Tesco are taking payments MONTHS after people have shopped

Shopped at Tesco in the last few months? You might want to check your bank account, as you could be unexpectedly paying for a purchase you made months ago.

Credit (background): Trevor Coultart - Flickr

Tesco shoppers are being urged to check their bank accounts after the supermarket chain admitted charging customers three months after they made payments.

The blunder occurred in 300 of its Express stores across the UK, leaving shoppers facing bills they didn’t plan for and, in some cases, going overdrawn.

Tesco’s card payments system has failed to process some transactions made on credit and debit cards since the end of November last year.

As such, some customers (including many students and some of the Save the Student office) have seen a delay in the money leaving their accounts, and some have even complained that they’ve been charged for multiple shops all at once.

The retail giant has apologised and says that it's contacted “as many affected customers as possible”, but we urge you to check your bank account if you have shopped at any Express stores at all over the last three months!

Are you at risk?

Tesco have refused to give precise information on exactly how many customers or which stores have been affected.

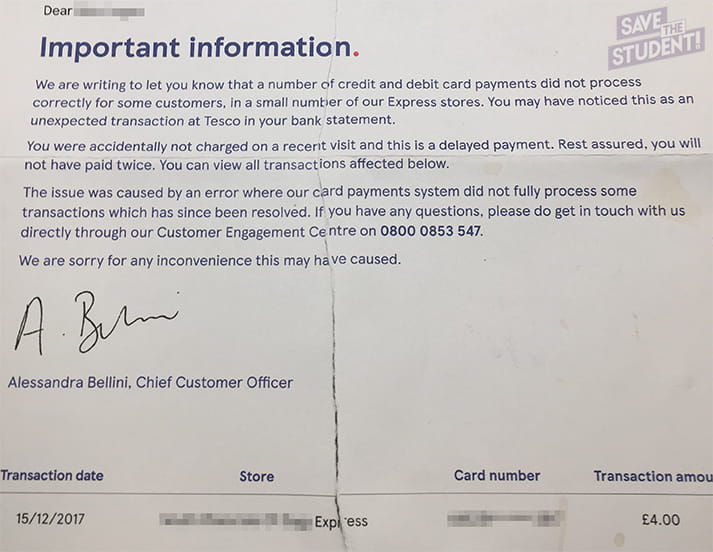

It just claims that “a small proportion” of its total customers have been hit. However, in a straw poll of the Save the Student office we found that half had been affected! Check out the letter one of us received:

Tesco didn’t even reveal whether all payments at the affected stores, or just some, were impacted. Given that we know the problem hit 300 stores, it's likely that thousands of customers have been affected.

Anyone who has shopped at an Express store at any location in the country should check their statements, but particularly if you use them regularly and spend lots of money with them. Don't just wait for a letter in the post!

Some shoppers, such as the Twitter user below, have been charged late for baskets that totalled well over £100. Whether you're on a student budget or not, that's a huge amount of money to lose out of the blue!

@Tesco on what planet is this okay? Your fault some 8wks ago. Prior notice would’ve been nice. Also, how did you get our address? £100 taken over the weekend pic.twitter.com/sTniclnEvx

— MikeD (@MikeyDizzl) February 12, 2018

What to do if you’ve been charged late

Tesco haven’t done anything illegal. Card schemes like Mastercard recommend that card payments are taken within seven days, but retailers are allowed to take longer. Ultimately, shops are entitled to take money if they have supplied goods.

However, Tesco says it will reimburse anyone who has incurred charges as a result of the delayed payments, “subject to evidence”. This includes overdraft and credit charges that you've received as a result of Tesco taking the payment late.

If you find something that doesn’t add up, you can contact the Tesco customer engagement centre on 0800 0853 547.

What are the dangers of being charged late?

Credit: Disney Pixar

One potential issue is credit scores. If the delayed payments have caused you financial problems, for instance going into an unarranged overdraft, a mark might have been put on your credit file, which could affect your ability to get credit.

Unarranged overdrafts are different to arranged overdrafts, which are organised as part of the bank account you have. Many student accounts have free arranged overdrafts, and going into them won’t cost you any money. However, as soon as you enter your unarranged overdraft, the costs rocket.

You can double check whether your credit rating has been affected with one of the three UK credit reference agencies; Experian, Equifax, and Callcredit. Marks can take between two and eight weeks to come up on your file, so you should keep checking back.

If you do have a mark, you might be able to get it removed by improving your credit score.

You can do this in a number of ways, like getting a credit card and using it wisely, paying your bills on time, and even getting on the electoral roll.

Credit ratings are a bit of a minefield, but essentially they're a grading system used by bankers and lenders to work out how much you should be loaned.

There is no such thing as a credit rating black list which prevents you taking loans, but having a poor credit rating (or none at all) could make it more difficult to be accepted for financial products such as mortgages and loans.

How did Tesco react?

Credit: Gordon Joly - Flickr

Tesco explained that most of the delayed payments were for less than £10, but that they occurred on both contactless and non-contactless cards.

- Best student credit cards 2018

- Who says you can't get something for nothing? Find out what freebies are on offer right now

A spokesperson for the supermarket chain said:

As soon as we identified this issue, we contacted as many affected customers as possible and have now processed all incomplete transactions.

The issue has now been resolved and we are sorry for any inconvenience this may have caused.

So if you have used a Tesco Express store in the last few months, we urge you again to check your account and claim money back from Tesco if it has cost you.

If you've have been charged late, how has it affected you? Let us know!