Student’s letter about student loans goes viral, but it’s factually incorrect

Note: To be clear, we do not support the current student loan system. However, we feel it's important to address Simon's letter to spell out some facts so that other students and graduates don't become confused about how their student loan is handled.

At Save the Student, we're all about campaigning against the unfair student finance system. We've always advocated free education and are strongly against the privatisation of the student loan book – we even held the biggest petition against the increase in fees to £9,000 back in 2012.

This is why we were thrilled to come across Simon Crowther's open letter to his local MP about the state of his student loan interest and debt. Since we first spotted the post, it's gone viral and has even been picked up by a number of mainstream news outlets.

However, after reading through Simon's post in full it was clear that there were a few "facts" in his post that simply aren't true – which is testament to the fact that UK students are being let down by a lack of information regarding their loans and how they're repaid.

We're glad that this post has been shared by so many and that it's drawn attention to the ridiculous interests we currently have on student loans (amongst other things). However, we feel that it's important to ensure that students have the full (and correct) picture.

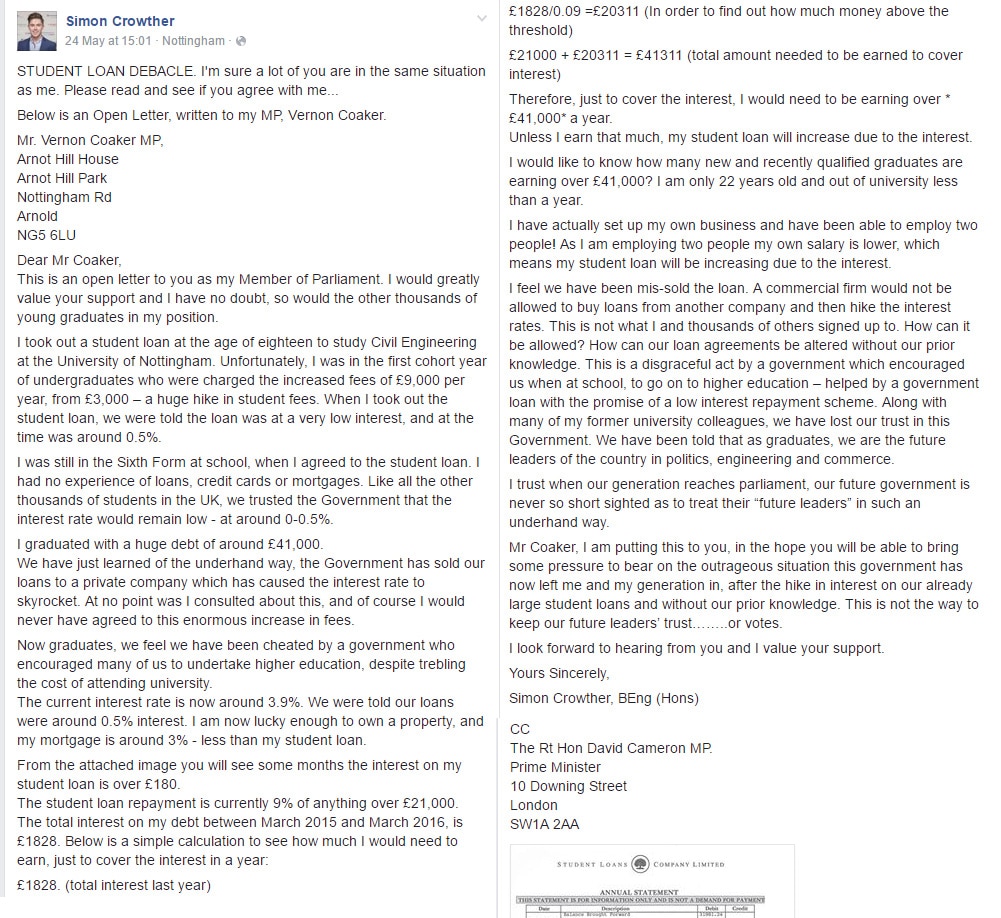

You can see the post below. We'll pick out some of the key points to clarify where Simon has been misinformed and tell you the hard facts.

The post on Facebook keeps getting hidden then re-shown. Here's a screenshot (click to enlarge):

There's some really crucial misinformation here that needs picking apart...

Here are the facts:

If you started uni on or after 2012 your interest is set at inflation + up to 3%, not 0.5%

Simon was part of the first cohort of students that started under the new £9000 fees.

He said:

When I took out the student loan, we were told the loan was at a very low interest, and at the time was around 0.5%.

Whoever informed Simon that the loan was 0.5% was wrong. Any student beginning their studies in 2012 or after would've started accumulating interest on their loan while studying at a rate of up to 3% + RPI (which was 3.6% at the time). The RPI has since dropped to 0.9% and will increase again next year. However, this can go up and down at any time due to inflation, and all students should have been made aware of this when they signed up to a loan. It's true that this part is often unclear to students, and should be emphasised to avoid confusion as it's not the easiest thing to grasp.

The interest on pre-2012 loans is charged differently than those post-2012

Simon's confusion may be that he was not made aware of the extra 3% of interest that is applied to the loans of those that started uni in 2012 and after. However, this fact will have been available since 2010-11, so Simon should technically be aware of this. It's very unlikely that the government would have said loans would have an interest of 0-0.5%.

If you started uni before 2012 and are also seeing your loan interest rates change, this is because it's charged at the rate of inflation (which changes each year) or the bank of England interest rate + 1% (depending on which is lower).

The pre 1998 student loans were privatised (not Simon's)

Simon then says:

We have just learned of the underhand way, the Government has sold our loans to a private company which has caused the interest rate to skyrocket.

There are two incorrect statements here that need clearing up. Firstly, the 2012 loans have not been sold to a private company. It was those that started before 1998 that had their student loans sold off. Even if students that had started in 2012 and after had their loans privatised, this would not be a reason for the interest rising. Once again, the interest goes up and down depending on inflation and your graduate salary – nothing else.

As an extra note, it's worth mentioning that that 1998-2011 were highlighted by George Osborne as needing to be privatised so although they aren't yet it may be likely in future.

The maximum interest is not applied to all grads

He then says:

The current interest rate is now around 3.9%

This is the current inflation (0.9%) + 3% which has always been the agreed rate (not that we think it's fair!). The full 3% is added to inflation during your studies and up to the April after graduating and then scaled between 0-3% depending on your earnings from £21,000 to £41,000+ when you graduate.

The only graduates with interest of 3.9% would be those earning £41,000+. Those earning £21,000 or below will only be charged interest of 0.9%.

It's worth noting that Simon's calculation is slightly flawed for the above reason, too. Although he is almost correct, if he was earning below £41,000, the full 3.9% interest would not be applied. He's simply misunderstood the fact that a maximum interest is applied while you're studying and then carries on (no matter what) when you graduate.

Check out our guide to repayments for more info on this.

The interest may not even be relevant

Statistics show that the majority of students may never pay off their whole loan before it's written off 30 years after they graduate. It's true that the interest is ridiculously too high for those earning above £41,000, but the important thing to remember is that no matter what the interest is you still pay only 9% of any earnings above £21,000.

Simon says:

The current interest rate is now around 3.9%. We were told our loans were around 0.5% interest. I am now lucky enough to own a property, and my mortgage is around 3% - less than my student loan.

Comparing the student loans to a mortgage is like comparing apples with oranges.

For a start, if you get made redundant and can't pay your mortgage, your house could be re-possessed. If you get made redundant, you'll be earning less than £21,000 a year, so your student loan repayments will simply stop until you are earning again. If you never earn more than £21,000 a year in your life, you'll never have to pay back a single penny of your student loan.

There has been another change to the terms, and this is a major issue

Simon failed to pick up on the real issue with the student loans. Many top economic experts (as well as the government) suggested that when the new student loan system was put in place it would be most unlikely that the terms would ever change. However, the government did make a change to the terms: they decided earlier this year to keep the minimum repayment threshold at £21,000, despite saying it would increase with inflation.

It's changes like this that we've been warning students about from the beginning, and these are the real issues that you need to watch out for. There is a need to campaign, but for the right reasons and armed with the facts.

One thing this does confirm is that there needs to be more education about student loans

Having said all of this, we'd just like to make it clear that Simon's misinformation as well as this post going viral just highlights the fact that there is a huge number of students that don't understand the loan system due to the government not explaining it correctly.

There certainly needs to be more clarity concerning loans and the terms involved so students know exactly what they're signing up to. Makes sense since they're likely to be paying it back for the rest of their lives, after all!

If you are confused about it all, take a few minutes to read our guide on student finance.

Please spread the truth!

If you want to get in touch about this or anything else related to student finance please email us.