC), we know the average Student Loan for students from England in 2023/24 was £7,202 (equivalent to around £600 per month).

To contextualise this, a loan of £600 per month would cover around 54% of the average living costs among surveyed students, leaving a shortfall of about £504 per month.

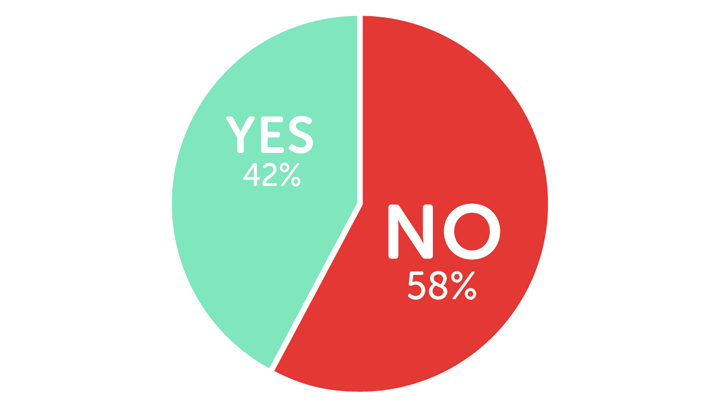

With this in mind, it's unfortunately not surprising that when we asked students if Maintenance Loans are big enough to live on, just under three in five (58%) said no.

What students say about surviving on Student Finance

- You are forced to take out a high-interest loan to just live on the threshold of poverty.

- Student Finance barely gives enough money to live on! If that honestly. Rent can be super expensive and the whole idea of university is to study and learn – but the majority of that learning time is taken up by a part-time job…

- Instead of relying on household income as data for loans they should rely on living situations. For example my parents earn above a certain threshold but because of how many people there are in my household it may not always be easy. Money isn't always accessible.

- Student Finance heavily assumes that all parents will support their child/ren at university. It also creates an imbalance of opportunities that students have access to, such as going on student-led trips and events that are probably already heavily subsidised, but still unaffordable.

- Student Finance offers the bare minimum. I know many students that are having to find extra funds elsewhere or having to drop out.

- It's a loan, not a grant – and with more people being forced to repay it makes sense to allow all students to apply for the max. However, I would support a means-tested maintenance grant for low-income students!

Do students have enough financial education?

The vast majority of surveyed students make an effort to track their spending, with 94% saying they try to budget.

But, for many, getting help with money hasn't always been easy.

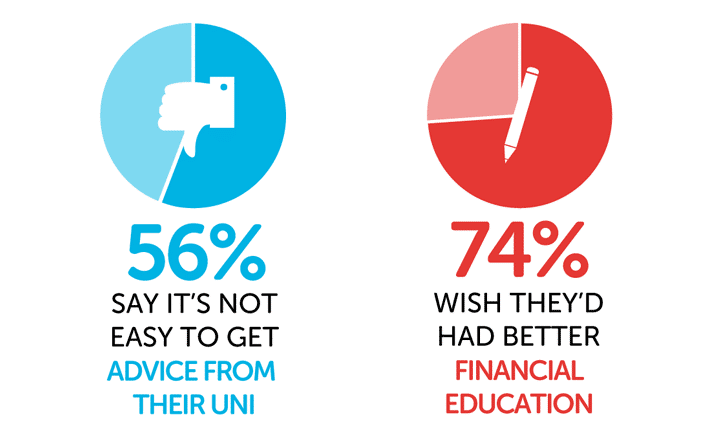

Nearly three-quarters (74%) arrived at uni with less financial education than they would have liked. And, among those who had asked their university for financial support or advice, 56% said it wasn't easy.

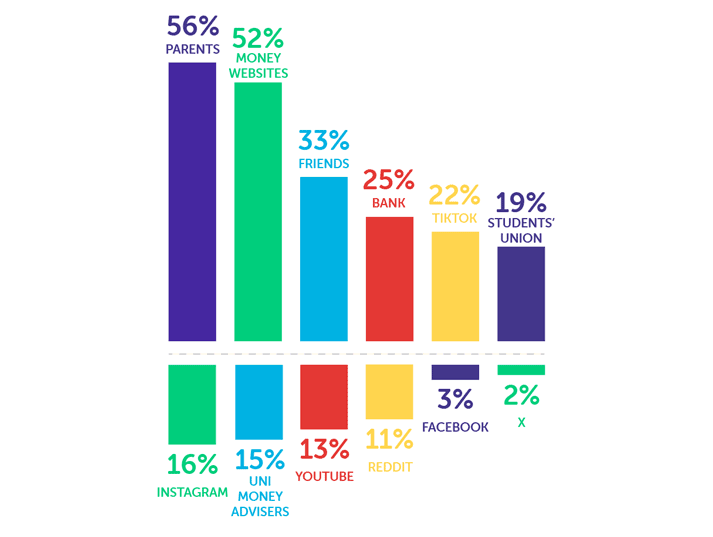

With many dissatisfied with the financial guidance they received at school and uni, where do students turn for tips and advice about money?

While the most common option was parents, just over half use money-advice websites (52%), around a third talk to friends (33%) and a quarter get guidance from the bank (25%).

Alongside this, over one in five (22%) uses TikTok to find money tips. This makes it the most popular option among the social media apps in the multiple-choice selection (Instagram, YouTube, Reddit, Facebook and X were other options).

TikTok was also a more common choice than students' unions (19%) and university money advisers (15%).

While there are some good tips on TikTok, there is also the risk that students who are looking for advice may encounter disinformation or even scams.

For those working in the university sector hoping to optimise their approach to supporting students, it's therefore a key platform to consider. Through engaging and informative TikTok content, there's the potential to reach more students and share reliable tips with them.

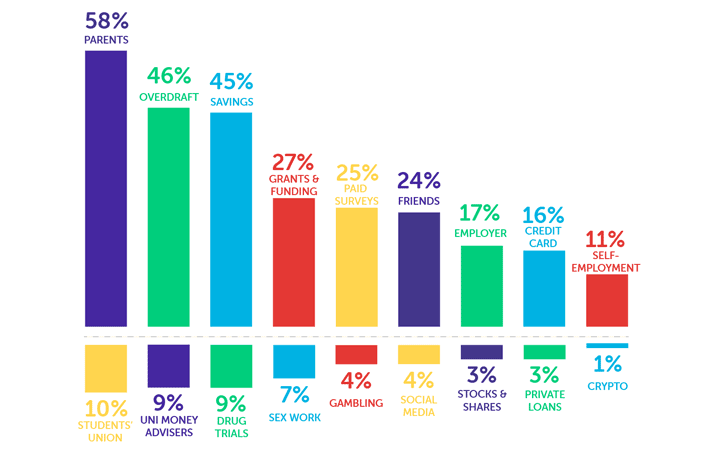

How do students get money?

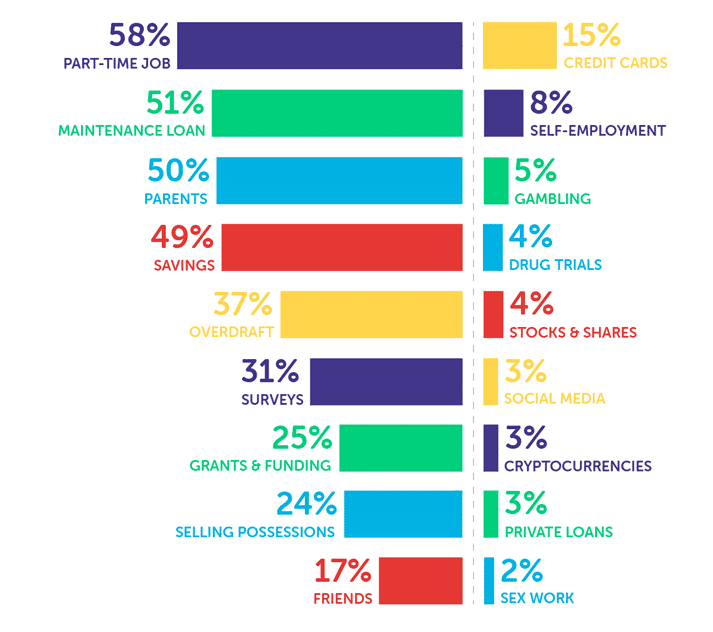

These are the sources of money used by students in the survey:

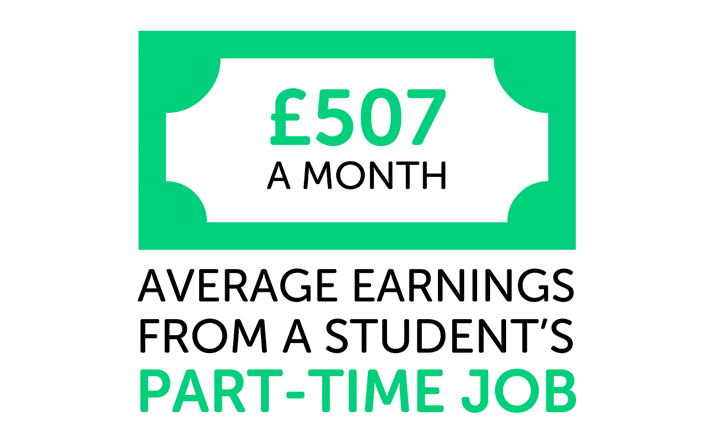

Just under three-fifths (58%) have a part-time job to get by at university and 8% are self-employed. Both of these figures are slightly higher than in the 2023 survey when 56% had said they worked part-time and 5% were self-employed.

Among those who do paid work alongside their studies, their average monthly earnings are £507 per month.

Students with jobs/self-employment work an average of 39 hours per month. Although this is down from last year when the average had been 46 hours per month, nearly half (46%) this year said the hours they work affect their studies.

10 surprising ways students have made money

We asked students about unusual ways they've made money. Here are some examples:

- "On TikTok people sometimes send me £10 voluntarily."

- "Chaperoning the Chelsea team's kids at a football event."

- "By selling AI-generated YouTube thumbnails on Discord."

- "Working as a film extra."

- "Volunteering to have my body scanned for an ultrasound teaching course."

- "Doing a psychological study involving lifting up jars of different weights for three hours."

- "Focus groups (complaining about the uni)."

- "Got paid £100 by a newspaper to send a photo of my bedroom floor."

- "Training AI."

- "Videographer for pimple popping videos."

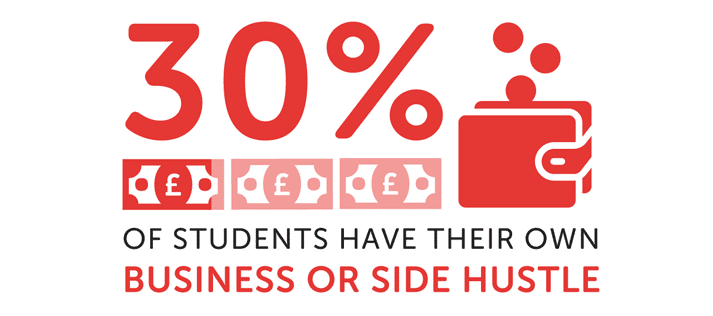

How many students have small businesses and side hustles?

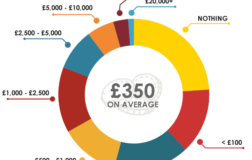

Three in 10 surveyed students said they earned money from their own business or side hustle. The majority have earned below £500 in the past year, but some reported earnings in the thousands.

Here's an overview of the earnings among those with a business/side hustle:

| Earnings (past 12 months) | % among students with a business/side hustle |

|---|---|

| <£500 | 81% |

| £501 – £1,000 | 9% |

| £1,001 – £3,000 | 7% |

| £3,001 – £10,000 | 2% |

| >£10,000 | 1% |

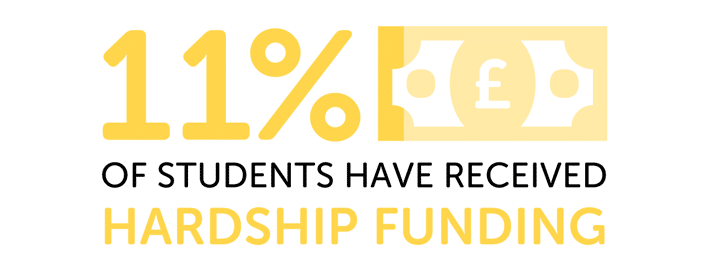

Grants, bursaries and scholarships

Although 25% said they received grants, around two in five (41%) felt they weren't made aware of the funding available to them.

One form of university funding that all students in need should be aware of is hardship funding, which 11% said they received in the 2023/24 academic year.

This was down significantly from the 2023 survey when 21% said they had received hardship funding.

Among those who have received hardship funding in this year's survey, the average amount they were given was £1,155.

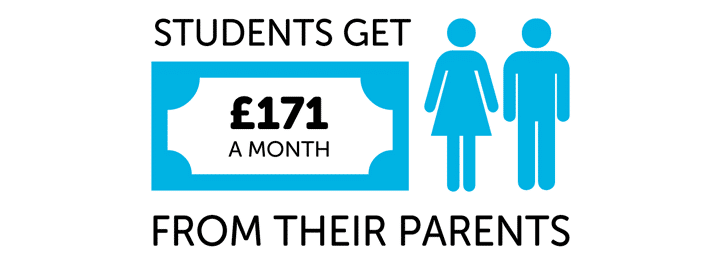

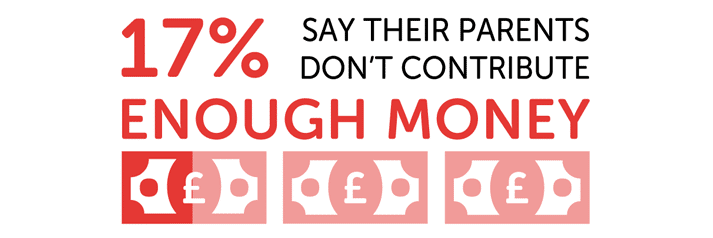

How much money do parents give their children at university?

We asked students in the survey how much they received from their parents each month, and the average response was £171.

Not all students were happy with the amount they received. Around one in six felt their parents didn't contribute enough money.

This highlights a contentious issue with the Student Finance system.

Maintenance Loans are calculated based on household income, so students with higher-earning parents generally receive smaller loans than others whose parents earn less. There's essentially an underlying assumption that parents with higher incomes will give their children more money at university.

But, regardless of income, not all parents are willing or able to give their children money for uni for a range of reasons. This means some students are under added pressure to find extra money from elsewhere to make up for the shortfall.

How much do students have in savings?

At the time of answering the survey, 77% said they had at least some money in savings.

The average they had saved was £655, but 37% had less than £100.

What students say about budgeting and saving money

- It's just added stress to think about how I'm going to budget every month to make sure I can live.

- I understand that money troubles and budgeting is a part of life for everyone, but I do feel that it is harder for uni students who still have a million classes to attend and a billion words due, and at my uni you aren't allowed to work during term time, so it really can be difficult to find ways to support yourself without letting your grades slip.

- I struggle to budget meals that fill me up but I stress about spending more so I tend to go hungry, and sometimes I don't eat at all just to save money. I also avoid doing things with my friends to save money and even then the stress of it tends to keep me up sometimes looking for ways to save money.

- I avoid going out with friends to save money and it really impacts me.

- I know I have great savings for someone of my age but this is all money that I have earned and saved myself since I was 18. I don't touch it except to pay my bills (not rent, I have a Student Loan). I want to do a post-grad and so this is the money I have put aside for it. It's stressful feeling like I won't meet my goal and not have enough money to live during my post-grad, but I'm also aware that I'm causing stress for myself now.

How would students get money in a cash crisis?

In an emergency, this is where surveyed students said they would look for money:

By far the most common source of emergency cash for surveyed students is their parents, which 58% said they'd turn to.

This is followed by an overdraft (46%) and savings (45%).

Sex work at universities

As we often see in the National Student Money Survey, a noticeably higher proportion said they would consider sex work in an emergency (7%) compared to those who already make money this way (2%).

Some speak positively about their experiences with sex work, including one student in the survey who viewed it as "easy money". However, it concerns us that we also hear from students who don't want to do sex work, but see it as their only option.

Here are some examples of comments we received about sex work:

- I wish I didn't have to.

- I only do this because I have no choice and it's never a stable payment each month.

- I haven't done any sex work but I have greatly considered it and am more than prepared to engage in sex work if it means making ends meet.

- I couldn't think of another way to make money.

- Advertised my services on a private site and got replies. Easy money.

- While I haven't taken part in sex work it is a reoccuring idea as it seems the only way for students to access large amounts of money.

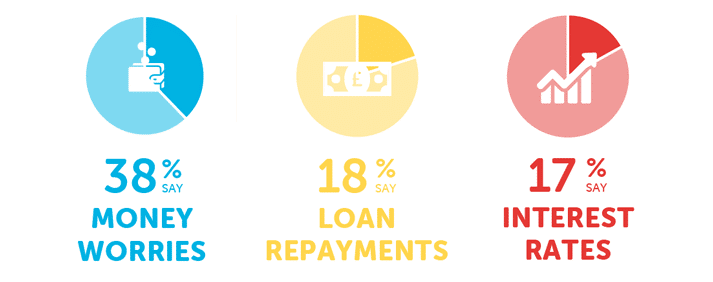

How many think about dropping out due to money?

We asked students whether they'd thought about dropping out of university due to these money-related reasons: financial struggles, high Student Loan interest rates or big Student Loan repayments after university.

While 52% said they hadn't considered dropping out for any of these reasons, the remaining 48% had, with money struggles being the most common reason.

As Tom Allingham argued: "Just as students need their universities to stay afloat, universities need their students to have the money to attend."

Money-related issues are leading a worrying number to question whether they can complete their degrees. For the sake of students and the universities they attend, more needs to be done to prevent this.

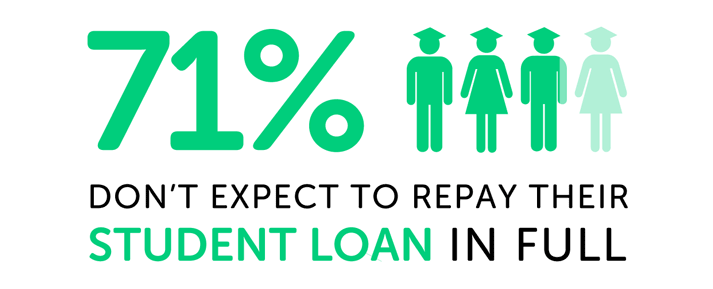

Do students understand their Student Loans?

Compared to the 2023 survey, we have seen a sharp rise in the proportion not knowing their loan's interest rate, up from 62% last year to 72% this year.

As a general rule, Student Loan interest rates usually change on a yearly basis each September. However, the last couple of years have been different.

Interest rates for Plans 2 and 5 loans increased six times between 1st September 2023 and 31st August 2024. This was due to the Prevailing Market Rate which the government used for interest rates in response to exceptionally high inflation.

In 2023/24, Plan 5 was introduced for new students from England. This plan increases the likelihood of students repaying their loans in full compared to those with Plan 2 loans.

However, the majority of students in the survey (71%) still don't expect to repay the entire debt before it's written off. This is up from 64% who said the same in the 2023 survey.

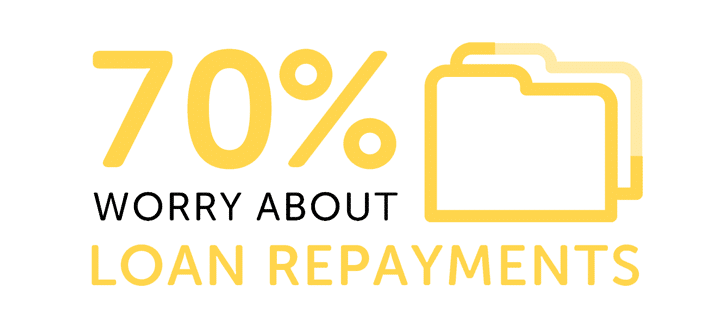

Another increase compared to last year's survey is in the proportion who are worried about Student Loan repayments – up from 67% last year to 70% this year. This could potentially be due to the high interest rates which, as mentioned, increased several times throughout the academic year.

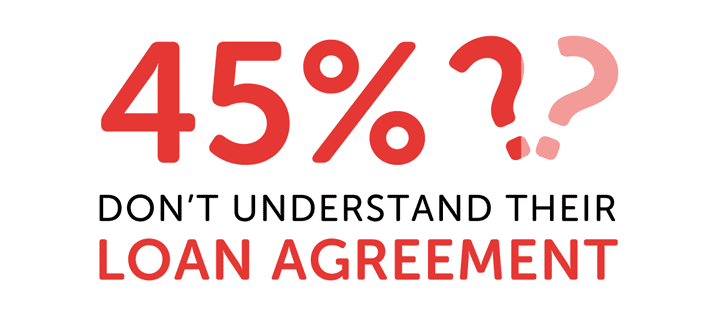

And, while it's good to see that over half of the students in the survey (55%) do fully understand their loan agreement, it's still a lower proportion than we would hope to see.

Student Loans are major financial undertakings that can see graduates making repayments for up to 40 years. It's essential the terms are clearly communicated to new students, and that students and graduates are kept updated about any changes to their loans.

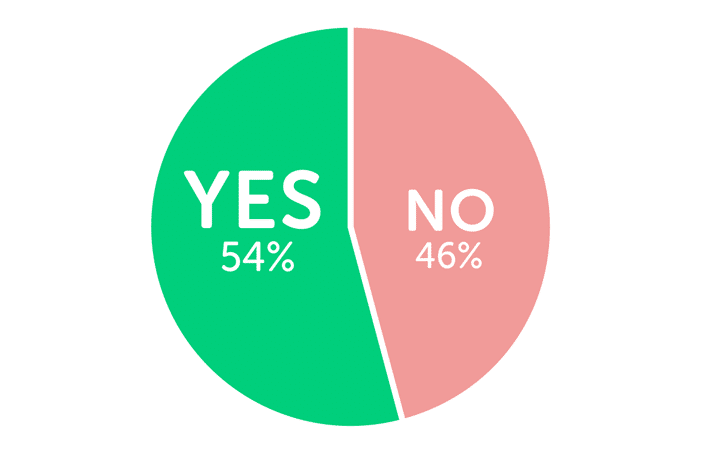

Is university good value for money?

We asked students in the survey whether they think university is good value for money. Here's what they said:

This is similar to the results of the previous two years' surveys, as 43% said uni was not good value in the 2023 survey and 47% said the same in 2022.

There have been recent reports that tuition fees at English universities would need to increase to £12,500 for the institutions to break even. However, it has been recognised within the sector that this would be an unpopular move among the public, and we echo these concerns.

If 46% of those surveyed are unhappy with the value of university with tuition fees of up to £9,250, any further rise would likely add to the dissatisfaction and frustrations a lot of students already have – especially if fees jump up so drastically.

While frozen tuition fees clearly aren't working for universities, it would be disappointing if the response was to worsen the burden for students and graduates whose access to higher education is dependent on Student Loans.

We would urge the government to balance the needs of universities with those of students and graduates to improve the system for all.

What students say about tuition fees

- I save and work to pay for my own tuition due to family wishes and as I live at home, the sacrifice made is towards spending on clothes, activities, etc.

- Way too much money for young people to afford, especially tuition fees when we're hardly in uni.

- I will be entering an NHS job, serving the public, the job is high pressure, understaffed, poorly paid. I don't believe I should have to pay to study Nursing and I think more financial support is needed to undertake post-graduate courses. I don't believe I received good education particularly during COVID but [was] still charged the same course fees.

- I mean technically it's great as we have a loan and can pay the uni fees with that, although having interest isn't great but that's how they work. I think in the first place uni shouldn't be that expensive honestly, it's really not worth it, genuinely unsure where all the money goes. We don't even have class everyday and it's not even a full year, like two terms as third term is just exams. So Student Finance is good but could be better I guess.

Graduate job prospects

When we asked students in the survey if they were confident about finding a job after university, over half (52%) said no. This is up from 42% who said the same in the 2023 survey.

On average, surveyed students expect a starting salary of £25,058 in their first job after university.

When we break down the results by the students' household income bands, we can see that those with lower household incomes generally expect a lower starting salary than those with higher household incomes:

| Household income | Expected starting salary |

|---|---|

| <£25,000 | £23,823 |

| £25,001 – £35,000 | £25,548 |

| £35,001 – £45,000 | £24,096 |

| £45,001 – £55,000 | £26,417 |

| £55,001 – £65,000 | £26,662 |

| >£65,001 | £28,217 |

With the exception of £35,001 – £45,000, there is otherwise an increase in the average expected salary in each income band.

To improve social mobility, it's important students from all backgrounds are made aware of what they can achieve. Any who underestimate their earning potential could enter the workplace without the confidence to negotiate higher salaries or the understanding that others with equal capabilities might expect more.

Based on these findings, we would encourage university career advisers to make particular efforts to ensure students receive clear guidelines on what they can realistically expect from a starting salary, along with tips to negotiate for more pay.

What others say about the survey

In response to the survey, Vivienne Stern MBE, Chief Executive of Universities UK said:

All students should have access to sufficient support to be able to thrive at university. No student should have to go hungry or be forced to make decisions about their future due to financial pressures.

Universities have stepped up to alleviate cost of living pressures for students in a number of ways, including through boosting their emergency financial assistance funds and providing affordable eating schemes.

But we know that this can only go so far, with universities becoming increasingly financially stretched. They cannot continue to do more with less.

It’s imperative that the government reinstates maintenance grants and uprates the student maintenance package in line with real rates of inflation to ensure students can continue to benefit from higher education.

This would ensure that those most in need of support do not carry the largest debt, and would reflect the increased living costs all students face.

We know that financial concerns can be a huge source of stress and anxiety, so we would encourage any student facing difficulty to talk to their university's student support team.

About this survey

Save the Student has been running the National Student Money Survey since 2013. Our independent findings provide insights into the realities of student money and inform the content on this website.

The survey was conducted entirely online.

We push it out to a mix of our own followers, distribution via student service centres and unions at some universities, as well as through social media promotion. This mix is done to ensure that we are not only polling our own users.

Figures have been rounded to the nearest whole number.

For more information about this survey, case studies or expert comments, please get in contact.

- Source: National Student Money Survey 2024 / www.savethestudent.org

- The average Maintenance Loan amount is based on FOI information from the Student Loans Company (SLC).

- The survey received 1,762 raw responses. After cleaning the data to remove any non-students and clearly false entries, we used the responses from 1,010 university students in the UK to calculate the results.

- Students were polled between April and August 2024.

- Data from our previous surveys.

- Save the Student's Press Page.

- Tools and resources.

Student Money Cheatsheet

In response to recent survey findings, we have created the free Student Money Takeaway resource for university students.

This is a printable PDF, and it includes a one-minute budget sheet. In the resource, you can find the best advice from our website condensed down to a couple of pages.

![What do students spend money on? [stats]](https://www.savethestudent.org/uploads/what_students_spend_money_on2-252x160.png)

![What do students spend money on? [stats]](https://www.savethestudent.org/uploads/what_students_spend_money_on2-100x100.png)