How to save money – 68 money saving tips

Discover how easy it is to cut the cost of everything, from rent to commuting, with our ultimate list of tips and tricks on how to save money. A penny saved is a penny made!

Credit: Linda Bestwick (background), WAYHOME studio (left), ussr (right) – Shutterstock

From 2-for-1 cinema tickets to Amazon's secret sales website, our list of practical money-saving tips below could save you £1,000s every year.

Best money-saving tips

These are the top ways to save money:

-

Follow a clear savings plan

Take some time to create your weekly budget. Break it down by how much you can afford in each area of your spending such as rent, bills, food and transport.

It helps to get a second account, such as an app-based one like Starling, and send a weekly 'allowance' to it. If you only use the second account for spending, simply checking the account balance will show how much of your budget is left.

We've created a free budget planner to help you get started.

-

Try the 1p Saving Challenge

If you're looking for a short-term savings goal, try the 1p Savings Challenge.

The premise is simple: on day one, you save 1p. On day two, you save 2p. On day three, 3p (and so on). After 365 days (or 366 in a leap year) have passed, you'll have saved over £650!

Although the challenge is intended as a way to start saving in the new year, you can start whenever you wish. You just have to keep up in 1p increments, and you'll save the same amount of money in the same period.

You can also alter the challenge to suit your budget. Maybe you start the challenge on 1st January but don't want the biggest daily savings to coincide with Christmas? You could start by saving £3.65 on the first day and go down by 1p each day.

We've created a tool to help you monitor your daily savings.

-

Identify and reduce your biggest costs

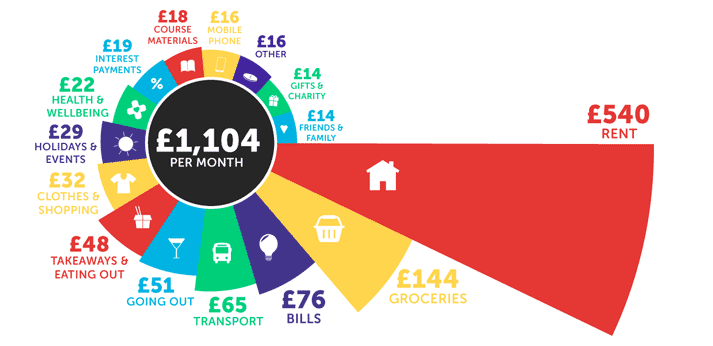

Based on the results from our latest National Student Money Survey, here's a breakdown of how much students generally spend each month:

How does this compare to your spending? If, say, you're spending a lot on bills, look into ways to cut down the cost.

You could start by comparing broadband deals to see if you can get fast WiFi for less with a new provider.

And make sure you compare the cheapest energy providers. Any money you can save on your monthly bills quickly adds up.

It's worth trying to haggle down the cost. Tell your provider you're taking your business elsewhere unless they beat the cheapest alternative.

This tip also works well with mobile phone companies. If you try to cancel your contract, you can expect to be directed to their loyalty team who have the power to offer substantial discounts to retain customers. This even works for SIM only deals.

-

Calculate the lifetime cost of your Student Loan

A question we often hear is: can you save money by paying off your Student Loan early?

Ultimately, whether you can save money long-term by making early repayments is complex and depends on a range of factors. These include how much you earn, the size of your debt and your Student Loan's repayment plan.

One key thing to know is that the debt will be written off after a certain period (again, this depends on your repayment plan).

High earners on track to repay their loan in full before the debt is cancelled might decide it's worth making early repayments to pay it off faster. This could save money overall by avoiding the added interest you'd be charged over the longer repayment term.

However, if you're not on track to repay it all, early repayments might lead you to pay more than you would have otherwise had you just paid the standard amount each month until the remaining debt was written off.

For a rough idea of how long it's likely to take for you to repay the debt in full, try our Student Loan calculator (link below).

It's best to speak to a financial advisor before making any decisions related to this.

-

Discover the best places for deals

Love a good discount? Us too. So much so that we've dedicated an entire section of our site to sharing the best deals. We may be a tiny bit biased, but we'd suggest looking there before buying anything online in case you can grab a bargain.

For our top picks, sign up for our email newsletter, join our WhatsApp group and follow us on Instagram.

It's also worth seeing if you can save money by shopping at any of these places:

-

Buy past 'best before' dates

Unlike 'use by' dates, 'best before' dates are solely recommendations about food quality, not safety.

The Approved Food website can help you cash in on this. They sell groceries close to (or past) their best-before dates that are still safe to consume. It's one of the best ways to save money. We slashed £55 off one shop, so there are plenty of savings to be had.

-

Food shop in the evenings

After about 6pm, a lot of supermarkets start heavily reducing prices on items they need to shift by the end of the day.

You should still make a list. But, if you're flexible on brands and flavours, you could bag fresh produce that's still perfectly fine to eat, just a lot cheaper. However, don't shop on an empty stomach. Otherwise, you'll end up buying food on impulse.

For more supermarket money-saving tips, see our guide to supermarket food shopping.

-

Have at least one 'no-spend' day each week

Having a no-spend day is a simple but effective way of saving money.

You probably spend money on at least one thing every day. It could be as small as a bus fare or a snack while you're out.

Try to have at least one no-spend day each week. You can pay for travel if necessary, but if possible, you could otherwise walk and get paid for it.

It'll take some planning, like buying enough food in a weekly shop. But the psychological impact of learning not to spend money should make you more mindful in the long term.

-

Save up for a house with a Lifetime ISA

For a lot of students, buying a house might feel like a distant dream. But it's never too early to begin saving.

A good place to start is by getting a Lifetime ISA (LISA). It's an account designed to help with long-term saving goals like becoming a homeowner and growing a retirement pot.

You can usually open a Cash Lifetime ISA with a minimum £1 deposit and save up to £4,000 per financial year (April – April) in the account. You'll get a 25% annual bonus from the government on the money you save, meaning you can receive up to £1,000 per year.

However, you can only use the money for these reasons:

- To buy your first home

- You're aged 60+

- Or you're terminally ill with less than 12 months to live.

If you withdraw the money for any other reason, you'll be charged a 25% penalty. This works out as losing the government bonus plus 6.25%.

There are further restrictions to be aware of. For example, to use the money for your first home, the property's value can't exceed £450,000. Find out more in our full guide to LISAs.

-

Get a Big Mac and fries for £2.99

Credit: 8th.creator – Shutterstock

Bit of a dangerous one, as when the food is this cheap, it's even harder to resist. But if you can exercise some self-control, this money-saving trick should save you some money whenever you decide to treat yourself.

All you have to do is get a McDonald's receipt, fill out a quick survey on their site, and the Big Mac and fries discount is yours. When using your McDonald's £2.99 deal, you can then use the receipt from that to keep the process going.

This is just one of the many ways you can save money at McDonald's.

-

Find cheap flights

Assuming the first getaway deals you find are the cheapest is a rookie mistake. These prices can change in minutes!

If you have a destination in mind, you can set up price alerts with momondo. Or you can use Skyscanner's 'Everywhere' tool to find bargain seats on flights to anywhere.

Travel expert, Nele van Hout, has first-hand experience of this:

As long as you know what dates you're available for a trip, you can find some awesome deals with the Skyscanner's 'Everywhere' tool – plus, you may be able to visit places you hadn't considered before.

As long as you know what dates you're available for a trip, you can find some awesome deals with the Skyscanner's 'Everywhere' tool – plus, you may be able to visit places you hadn't considered before.In the past, I've managed to get £20 return flights from Manchester to Milan. I had an amazing time!

Complete holiday packages can sometimes (although not always) work out as cheaper overall. Compare prices on sites like lastminute.com.

But don't dust off your bikini until you've read our full tips on getting cheap flights.

-

Get £200 worth of freebies

Cloud storage, condoms, food and drinks are just some of the many freebies we know of. If you work your way through our list of free stuff you could save yourself over £200.

You can also get loads of free stuff on your birthday, such as food, drinks and vouchers. Don't miss out!

-

Get cash back on almost anything

Every time you shop online, get some of your money back by learning how to use cashback sites.

TopCashback, Quidco and Swagbucks are worth joining. Between them, they cover almost every online retailer in the UK. You'll be amazed at how much you get back.

But it's not just online shopping that offers cashback. Free food (and occasionally some cleaning products and pet food, too) can be nabbed through supermarket cashback apps.

-

Use the 'skimming' trick

When you experience the thrill of money hitting your account – be it your Maintenance Loan, some birthday cash, wages or anything else – skim 10% off the top and whack it in a savings account.

If you can manage £20 a month, you'll be £240 better off at the end of the year. And if you stick it in a top-paying savings account, it could be even more.

If you're not confident you'll be disciplined enough to stash money away, set up a standing order to automatically move the cash over when it lands in your current account.

-

Shop baby and world food aisles to save up to 80%

Supermarket international food aisles hide big savings on kitchen cupboard staples including rice, lentils, beans, spices and sauces. Foreign brands can be up to 80% cheaper. Plus, they're often more authentic than domestic equivalents in the UK.

The same applies to the baby aisle for items like moisturising lotion.

The quantities can be different, so check the price tag for the price per unit of measurement. This is the real indicator of whether something is cheaper or not. Checking it is one of the best ways to save money at the supermarket.

-

Get cheap phone insurance

Credit: Jan Faukner – Shutterstock

Whether you're a serious butter-fingers or you're worried about someone stealing your phone, getting insured could save you a packet in the long run.

Insurance obviously costs money. But, compared to the cost of a new phone or getting your existing one repaired, it's usually a lot cheaper. If you're notoriously clumsy, have a pricey device or you're locked into a lengthy contract, getting insured is often worthwhile.

And don't just go with the policy that's bundled with your gadget! You can get very cheap mobile phone insurance.

-

Get cheaper bus tickets

If you catch the bus every day, a bus pass usually works out as cheaper than buying a ticket each time.

What's more, if you're entitled to disability support, you may be able to get free travel or funds to help you pay for a pass. Check if there are free metro bus services in your area, too.

Feeling lazy? These money-saving resources will do the hard work for you. -

Call premium rate numbers for free

If there's one thing worse than most companies' choice of hold music, it's the rip-off rates you pay for calling their pricey 084 and 087 numbers. Even on an inclusive call plan, they can cost up to 13p a minute.

If you can't avoid 084 and 087 numbers, see if you can find a cheaper alternative at saynoto0870.

-

Get 2-for-1 cinema tickets for less than £2

How we miss Orange Wednesdays. If you were on the network (which is now EE), you'd always get half-price cinema tickets. And even if you weren't on Orange, you'd almost certainly have memorised a list of all your friends and family who could give you their code.

The good news is that the 2-for-1 baton has been passed to Compare the Market's Meerkat Movies scheme. All you have to do is make an eligible purchase with them. The best part? It includes travel insurance, which you can usually get for just a few pounds.

We know of plenty more ways to get cheap (or even free) tickets. Find out more in our guide to the best cinema hacks.

We also know some great ways to get free or cheap theatre tickets. -

Get a three-year Railcard when you're 23

Train tickets in the UK are notoriously expensive. But if you buy or renew a three-year 16–25 Railcard the day before your 24th birthday, you can enjoy a third off rail fares until the day before you turn 27.

You might be wondering why it's worth doing this when there's now a 26–30 Railcard too. That's because a three-year 16–25 Railcard costs £70 – £20 less than three one-year Railcards at £30 a pop, be they 16–25 or 26–30.

You can't buy a three-year 26–30 Railcard, so you may as well get the three-year 16–25 Railcard at a sizeable discount while you still can.

You'll struggle to find a better way to get cheap train tickets than this.

-

Don't pay for a TV Licence

If you've got top-speed unlimited broadband and use streaming services like Netflix and Amazon Prime, you could save a bundle by ditching your TV Licence.

In fact, you may not even need a TV Licence to watch live TV or iPlayer, either.

Despite TV Licensing shouting from the rooftops that you do need a licence, we found a loophole for students that means you can still get away without paying. And yes, TV Licensing even confirmed to us that the loophole is legit.

If you do have to pay for a TV Licence, remember that you can get a refund to cover the summer months you're not at uni.

-

Get a cheap gym membership

Opt for any of the big fancy fitness chains and you could be paying anything up to £80 a month – if not more. While that may incentivise you to actually go, there are lots of ways to lose a few pounds for fewer pounds.

Your university is likely to offer most of the same facilities for a fraction of the cost, with no lengthy contract. Or, you could check out Hussle for hundreds of pay-as-you-go or no-frills gyms all over the country.

Not enough for you? Get more info on how to get a cheap gym membership or check out the top ways to get fit for free.

-

Get 100s of free photo prints

Hanging photo prints is one of the classic ways to decorate a uni bedroom. Fortunately, there's a way to do it for free.

Check out our guide to free photo printing offers and you'll find companies that will print dozens, if not hundreds of photos for you for free. All you need to pay for is postage.

-

Always compare and track prices

Take the leg work out of penny-pinching by comparing the cost of items using sites like Idealo and camelcamelcamel. These sites track prices over time and give you a good indication of whether the price tag is a good one, or if the price is likely to go down.

While camelcamelcamel only tracks prices on Amazon, Idealo has data for hundreds (if not thousands) of online retailers. This means that as well as tracking the cost over time, you can also use Idealo to find where it's available at the lowest price.

-

Watch gigs and events for free

Events newsletters can be worth signing up for if they get you early-bird discounts on your favourite gigs.

Keep an eye on giveaways for TV and radio shows. The BBC regularly hosts big-name musicians, while ITV and other channels offer free tickets, including for jackpot-heavy game shows.

And we have loads of tips on getting cheap concert tickets in our dedicated guide.

-

Use discounted gift cards at big chains

Ever been given a gift card for a shop that you never go to? You're not the only one. People are so keen to get rid of these vouchers that they're willing to sell them for less than their worth.

eBay is one of the main marketplaces for buying and selling gift cards. They have vouchers for some shops with discounts as big as 20%.

Retailers like Tesco have also been known to have sales on gift cards (like 20% off). We'll almost certainly let you know if they've got one going, so check out our deals section for the latest offers.

It's also worth checking CDKeys as they often sell gift vouchers at reduced prices.

We list more examples in our guide to buying discounted gift cards.

Obviously, this won't save you money if you just end up impulse buying. But if there's a shop you use all the time, or you're planning to make a big purchase (like electronics), this is a great way to cut costs.

-

Stop smoking

If you're a smoker, you could be burning a grand a year or more to fuel your habit.

One of the best ways to quit smoking is to use a quitting kit (patches, gum, sprays and medication). These are available for much less on the NHS.

Lots of ex-smokers swear by Allen Carr's book. Have a look in the library to read it for free.

-

Don't pay for software

No need to panic, we're not talking about illegal downloads here. These are tips on how to save money legally.

From writing to image editing, there's always a free alternative out there. Some of them are even good enough to pass for pro products that would otherwise cost £70 and up.

Libre Office does everything Microsoft Office can, GIMP (not what you're thinking) gives Photoshop a run for its money, while Google Drive and Dropbox offer free cloud storage.

Want more? We've got a full guide to the best free software.

-

Find the top offers on eBay

When shopping on eBay, check the official outlets. They stock all the same gear that you'll find in the high street stores, but up to a third cheaper.

Why? Because these are end-of-line, returned or ex-display items. Retailers (which include Adidas, Calvin Klein and Superdry) guarantee your quality and rights just as with full-price products. If there's something you're buying, see if you can get it cheaper from an outlet store.

And eBay's not the only place you can find these bargains! Check out our list of the best outlet stores in the UK for more incredible deals.

It's also worth checking for including typos in your searches. There are plenty of perfectly good products on the site labelled as, for example, 'sansung'. This means they won't appear in searches for 'Samsung'.

As a result, these auctions get far fewer views and therefore fewer bidders than they would with the correct spelling. Fewer bidders usually equals fewer bids, which in turn should mean lower prices.

Check out our eBay buying hacks for more tips.

-

Abandon your online shopping basket

Credit: Butus – Shutterstock

This is by no means the case for all websites or even most of them, but it's certainly been known to happen.

If you put items in your basket, then quit the website and take it no further, companies will sometimes offer you a discount via email in the hours or days afterwards. For them, it's better that you spend a little less than nothing at all.

This is also a great trick for dealing with impulse purchases. Use the extra time you've gained from abandoning your basket to decide how much you need or want the item. If you still think it's a good idea, the discount is just a cherry on top.

Our Digital Marketing Manager, Lauren Nash, is a deals expert – and even she has been surprised at the offers you can get:

I tend to know which sites offer a further discount after abandoning my online basket, but was pleasantly surprised the other day when I was offered a code from an unsuspecting website.

I tend to know which sites offer a further discount after abandoning my online basket, but was pleasantly surprised the other day when I was offered a code from an unsuspecting website.I took a few hours to decide on my Etsy purchase and was offered 10% off, not just for one, but for both sellers' items I had in my basket. It really does pay to wait!

-

Claim loyalty points when you shop

Get yourself a reward card and hoard points to claim money off, free treats and other discounts. At the very least, get one for your favourite supermarket.

A few of the most rewarding cards are Tesco Clubcard, Nectar Card (Sainsbury's) and Boots Advantage card. Consider sharing an account with mates to reach pay-out thresholds faster.

-

Furnish your home for free

It's usually worth sticking to furnished rental properties to avoid buying (and carting around) bulky furniture and appliances. But if it's unavoidable, or you want to make an addition, freecycling is your go-to.

You'll find almost anything up for grabs on Gumtree Freebies, Freecycle.org and Preloved. Then there's always eBay for paid bargains.

-

Freeze your groceries

The average UK household bins around £700 worth of uneaten food a year! Planning meals can help you cut back on that, as can freezing food to extend its life beyond the use-by date.

There is a lot of food you can freeze, including bread, milk, pasta and wine (all your essentials, in other words). When you freeze leftovers, you get a cheaper and healthier alternative to takeaways and shop-bought snacks.

Make sure you know which foods should go in the fridge and which go in the cupboard. This will keep your food fresh for longer, which in turn will save you money.

-

Save £600 on lunches

Credit: Oksana Shufrych – Shutterstock

Do you buy lunch while you're out and about three days a week? At around £4 a pop, your munching could set you back over £600 over the academic year.

It doesn't take much to get organised and save money. Cook extra at mealtimes and bring in leftovers to uni, or make sandwiches the night before.

You could also get a flask to have soups, stews and hot drinks on tap for less.

Our weekly meal plan could save you £100s over the year too. -

Downshift to own-label brands

Many own-label products are the same as branded ones but without the hefty price tag. It can be true for everything from aspirin to coffee at the supermarket. Downshifting even works for substituting overpriced designer clothes for high-street brands.

The same applies to medicines such as hayfever tablets. Nurofen packets might look nicer than Tesco's own alternatives, but they both do the same job. As long as the active ingredient (and the amount of it) is the same, the effect of the drug will be the same.

If you have any allergies, check the inactive ingredients too, just in case.

And see what else you could save with our intro to the supermarket downshift.

-

Sign up for free trials

Whenever possible, try before you buy. Many companies offer free trials to let you try their product or service before parting with your hard-earned cash.

If you play it right, you could take advantage of the best free trials to stream films, music and more for months without paying a single penny. Just cancel and move to a new service once the trial period is up!

-

Round-up your spend

If your bank runs a 'Save the Change' scheme, it's a zero-effort way to save money. Each time you pay with a debit card, your spend is rounded up to the nearest pound and the leftover is nudged into your savings account.

Lloyds, TSB and Bank of Scotland are just a few of the banks in the UK that do it, but others do too. Check if your bank has a similar scheme.

Some app-based banks also have tools that round up your spending to help you save money. These include Monzo, Starling and more.

Check out our guide to saving money at the supermarket for more great tips. -

Click & Collect for free delivery

Lots of online retailers in the UK offer a Click & Collect service. With it, you can avoid the standard P&P and get purchases of any size delivered to a local store for free.

For example, Next, River Island and Very all offer free pick-up options (although there might be a minimum spend).

Of course, some sites like Amazon (Prime) offer free delivery anyway, so always compare.

-

Get paid for your commute

If it's a journey you'd be making anyway, recoup the cost of your fare by playing postie while you're at it.

Sign up to Amazon Flex and check the app to see available delivery blocks in your area. Select a time that suits you and get paid to deliver items ordered through Amazon.

You could even make money if you can walk or cycle the route – especially if you use these apps that pay you to exercise and follow our tips to save money on cycling.

-

Put a brick in your toilet

No, we don't mean it like that. We mean an actual brick.

Toilets use a crazy amount of water per flush. It's arguably more than is needed (presumably as a precaution, just in case there's a really tricky customer that needs dealing with).

But, if you open the cistern (the box at the back of the loo) and pop a brick in, it'll stop using so much water. This could save you money on your water bill.

-

Trade-up to new gadgets

When it comes to gadgets, always have a one-in, one-out policy. Either ask for money off when you're trading in or sell your unwanted item before buying a new one.

You can recycle old phones for cash, sell your old TV on eBay and find a new home for just about everything else.

-

Get free water at the airport

As you're not allowed to take many liquids through airport security, you may find yourself buying several bottles of water in duty-free. But the truth is, you don't need to.

The ban only applies to liquids, not bottles. If you take an empty bottle through airport security (they've confirmed this is fine), you can fill it up for free using the water fountains you'll find in most airports. This is one of the best money-saving holiday tips.

-

Use the library to read for free

Always got your head in a book? Or just need to do some reading for your course? Rather than splash out on your own copies, hit up your university library (or even your local library) and rent books for free.

In fact, free access to books and journals is one of the best free things you can get from your university.

Just ensure you return the books on time to avoid a library fine.

If you can't get hold of books through the library, look on Google Scholar and Google Books.

-

Complain to get train refunds

The national 'Delay Repay' scheme applies to most train operators. Any time you're delayed on a prebooked train ticket by at least 30 minutes (15 minutes on some operators), you can check if you're eligible for a (partial) refund.

You usually have 28 days to request one, with each operator deciding how much they'll refund you and for which part of your journey.

Read our guide to claiming refunds on train tickets for how to put in a claim. Or, if your gripe is with something other than punctuality (like poor conditions in the carriage, for example), learn how to complain properly and see if you can get some money back.

-

Get your drinks 'on the house'

There are tons of gigs out there for mystery shopping, some better paid than others. But for this one, we're talking specifically about getting paid to go to the pub.

Serve Legal pays you for your time, travel and anything you're asked to buy.

In this role, if you're aged 18–19, you'll likely need to check if venues ask for your ID (for example, when buying alcohol).

There's no guarantee how much work you'll get, but you could potentially earn £4 – £40 per audit.

-

Collect vouchers and rewards

Credit: Chermen Otaraev – Shutterstock

Complete online surveys in exchange for vouchers for major retailers, or even get free products to test. We've reviewed the best paid survey sites, and have dedicated guides to earning on Toluna, on Branded Surveys and on Swagbucks.

If you're on top of your money (and have some means to repay), you can use credit cards to not only manage your cash flow and build your credit score, but also get cashback or rewards.

Opt for a credit card that offers rewards and do all your spending on it to max out the savings. Spend £200 a month on a card that pays 1% cash back, for instance, and you'd get £24 back over a year.

Make sure you set cash aside to repay your balance within the 0% interest period.

-

Barter for freebies

Bartering is a bit like haggling but with less cash involved. If there's something you have, can do or are qualified in, you could swap your time, stuff or services for things you need.

It works best with small traders or personal swaps. For example, it could include things like free gym entry in exchange for promoting them on social media or creating artwork for a local restaurant in return for a meal out.

It can take a bit of nerve to ask in the first place, but there's no limit to how creative you get after that.

These swapping sites are the perfect places to hone your bartering skills. -

Order your cab through an app

Uber, FREE NOW and Bolt are all worth considering if you need a taxi.

Compared to traditional black cabs, you can sometimes save around 50% on taxi rides in most UK cities and abroad. Better still, these companies often have discount codes for new customers. Click the names above to see if they have any offers available right now.

-

Trim the cost of haircuts

If you can't live without a big-name salon, find one with a local training school or ask whether your usual salon needs hair models. You may not get to choose exactly what you want, but you can shave pounds off a typical £20+ cut (or get one for free).

There are lots more tricks and tips, so check out our ways to save money on haircuts.

-

Don't pay to withdraw your cash

It's tempting to simply accept the cost of using ATMs that charge, but you could be paying as much as £5 to receive your own cash. That's a 50% charge if you're taking out a tenner!

Unless it's a real emergency, you could easily save money by walking to the nearest free machine instead (Google Maps is your friend here), paying by card or borrowing from a mate.

-

Get free coffees

We all have our guilty pleasures. For many of us, it's spending a few quid on a takeaway coffee on an all-too-regular basis.

Fortunately for you, we've put together a list of the best free coffee deals at all your favourite coffee shops. These include Costa, Starbucks, Pret, Caffè Nero and more.

-

Or get a discounted drink from a coffee shop

Being told to buy a drink from a coffee shop is probably the last thing you expected to read when we said we'd teach you how to save money. But this is specifically aimed at those of you who are set on buying hot drinks and have raced through all the free coffee offers.

Starbucks, Costa, Pret and Caffè Nero all have their own spins on this one, but essentially they reward you for using a reusable cup when you buy a drink from them. To say "thanks for saving the planet" they could give you some bonus loyalty points, or even a discount on the drink.

Alternatively, you could brew gourmet coffee at home with an Aeropress.

-

Grow your own food

If you've got the patience to grow fruit and veg, this is a great way to reduce the cost of your weekly food shop.

You don't need lots of space or equipment to grow herbs and small veg – a bag of compost and some seeds will do. You don't even need to shell out for pots. Lots of plants can thrive in old wellies, buckets, hanging baskets and window boxes.

-

Become a vegetarian for two days each week

Just like cheese, you often don't realise how expensive meat is until you go to uni.

Eating vegetarian food for a couple of days a week will save you money while giving you the chance to eat more veg. On top of that, it's a great way to cut your carbon footprint.

If you can't cope without something meaty in your meals, there are plenty of delicious meat substitutes out there. We're big fans of products like Quorn. They can be cheaper than meat and contain less fat.

-

Go foraging to eat on the cheap

Credit: Mirage_studio – Shutterstock

If the closest you've come to foraging is trying to remember where you put the Jammie Dodgers, there's a whole world of free food out there for you to discover.

We're talking wild garlic, fish, cockles, berries and mushrooms for starters. To stay safe, get a wild food book or course under your belt.

If it all sounds a bit 'survivalist' for you, try the urban alternatives: supermarket launch events, Olio and closing time in your local chippy can come up trumps for free food.

-

Cut driving costs

If you have a car, you'll know it is not cheap. However, there are some things you can do to save money.

For starters, keep your tyres inflated to minimise petrol usage.

And when you need to cool down your car, avoid using the AC too much by opening your windows instead at low speeds. However, AC will be better at high speeds as open windows could increase drag and make the engine work harder.

Another good tip is to avoid driving with a tank that's either full or empty.

A full tank of petrol will add weight to your car. That means your engine will have to work harder (and guzzle more gas) to keep you moving.

But you also shouldn't try to empty your tank. Your engine could get damaged if you regularly drive with a small amount of petrol in the tank. Try to keep the fuel gauge at 50% – 75% to ensure a happy medium.

Find more ideas in our guide to saving money on driving.

-

Use price matching

It's only worth price matching if the retailer offering it can give you something extra. Maybe it's cheaper delivery, loyalty points, or even an extended warranty you won't get elsewhere.

Remember that a fair number of price-matching retailers let you use the service even after buying the product. In other words, if you buy something from them and then see it available for less elsewhere (or even on their own site), you can ask them to pay you the difference.

That said, there are often a few caveats with price matching. Not all retailers in the UK offer it, and among those that do, the rules differ.

Some are very strict about the shops whose prices they'll match, while others will only give you a short period after your purchase to find a lower price. Always check the T&Cs!

-

Cut your energy usage

Energy bills can be expensive – particularly in winter. However, there are some things you can do to use a bit less energy.

Make sure you use energy-saving bulbs and turn off lights when you leave the room.

Before turning on the heating, put on extra clothes.

Also, don't leave your gadgets plugged in when you're not using them. Turn them off at the socket.

Electric blankets are a great way to stay warm while saving on energy bills, as they're much cheaper to run compared to putting on the radiators.

You'll find loads more ideas in our guide to saving money on energy bills.

-

Watch football on TV for free

Being a devoted football fan in the UK can be expensive, even if you're not paying to attend matches in person. If you want to (legally) watch most competitions, you'll usually need to subscribe to at least one sports package with your TV provider, if not more.

However, as we explain in our guide to watching football on TV for free, there are some hacks to watch Sky Sports and Amazon Prime Video for less. In some cases, it's completely free.

We also have a guide on the top ways to get cheap Sky Sports.

-

Make your own cheap alternatives to cleaning products

If you're old enough to remember How Clean Is Your House?, you'll know that Kim (more recently of Celebrity Big Brother fame) and Aggie were always showing you how to make your own cleaning products with things you've got lying around the house.

It turns out they weren't spinning us a yarn of lies. By making your own cleaning products, you could get chores done using vinegar, lemons and even Coca-Cola.

-

Get extra discounts

Get yourself a discount card to hoover up any student savings going. It's free to sign up for TOTUM Student, which gives you access to their online student discount.

At the time of writing, some top student offers include 23% off birthday gifts at Buyagift and savings of up to £300 on First Choice holidays (T&Cs apply).

Like to eat out? Paid TOTUM memberships include a tastecard. With it, you can knock 50% off at loads of restaurants in the UK. It's also worth noting that some banks offer a free tastecard for opening a student account with them.

Even if you don't want to sign up for TOTUM, you can still use your student ID instead at a range of places, such as clubs and cinemas. Check out our full student discount directory.

-

Earn money from your Student Loan

Ever have extra cash you don't need straight away? You could consider putting it in a high-interest cash ISA or a savings account.

If you have other funds to live on (income from a job or a student start-up), you'll earn more tax-free interest by leaving your savings alone to accumulate.

Keep track of your living costs and factor the amount you're saving into your monthly budget to ensure it's manageable.

-

Save on postage costs with Amazon Prime

Amazon's Student Prime trial gives you six months of free one-day delivery with no minimum spend. After that, you'll still get a big discount on the usual yearly membership fee.

You also get access to the full Prime Instant Video catalogue along with other exclusive Prime offers.

Of course, after the free trial ends, a Student Prime membership will only save you money if you actually order from Amazon regularly enough to benefit from free delivery, or if you're always paying to watch films and TV. Otherwise, you might be better off cancelling when the trial expires.

-

Get your tax back

Most students won't earn more than the personal allowance each year, so shouldn't be taxed on any of it. For example, if your employer has put you on an emergency tax code, you could be entitled to a tax refund.

If you run a student business, you can also claim for allowable expenses. This means that there are fewer profits to pay tax on.

-

Consider alternative student accommodation

Don't assume uni accommodation is always your cheapest option. If you're prepared to get creative, you could save a ton. For example, one student previously lived on a yacht for a quid a day.

If that's not for you, you could save around £540 a month by living at home if that's an option. Or, use Rightmove to filter areas and private accommodation options that fit your budget.

Whatever you do, use our tips to save money on rent.

-

Get student funding

Do some research to see if you're eligible for any bursaries, scholarships and grants. Explore as many angles as you can (location, dependants, gender, subjects studied, etc.).

Your uni will likely have some schemes, but there are also private scholarships, sponsorships, grants and emergency funds. We have a guide with some of the best student bursary and scholarship sources.

Disabled Students' Allowance (DSA) is worth looking into if you have a disability, learning difficulty or health problem. This funding can help to cover the costs of any equipment or services you need due to your disabilities at uni.

Even if you don't meet the more common criteria for extra funding, there might still be some grants you could apply for. As our guide to weird bursaries, scholarships and grants can testify, there's cash out there for pretty much everything – it's just a case of finding out what!

-

Free extra tuition

This isn't a replacement for the degree you're already paying for, but with access to course content, book discussions, leading academics and further reading, free courses from the world's top universities are worth a try.

The edX website lists hundreds of courses from the likes of Harvard, Princeton and MIT. There are also loads to choose from at The Open University.

Also, have a look at this list of free online courses with qualifications. From HTML to social media strategy, you can learn it all.

-

Go abroad for postgraduate study

Finland, Germany and Iceland are just a few of the countries offering free or low-cost study, even for international students. This could save you thousands each year.

On the downside, living costs can be pricey, and you may need to know the local language to get a place (or a job). Start saving, look for student bursaries and learn the lingo.

Next read: the best money-saving tools.