Parents’ guide to university 2025

From applications to funding, accommodation to career goals, we're donning our parent cap to unpack the world of university and Student Finance.

So your son or daughter's off to university? Congratulations! It's a brilliant achievement and an exciting step but, like any big life event, university often whips up plenty of uncertainty for all involved.

Since 2007, Save the Student has been the resource millions of students trust when it comes to managing their finances. We work hard to highlight the realities of managing money as a student in the UK.

Did you know that the average Maintenance Loan comes to around £510/month while, in our latest National Student Money Survey, students had average living costs of £1,078/month? And were you aware that in many cases it's parents who are 'expected' to help bridge the gap?

We'll reveal exactly how much that might be for you in this guide, as we pull back the curtain on university life and Student Finance...

Tips for parents of university students

- Is university worth it?

- Key organisations

- Applying to university

- Dates for your diary

- How Student Finance works

- How much money should parents give their children at university?

- Repaying Student Loans

- Should students pay off their Student Loans early?

- Accommodation at university

- Preparing for employment

Is university worth it?

Without sounding too much like conspiracy theorists, the mainstream media often obsess over headlines about students graduating with debts in excess of £50,000.

But, as you'll soon see, Student Loans have very little in common with normal commercial debt. The repayment terms are designed to be manageable, based on how much they earn.

Plus, the loans get cancelled after a certain period of time, even if a graduate hasn't repaid the loan in full. The number of years before the debt is cancelled varies depending on the graduate's repayment plan.

It's important to note that there have been changes for students from England who started university in or after August 2023 which has impacted their loan repayments. They have a Plan 5 loan, which involves a lower repayment threshold and a longer repayment period.

According to the government, 65% of undergraduate students from England who started in 2023/24 are expected to repay their loans in full under the new system, compared to 27% of those who started in 2022/23.

However, while we don't agree with the sky-high fees or some of the changes the government has made, uni is still more affordable than many believe. In most cases, the wider benefits outweigh the costs (personally and professionally).

Research by the IFS has shown that over their working life, men are around £130,000 better off by going to university. For women, this is around £100,000.

And, according to a 2019 government report, the proportion of jobs requiring a degree could be as high as 38%.

This suggests that, despite the costs involved, having a degree will likely lead to better employment prospects and more money in the long run. See our guide to the average graduate salaries for more info.

Having said that, getting a degree still involves some large sums of money. With tuition fees as high as £9,250 a year, many people rightly question whether university is worth the cost.

Of course, the path isn't for everyone, and there are alternatives to attending university like apprenticeships and school leavers programmes.

Important university and higher education organisations

UCAS

UCAS (the Universities and Colleges Admissions Service) is the service that students use to apply to university.

Students don't apply to individual universities. They submit one application through UCAS, which then distributes it to the student's university choices.

This keeps the application process straightforward and centralised, with everything from the personal statement to university offers stored on the student's UCAS portal.

Student Finance

Student Finance is the organisation responsible for providing Tuition Fee Loans and Maintenance Loans to students at university.

There are four separate Student Finance organisations across the UK:

- Student Finance England

- Student Finance Northern Ireland

- Student Awards Agency Scotland (SAAS)

- Student Finance Wales.

Students apply for their funding through the relevant Student Finance organisation in their country of residence, not the country where they'll be studying. For example, a student from England planning to study at the University of Edinburgh would still apply through Student Finance England.

Student Loans Company

The Student Loans Company (SLC) is a government organisation that organises the repayment of Student Loans.

They work alongside HMRC to collect Student Loan repayments in line with graduates' salaries, and graduates must inform the SLC if they move abroad.

University admissions departments

While students don't apply for places through individual university admissions departments as they do in the USA, students will need to contact them if they have any specific questions or problems with their application.

Students should also contact university admissions departments if they're applying through UCAS Clearing. This is a service for students who don't achieve the grades needed to meet their university offers.

University accommodation department

Students apply for a place in university-managed halls of residence through their university's accommodation department. This will be who students pay their rent to when living in halls, and who they'll contact for any accommodation-related problems or questions.

NUS

The National Union of Students is a confederation of student unions from across the UK. It works to champion and protect student rights and campaign for a better deal for students.

Most students will probably know it best for the TOTUM card, a student discount scheme that saves students money at a wide range of shops and brands.

Helping your child apply to university

The first hurdle on the journey to university is the application process. It's relatively straightforward, but there are some key deadlines to keep an eye on.

Applying to university can be a stressful process for students, especially with the added pressure of A Level results. But if you're both clued up on how it all works, you can help take some of the stress off.

Here's a brief timeline of a typical university application process:

- Choose a subject – First of all, your child needs to decide what they want to study at university. This might be a subject they already enjoy at school, a subject with a specific career in mind or something completely new. Don't forget that joint honours degrees, which combine two subjects together in one course, are also an option.

- Use UCAS to search courses – Make sure they check entry requirements and are choosing courses that are achievable and in line with their predicted grades.

- Attend open days – University open days will let your child get a feel for the university and department they'll be studying in. They'll also get the chance to ask lecturers and tutors any specific questions they might have.

- Choose courses – Each student can select up to five choices (four for Medicine, Dentistry and Veterinary Medicine/Science applicants, although these students can select a fifth choice for a different course).

- Complete the UCAS application – This involves filling in personal details and education history. They'll also need to write a personal statement of 4,000 characters which is their opportunity to sell themselves to the universities.

- Apply for Student Finance – Create an account online and make a provisional application for Tuition Fee and Maintenance Loans.

- Wait for offers and A Level results – Depending on the subject, your child might have to attend interviews or take exams before any offers are made. The student will then choose a firm and insurance choice from the offers they receive, and as long as they get the grades, they'll be off to one of their chosen unis. A Level results day isn't always that simple though, so be prepared for all possible outcomes.

Important dates and UCAS deadlines for 2024 entry

- 16th October 2023: Deadline for Oxford and Cambridge applications, as well as most Medicine, Veterinary Medicine/Science and Dentistry courses.

- 31st January 2024: Deadline for the majority of undergraduate courses.

- 28th February 2024: UCAS Extra opens. Students who don't receive any offers from their five choices can use this service to submit further applications.

- April/May/June 2024: Student Finance application deadlines.

- 16th May 2024: Deadline for universities to make their decisions on applications (those submitted by 25th January).

- 6th June 2024: Deadline for students to respond (i.e. choose their firm and insurance choices) (if you received all decisions by 16th May).

- 30th June 2024: This is the final deadline for students to apply to university. If students don't make this deadline, they will have to apply through Clearing.

- 4th July 2024: Deadline to apply through UCAS Extra.

- 5th July 2024: UCAS Clearing opens. Students who don't receive the required grades for their courses can use this service to find spare places.

- 17th July 2024: Deadline for universities to make their decisions on applications (those submitted by 30th June).

- 24th July 2024: Deadline for students to respond (i.e. choose their firm and insurance choices) (if you received all decisions by 17th July).

- 6th August 2024: SQA results day.

- 15th August 2024: A Level results day.

- 15th August 2024: Apply for a student bank account.

How Student Finance works

When the government increased tuition fees to £9,000 a year (a figure which has since gone up to £9,250 a year), people were quite rightly outraged. But it's not as scary as it seems. It's actually the cost of living at university that most parents should be focusing on.

This quick Student Finance 101 will tell you everything you need to know, including how much money your child is likely to receive at uni and how much you might need to contribute.

The Tuition Fee Loan

Pretty much all UK students studying for their first undergraduate degree will be eligible for a Tuition Fee Loan – regardless of how much their parents earn.

This loan covers the cost of the degree, which will be a maximum of £9,250 a year. Student Finance pays this money straight to the university, meaning the student never sees it.

This means that students don't really need to think about tuition fees at all – until they start paying it back, of course...

The Maintenance Loan

The Maintenance Loan is where things start to get a little more complicated. This is the money students receive to cover their living expenses while they study, but how much your child receives will depend on how much you (the parents, or the household) earn.

Basically, the higher a student's household income, the less money they'll get, as it's assumed the student's parents will be able to cover the shortfall.

Unlike the Tuition Fee Loan, this money is deposited directly into students' bank accounts in three instalments throughout the year, and it's up to them to learn how to budget it. Our complete guide to budgeting at university has some advice on how to do this.

There are a couple of other factors that determine how much money your child receives in their Maintenance Loan. Students moving away from home receive more than those staying put (to cover rent costs). Also, those studying in London receive more to cover the capital's higher cost of living.

The figures below are for English students. We include figures for other parts of the UK in our Maintenance Loan guide.

Maximum Maintenance Loan amounts 2024/25

| Student living situation | Maximum Maintenance Loan (per year) |

|---|---|

| Live at home | £8,610 |

| Live away from home | £10,227 |

| Live away from home, studying in London | £13,348 |

| Live away from home (abroad) | £11,713 |

These numbers show the maximum amount a student can apply for – they don't have to take the full amount of money if they don't want to. The maximum amount your child can apply for will also reduce in their final year, as they won't be a student over the summer and therefore won't be given money to cover this time.

Where does household income come into it?

Basically, only students with a household income of £25,000 or less will be eligible for the highest figures displayed in the table above.

From that point onward, the higher the household income, the less money students can generally apply for:

- Students living at home with a household income of £58,307 or above will receive the minimum amount of £3,790.

- Students living outside London and away from home with a household income of £62,347 or above will receive the minimum amount of £4,767.

- Students living away from home and in London with a household income of £70,098 or above will receive the minimum amount of £6,647.

The table below has all the details:

Maintenance Loan amounts based on household income

| Household Income | Living at home | Away from home (outside London) | Away from home (London) |

|---|---|---|---|

| £25,000 or less | £8,610 | £10,227 | £13,348 |

| £30,000 | £7,887 | £9,497 | £12,606 |

| £35,000 | £7,163 | £8,766 | £11,863 |

| £40,000 | £6,440 | £8,035 | £11,120 |

| £42,875 | £6,024 | £7,614 | £10,692 |

| £45,000 | £5,716 | £7,304 | £10,377 |

| £50,000 | £4,993 | £6,573 | £9,634 |

| £55,000 | £4,269 | £5,842 | £8,891 |

| £58,307 | £3,790 | £5,359 | £8,400 |

| £60,000 | £3,790 | £5,111 | £8,148 |

| £62,347 | £3,790 | £4,767 | £7,799 |

| £65,000 | £3,790 | £4,767 | £7,405 |

| £70,000 | £3,790 | £4,767 | £6,662 |

| £70,098+ | £3,790 | £4,767 | £6,647 |

You'll have to fill out a lengthy form from Student Finance to declare your household income – but don't forget, only taxable income counts. If you're unsure what counts as taxable income, check out the page on Income Tax on the government's website.

You'll also have to provide your National Insurance number, which Student Finance will then use to check how much you're earning.

What if you're a single parent, separated or divorced?

In this instance, the parent/household assessed is the one upon whom the student is financially dependent. This usually means the household in which the student lives most of the time.

Remember that if said parent now has a new partner, Student Finance will include their income as part of the overall household income – even if that partner doesn't necessarily have any financial responsibility for the student.

If you are a single parent with a child going to university, you may potentially be able to receive further support from the university finance department, so it's always worth asking the question.

What if you have more than one child at university at the same time?

There will be space on the application form for parents to declare any other children they support too.

For each child that's financially dependent on you (including any at university), Student Finance will generally deduct some money from your household income to accommodate this.

For example, in England, the deduction is £1,130.

So let's say your child is applying to Student Finance England and you're already supporting another child through university. If your household income was £40,000, Student Finance would effectively consider it to be £38,870, entitling your children to more money from their Maintenance Loan.

However, most parents and students report that this deduction is nowhere near enough to accommodate the strain of simultaneously supporting two or more students through higher education.

What if you don't give your children any money?

We're often contacted by parents who ask what happens if you don't (or can't) give your children much money while they're at uni. Will the government make up the shortfall? Unfortunately, the answer is: no.

Similarly, if your partner who's included in the household income calculations doesn't actually contribute any money to your child, there's not much you can do.

Sadly, whether or not you can or do choose to help with your child's finances isn't really relevant. The assessment will only take into account your household income.

How much money should parents give their children at university?

Not all parents are in a position to give their child money at university, but of those who are, many don't know how much is a suitable amount to give.

In our latest National Student Money Survey, surveyed students said they received an average of £171 every month from their parents.

Every individual situation is different, of course. Some students might choose to get a part-time job so their parents don't need to provide as much. Or, in some cases, students might have to get a part-time job, as even contributions from their parents won't be enough to cover living costs in full.

Many factors, such as the price of rent, the amount of Maintenance Loan your son/daughter receives and the general cost of living in the area they're studying in will affect how much you'll need to provide.

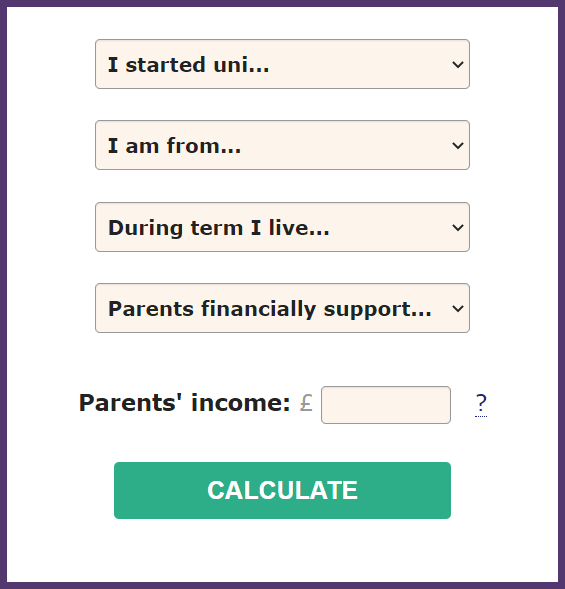

To see a suggested yearly parental contribution, use our Parental Contributions Calculator.

This will show you the maximum Maintenance Loan for a student in a given living situation, what your child will get based on your household income and the difference between the two – which is how much you're 'expected' to pay.

The bottom line is that the Maintenance Loan system is set up in a way that expects parents to contribute – even if this isn't made explicitly clear to students when they apply.

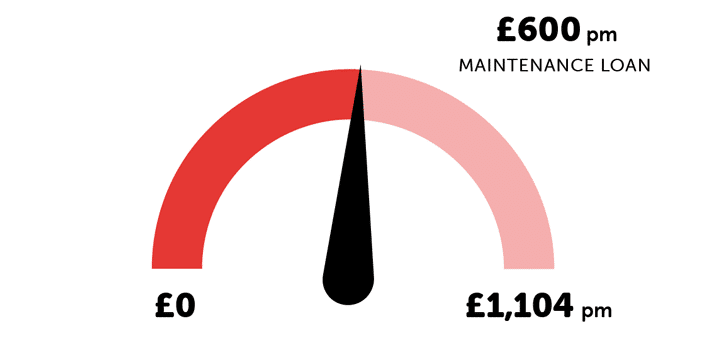

As an example, when we ran our latest National Student Money Survey in 2024, we found that the average surveyed students' living costs were £1,104 per month.

However, from an FOI request to the Student Loans Company (SLC), we know the average Maintenance Loan for students from England in 2023/24 was equivalent to around £600 per month. If we compare this average loan to the £1,104/month average living costs from the survey, this would leave a shortfall of £504 per month.

As such, there's a high chance that the Maintenance Loan provided by Student Finance won't be enough to cover everything your child needs at university.

On average, the Maintenance Loan falls around £504 short each month – National Student Money Survey 2024

This is another reason why it's a good idea to encourage your child to start learning how to save money before they go to university. Even just a few hundred pounds can go a long way when it's the end of term and their Maintenance Loan has run out.

Repaying Student Loans

When your child graduates from university, their Tuition Fee Loan and Maintenance Loan will be bundled together into one lump sum and they could be graduating with a debt of over £50,000.

We realise that this sounds like a large amount of debt to be in, but you should never be tempted to pay it off for your son or daughter.

While we are against the high tuition fees, the Student Loan repayment system makes repayments fairly manageable as they will be in line with your child's salary. Plus, any money they haven't paid off will be wiped after 30 or 40 years. Here's how it works:

- Students only start repaying their Student Loan from the first April after they graduate, and then only if they're earning over a threshold. If they're earning less than that they don't pay back a penny.

- For students from England who started university in 2023/24 or later, the repayment threshold is £25,000 per year.

- For students from England who started uni between September 2012 and 31st July 2023, as well as students from Wales who started uni after September 2012, the threshold is £27,295 per year.

- For students from Northern Ireland, the threshold is £24,990 per year.

- And for Scottish students, the threshold is £31,395.

- Graduates only pay back 9% of anything they earn over that amount. So if a graduate from Wales was earning £32,295, they'd pay 9% of £5,000 (£450 per year).

- The repayments are automatically docked from graduates' payslips so they don't have to do anything. If their pay drops below the current earnings threshold, their repayments also stop.

To give you an idea of exactly how much your child will be paying on a monthly basis, this table breaks it down by salary. Note: This table applies to students from England who started university in 2023/24 or later only.

Student Loan repayments based on salary

| Annual salary | Plan 5 monthly repayments (6th April 2026 – 5th April 2027) |

|---|---|

| £25,000 | £0 |

| £30,000 | £38 |

| £40,000 | £113 |

| £50,000 | £188 |

| £60,000 | £263 |

| £70,000 | £338 |

| £80,000 | £413 |

| £90,000 | £488 |

| £100,000 | £563 |

What is the interest rate on Student Loans?

People often forget that a student's debt doesn't just account for the Maintenance and Tuition Fee Loans – it also includes interest, which is applied from the day your child starts university.

In simple terms:

- Students from England (starting their degree before 1st August 2023) and Wales – While studying, and up until the April after graduation, interest is currently 7.3%. After graduating, it's 4.3% plus an extra amount between 0% – 3% depending on graduate earnings. It's capped at RPI + 3% when graduates start earning £51,245 or more (following the Plan 2 Student Loan model).

- Students from England starting their degree on or after 1st August 2023 – The interest rate is currently 4.3%. Student Loans on Plan 5 usually have an interest rate in line with RPI.

- Students from Scotland and Northern Ireland – The Student Loan interest rate is 4.3% (based on RPI, following the Plan 1 and 4 Student Loan models).

Remember that anything graduates don't pay off will be wiped after 25, 30 or 40 years depending on their loan plan – which leads us on to the next point.

Should students pay off their Student Loans early?

When students and parents are faced with eye-watering interest rates on Student Loans, many are keen to repay the loan as soon as possible. Because the more interest that accumulates, the more you end up paying off in the long run, right?

Well, yes and no. Research has shown that only 27% of students from England who started uni in 2022/23 are expected to repay their Student Loan in full before it's wiped after 30 years. This means that if your child decides to pay off the loan early, there's a risk of them paying more than if they'd paid the standard monthly payments until the debt was wiped.

The exception to this is if your child is sure they're going to be on a high salary for the majority of their career and are likely to pay off the loan in full. In this case, it might be worth paying off early to avoid the extra interest – but make sure you do the calculations first. It's worth talking to a financial adviser before making a decision.

As mentioned previously, things are different for English students who started on or after August 1st 2023. Among the 2023/24 cohort, 65% are expected to repay their loan in full.

Our guide to Student Loan repayments explains the process in more detail.

Our Student Loan repayment calculator should give you a good idea of how long it will take your child to pay off their loan (and how much they will actually end up paying back) based on their starting salary.

Accommodation at university

Deciding where they're going to live at university is a really exciting process for new university students. After all, if they're moving out for the first time, it's a huge step.

Make sure you can help them make the right decision by being aware of the different options they have for university living.

Staying at home

If your child is planning to study at a university close to home, they might decide to commute rather than move out. This is perfectly normal, and thousands of students do it every year. In fact, research shows that the number of 'commuter students' is on the rise, particularly in London.

If your child does choose to stay at home for uni, they could end up saving thousands of pounds by not paying rent – although you will need to factor in the cost of driving or public transport. Plus, students who live at home receive a smaller Maintenance Loan than those who move out.

Lots of students worry that they'll find it more difficult to make friends at uni if they stay at home.

Most students should easily be able to make friends on their course or by joining clubs and societies. However, they might need to make more of an effort to attend events and socials than those in halls who are naturally surrounded by students all of the time.

Moving away from home

Lots of students choose to move away for university every year and, for some, living independently for the first time is an integral part of the uni experience. Here are their options:

University halls

University halls of residence are properties owned and run by the university itself (or, increasingly, a private company contracted to run the property on the university's behalf).

Most students who select a university as their firm choice and apply for accommodation by a certain deadline will be guaranteed a place in university halls. There are some exceptions though (particularly with unis in London), so make sure to check with the university on this.

Halls are traditionally where most students live in their first year of uni, before moving into private housing in their subsequent years of study. Here are some key things to bear in mind:

- Some halls will be self-catered (meaning students have access to a kitchen for cooking), while others will be catered (students have their meals provided in a canteen or get given a food card to buy food in outlets on campus). As you'd expect, catered is normally the vastly more expensive option.

- Students will be able to choose between a shared bathroom and en suite halls – again, en suite rooms will cost more.

- Check how far away the halls are from the city centre and campus. Location will have a big impact on price, and it's not always necessary for students to live on, or right next to, campus.

- In some halls, students will have to completely move out during the Christmas and Easter breaks, as the university will rent the rooms out to others during these periods – so make sure to check the tenancy agreement.

- If your child has a car, check to see if the halls have any car parking facilities, or whether they'll have to pay for a parking permit (nobody wants to have to juggle uni with appealing a parking ticket).

- Some universities will have halls specifically for international or postgraduate students. If this applies to your child, contact the university in advance to find out what their provisions are.

Private halls

Private halls are very similar to university halls, except they're owned and run by a private company that may not be affiliated with the university at all.

They're purpose-built student accommodation blocks and, like halls, the rooms are normally arranged into small flats with a shared kitchen and living areas.

The main downside to private halls is that they can be more expensive than university halls or private housing. In recent years there's been a rise in 'luxury student living', with some private halls including rooms with sizeable TVs and professional cleaning services – and a hefty price tag.

Private housing

Most students will move into private housing in their second year of uni onwards, but it's also a good option for postgrads and first years if they're unable to get a place in halls.

Unfortunately, the student housing market is plagued by dodgy landlords and sub-par properties, so it's worth doing some serious research here and getting clued up on tenancy rights.

Most universities or student unions will have an accommodation service that can point you towards reputable landlords.

Make sure your child views the property before they sign a contract – and use our guide to what to look for when viewing houses to ensure they're not getting a bad deal.

How to prepare your child for moving out

If this is the first time your child has lived by themselves, they might be lacking in some of the skills needed for independent living.

The best thing you can do is take some time to teach them the things they'll need to thrive when they fly the nest:

- Cooking skills – Make sure your child knows some basic cooking tips, as well as stuff like how long food keeps before it goes off and what food can be frozen. Invest in a student cookbook, like Nosh for Students, which should help ensure they don't resort to pizza and chicken nuggets. We also have our own student meal plan which provides recipes and shopping lists for one month's worth of breakfasts, lunches, dinners and snacks.

- Laundry – Give your child a quick washing machine tutorial, make sure they know how to split up their clothes into whites and colours and show them what kind of washing detergent or fabric conditioner they should be buying. Also, ensure they know how to use an iron without burning their clothes.

- Bills – It's likely that bills will be included with rent in halls. But in private housing, it's often up to the tenants to sort it out. Make sure they've got gas, electricity, water and broadband covered. Our complete guide to student bills has all the cheapest deals and advice on how to set up, switch and split bills. And remember that, although full-time students don't have to pay council tax, they may have to apply for an exemption.

What to take to uni

Do they really need six frying pans? Is a beanbag a little excessive (it is)?

If you're wondering exactly what your child needs to take with them to university, our complete packing checklist has you covered.

We've broken it down into handy sections covering the kitchen, bedroom, bathroom and more, plus we've got all the things students tend to forget – a doorstop, for instance, is very useful.

Preparing your child for employment

While graduating from university is an amazing achievement, often a degree alone is not enough to impress employers when students are on the hunt for their first graduate job.

If you or your child is worried about how they can prepare for the world of work post-graduation, here are some key things they can be thinking about while they study:

-

Apply for work experience and internships

Getting hands-on experience in the world of work through an internship or placement will stand them in good stead when they go for job interviews, and can provide a good foot in the door of competitive industries.

However, make sure they know their part-time workers' rights and aren't getting ripped off by working for free – companies should at least offer some form of reimbursement.

-

Clubs and societies

Most unis will have a society for pretty much any hobby or pastime you can think of. So, whatever your child is interested in, they're bound to find a way to keep it up at uni.

Not only is it a great way to make friends and demonstrate extracurricular interests outside their studies, but students can also run for a committee position which will help build leadership and teamwork skills – something employers love to see.

-

Part-time jobs

In our latest National Student Money Survey, 58% of surveyed students had a part-time job. For many, it's a necessity for financial reasons, but a part-time job also provides students with skills they can put on their CV and expand on in job applications.

-

Travelling

You might think that when students go travelling it's all about getting drunk with their mates, but travelling can make students more employable.

From language skills to awareness of other cultures, budgeting to problem-solving, travelling has more benefits than you might think.

Do you have any further questions about university or Student Finance? Get in touch with us via email or social media and we'll do our best to get back to you.