Government announces big changes to Student Loan repayment system

The government has announced drastic plans to lower the repayment threshold and extend the repayment period for future students – but the changes could lead to a shocking inequality.

Credit: Krakenimages.com, Linda Bestwick – Shutterstock

Update: This has been edited based on the Institute for Fiscal Studies' updated estimations in March 2022 – their analysis found that lower and middle-earning graduates will be hit even harder by the changes than initially thought.

When we first heard speculation that the government was planning to reduce the Student Loan repayment thresholds of some Student Loans last year, we were disappointed, to say the least.

We had hoped that, given the backlash from students and organisations like ourselves, the government would rethink its plans and scrap them. However, it's been announced that students who start university in 2023 will face major changes to the Student Loan repayment system, based on recommendations from the Augar review.

These changes will lead many lower-earning graduates to repay more than they would have done under the current system, while the highest-earning graduates will repay less. For the government to introduce a system that negatively impacts those on lower incomes is shocking.

What's more, current students and graduates, as well as anyone from England and Wales who starts uni before the 2023/24 academic year, will also be impacted by a change in the way the repayment thresholds will be adjusted from the 2025/26 financial year onwards.

Read on for the key things to know.

Changes to the Student Loan repayment system

Credit: Yevgen Kravchenko, kamui29, Bell Photography 423 – Shutterstock

Here's an overview of the Student Loan changes affecting students in England who start uni from September 2023:

- The repayment threshold will drop from £27,295 to £25,000. This will increase each year from the 2027–28 financial year (which runs from April to April) in line with the Retail Price Index (RPI).

- Graduates will need to repay their loans for up to 40 years, rather than 30 years.

- The interest rate will be cut so that it's only the rate of RPI rather than RPI plus a percentage of up to 3% as it is currently.

And this is a change that will impact everyone already on Plan 2 loans, as well as those who start uni in 2022 or earlier:

- The repayment threshold will begin to increase annually by RPI from April 2025 (it has previously been increasing in line with the average earnings growth).

Reducing the threshold to £25,000 for future students could cost the average graduate from the 2023/24 cohort or later £1,000s more over their lifetime, compared to the current system. Just like the upcoming hike in National Insurance payments, it will be the middle and lowest earners who are hit the hardest by the change to the repayment threshold.

This is because, not only will many future graduates need to start making repayments earlier, but they will also need to repay more each month.

Graduates are required to repay 9% of whatever they earn over the threshold. For someone on a £28,000 salary, they'd need to repay around £5 a month with the current threshold of £27,295. But, with a repayment threshold of £25,000, repayments would increase to about £22.50 a month.

Lowest-earning graduates will repay more, but the highest earners will repay less

For graduates from the 2023/24 cohort or later who go on to earn the highest salaries, the changes could save them money as they'd have already been likely to repay their loan in full under the current system. The bigger monthly repayments could result in them repaying it all sooner, meaning there's less time for interest to be added to the debt.

On top of this, as interest rates will be cut down to just RPI, rather than RPI plus up to 3%, the overall amount they'll need to repay will be lower. It again speeds up how quickly they can repay their loans in full, and further cuts down the amount of added interest they'll need to repay.

Overall, graduates in approximately the top 30% of earners will repay less, with the very highest earners saving around £25,000 across their lifetime.

However, for graduates on lower incomes, the overall amount they'll need to repay will likely increase. As their loans will no longer be wiped after 30 years, they could be making repayments for up to 10 more years.

Even though the added interest will be lower than it would have been under the current system, it could still be added to the total debt for an extra 10 years, making it even harder for grads on the lowest incomes to repay their loans.

Under the new system, the majority of graduates will repay more than they would have done with the current repayment terms – this could be as much as £28,000 more.

Then, when we look at the change that also affects everyone on Plan 2 loans (increasing the repayment threshold in line with RPI each year instead of average earnings growth), this too could negatively impact graduates on lower incomes.

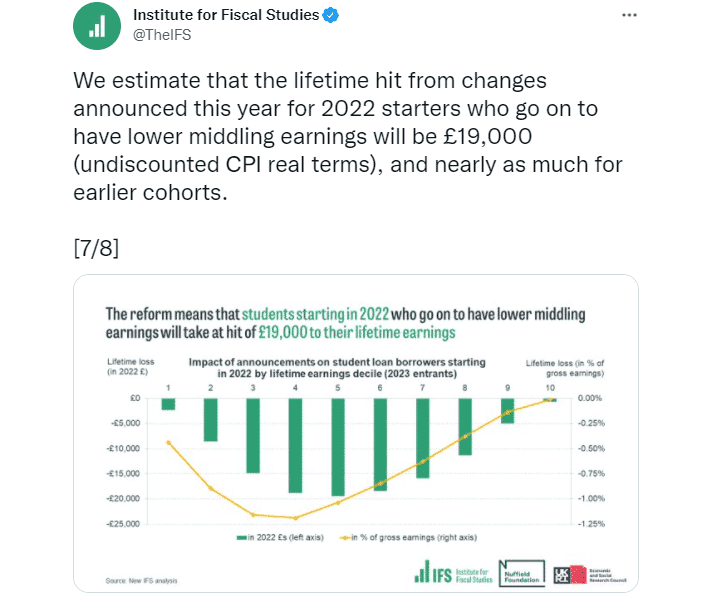

The IFS estimates that students who start uni in 2022 who go on to have lower middling earnings could be £19,000 worse off due to the changes:

Students will need to meet minimum entry requirements to get Student Loans

The above news is disappointing enough, but the government is also consulting on whether students will need to have at least a grade 4 pass in GCSE (equivalent to what used to be a C grade), or two Es at A Level to access Student Loans.

We really hope this change isn't introduced.

Passing English and/or Maths at GCSE is not necessarily an indicator of whether a student will succeed in their chosen subject. And, on top of this, the inequality of it is incredibly unfair.

Students from higher-earning households could still have the ability to attend university if their parents can cover their tuition fees and living costs. However, for many students and their families, this just wouldn't be possible.

This all comes weeks after the government announced an energy bills package that we estimate could leave students £100m worse off than those fully eligible. The government is repeatedly overlooking the needs of the majority of students, and this needs to change.

If you'd like to join us in calling for the government to reverse these planned changes and introduce a fairer Student Loan system for students, please sign our petition.

Save the Student's response

Our Head of Editorial, Tom Allingham, says:

We're extremely disappointed by the government's plans to reduce the Student Loan repayment threshold and extend the repayment period for new students.

Estimates suggest that the middle-earning graduates of the future will be the hardest hit by these reforms, in some cases repaying £28,000 more across their lifetime. By contrast, the highest-earning graduates will see their lifetime repayments drop, by as much as £25,000 in some instances.

The proposed combination of a lower repayment threshold and a cap on interest rates means that the highest-earning graduates will not only accrue less interest on their debt each month, but repay over a shorter period too.

On the other hand, under the current system, middle- and lowest-earning grads are unlikely to fully repay their loans, and often won't repay the amount they borrowed excluding interest. Starting repayments sooner and being committed to them for longer will inevitably cost this demographic more, and they're far less likely to see any benefit from a cap on interest, beyond the psychological.

But perhaps most cycnical of all is the proposed change to how the Plan 2 repayment threshold is calculated. The subtle detail of increasing it in line with RPI, rather than average earnings, may seem irrelevant at first glance, but it could end up costing some lower- and middle-earners as much as £19,000 more in total.

Given our findings that, on average, Maintenance Loans fall short of living costs by £340 every month, and that 52% of students are already worried about repaying their loans, it's hard to see this as anything other than the government showing a complete disregard for young people.

We've always known that changes can, have and will be made to the Student Loan system, but these would be among the most regressive yet. We'd strongly encourage students and graduates to join us in campaigning against these proposals.

Petition against the Student Loan repayment system changes

Credit: fongbeerredhot – Shutterstock

At Save the Student, we're calling for the government to reverse the decisions to lower the repayment threshold and increase the repayment period for students starting in September 2023 or later.

Instead, we are urging them to keep the repayment period at 30 years and continue to increase the repayment threshold annually, in line with average earnings.

To join us in campaigning against the Student Loan changes, click the button below to sign our petition and share it with your friends.

Keep up with our campaign on Facebook, Twitter and Instagram.